No Data

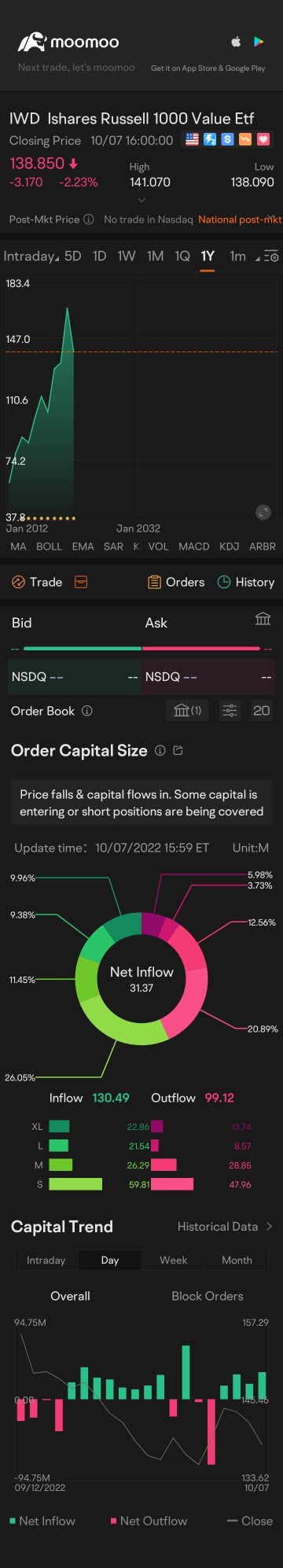

IWD Ishares Russell 1000 Value Etf

- 197.600

- -1.010-0.51%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

The Nasdaq index reached a new high, French stocks rose, the south korea etf narrowed after a 7% drop, and the offshore yuan briefly fell below 7.31 yuan.

South Korean President Yoon Suk-yeol abruptly declared a state of emergency, boosting safe-haven assets such as U.S. Treasury bonds, Japanese yen, and gold, while cryptos on the South Korean exchange plunged. The South Korean parliament quickly passed a resolution to lift the state of emergency, with the Ministry of Finance and the central bank actively working on market rescue measures. After a 2.7% drop to a two-year low, the won’s decline was cut in half, South Korean etfs fell by 1.6%, and the yield on 10-year U.S. Treasury bonds turned to increase after hitting a new low in over a month. France is set to vote on dissolving the government as early as Wednesday, with French stocks following European markets upward, although they had previously declined during the day. The Dow Jones, small cap stocks, and semiconductor indices fell, while the China concept index once rose by 1.9%. The yuan hit a new low in a year during the day, and U.S. oil rose nearly 3% testing the $70 mark.

UnitedHealth Group Introduces FY25 Guidance, Sees EPS $29.50-$30.00 Vs $29.92 Est.; Revenue $450B-$455B Vs $431.435B Est.

Fresh Closing Highs from S&P 500 and Nasdaq | Wall Street Today

Analyst Expectations For Bank of America's Future

Looking At Walmart's Recent Unusual Options Activity

Procter & Gamble Q2 Results Could See an Impact From FX Volatility, Blue Yonder Hack

Comments

Berkshire Hathaway's impressive performance is partly driven by its investments in key sectors. In energy, it has a large stake in $Occidental Petroleum (OXY.US)$, while in financial services, it holds significant shares in $Chubb Ltd (CB.US)$, $American Express (AXP.US)$, ��������...

- This September, global markets have seen their biggest monthly pullback since December 2022, with the US benchmark index, the S&P500 down 4.2%, the Nasdaq 100 shed 5.2%, and Australia's benchmark index, the ASX200 is 3.6% lower (month to date). Stocks such as global chip maker giant, Nvidia are down 16%, Australia' s second biggest lithium company Allkem is down 17%...

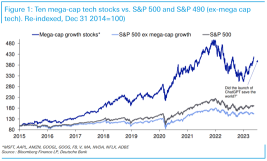

The gauge that measures the relative strength of value against growth stocks climbed as high as 33% in 2022...

The $SPDR S&P 500 ETF (SPY.US)$ is up nearly 10%, while the equal-weighted S&P has gained a little more than 1%.

The Big Tech really has enjoyed the enthusiasm for AI, especially with the quick use of ChatGPT.

"The SPX seems increasingly divorced from decelerating consumer trends and other major indices (except the $Invesco QQQ Trust (QQQ.US)$ ) due to ...

sociable Sheep_7248 : Overvaluated stocks and a shit dollar what an accomplishment

70193418 : He once sold 251 of his shares and made dozens more. When he first entered the stock market, he almost tripled in 2020 if he bought his A shares and got it now, and you don't have to trade with just sleeping. I only shook my head when I looked at the mouse eyes of the year

I only shook my head when I looked at the mouse eyes of the year

EZ_money sociable Sheep_7248 : it's all due to inflation that's all this is

Wakaoz : Who at 94 is still making Tsunamis with his every move?![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Phuk Yu : nope

View more comments...