No Data

IWM241204P250000

- 10.65

- 0.000.00%

- 5D

- Daily

News

Producer Inflation Comes in Hot. The Fed Will Still Cut

Exchange-Traded Funds, Equity Futures Lower Pre-Bell Thursday as Traders Pull Back in Anticipation of More Inflation Data

US Morning News Call | Adobe Predicts Lower Revenue for FY25 Amid Slowing Subscription Sales

The Nasdaq has risen above 0.02 million points, and the Analyst "pours cold water": it's just "eating the food of the future."

Historically, the U.S. stock market usually performs well in December, especially in the second half of the month, but this year investors seem to be overly enthusiastic, with analysts suggesting that the current gains are overextending future potential.

Inflation Isn't Coming Down. Why the Fed Is Poised to Cut Interest Rates Anyway

The Nasdaq hits 20,000 points! Besides US bonds, US investors are buying everything.

After the release of USA's November CPI data on Wednesday, investors seem to have finally "confirmed" that the Federal Reserve's interest rate cut next week is a done deal; financial markets across asset classes on Wednesday also appeared quite uplifting; apart from the decline in USA Treasuries, investors are buying everything else - USA stocks are rising, Gold is rising, the dollar is rising, Crude Oil Product is rising, and Cryptos are rising...

Comments

IWM, tracks the performance of

the Russell 2000 Index, which

represents small-cap stocks in

the US. This ETF holds a basket of

nearly 2,000 smaller publicly traded

companies across various sectors,

including technology, healthcare,

finance, consumer goods, and

industrials A.

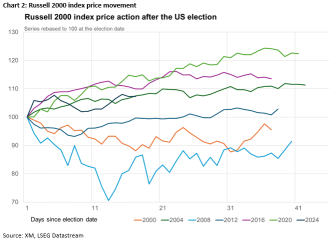

Now that, Donald Trump is the new president, it will be beneficial for small-cap companies because he's very pro on them. The recent 1 mth run up of 9% to 242 ...

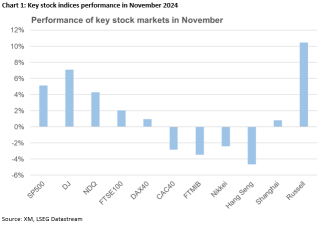

One standout is the Russell 2000, which jumped 10% in November. That's its best month since July 2024, when it also popped 10%. $iShares Russell 2000 ETF (IWM.US)$

Mak...