No Data

IWM iShares Russell 2000 ETF

- 203.790

- -1.270-0.62%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

The more it falls, the more they buy! South Korean retail investors flock to "bottom fish" in the US stock market, and the inflow of funds hits a historical high.

1. Retail investors in South Korea have invested 10.2 billion USD into US Stocks and ETFs from the beginning of this year to March 20, setting a quarterly inflow record since 2011; 2. South Korean regulators and corporate executives are concerned about investors falling into high-risk betting traps, and the Financial Supervisory Service of South Korea is considering tightening regulations on some overseas ETFs.

Is the market currently exaggerating expectations of a recession in the USA?

Morgan Stanley believes that investors' panic over a USA economic recession is likely exaggerated, and the real economic slowdown has yet to fully manifest. There is still significant uncertainty (such as immigration policy) that has not materialized, and investors should focus on hard data, especially non-farm payroll data.

Goldman Sachs: The decline in sentiment for U.S. stocks may signal a Call, and foreign capital is expected to further Buy U.S. stocks.

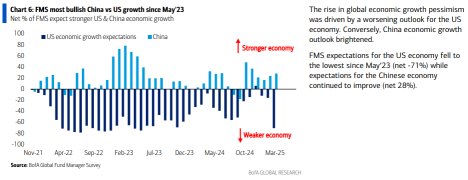

Goldman Sachs' chief USA Stocks strategist David Kostin stated that the sharp decline in investor confidence, the contrasting performance of Global stock markets, and the changing trends in holdings are raising key questions about the future direction of the USA stock market.

Canadians Trade Tips to Boycott American Stuff. Great App, Eh?

U.S. Stock Futures Rise as Wall Street Looks to Extend Gains Despite Uncertainty

US Tech Rout Fuels Wild Bets From Korean Retail Investors

Comments

so right now the stock composition is

- 75% institution

- 25% short ( some institution do neutral strategy so need to have the cover for their long position, that’s why if u total the composition it will be higher than 100%)

- 10% insider

monitoring the volume available for short, it left 2-3 mills share on the pool. Therefore the current price action should be sideways from 12-16, which totally being moved by quant algo.

Note that this stock is no...

Starting from February 19, U.S. stocks experienced a significant pullback, with the $S&P 500 Index (.SPX.US)$ dropping from its high of 6,147.43 points to 5,521.52 points by March 13, before stabilizing and starting to recover. This correction can be attributed to several factors:

According to insights from Goldman Sachs' Macro Weekend Call, the recent market correction is partly due to uncertaint...

Mob-Town-Bulls : looks like a trap but iv been wrong b4

Derpy Trades OP Mob-Town-Bulls : Bull trap or bear trap? Lol. I would wager a bull trap.