No Data

JD241122P60000

- 0.00

- 0.000.00%

- 5D

- Daily

No Data

News

Barclays Maintains JD.com(JD.US) With Buy Rating, Maintains Target Price $50

JD.com Shares Poised for 50% Surge After Strong Q3, Say Analysts

[Brokerage Focus] Bocom Intl maintains a buy rating on jd.com (09618), expects a 5.7% year-on-year increase in revenue for the fourth quarter.

Bocom Intl Research Report: JD.com (09618) Q3 2024 revenue met expectations, profits exceeded expectations. Revenue increased by 5% year-on-year, with electrical revenue rebounding under the trade-in policy, up 3% year-on-year, daily necessities revenue up 8%, and supermarkets/clothing categories achieving double-digit growth. Gross margin increased by 1.7 percentage points year-on-year, adjusted net income increased by 24% year-on-year, benefiting from supply chain capacity building, improved price competitiveness, and economies of scale. Retail revenue increased by 6% year-on-year, adjusted operation margin at 5.2%, unchanged year-on-year. Looking ahead to Q4, the bank expects revenue to increase year-on-year.

"One hand supporting two families," jd.com (JD.US/9618.HK) "growth flywheel" accelerates rotation.

With the introduction of a series of stimulus policies, china's assets have once again come back into the view of global investors.

JD.com Options Spot-On: On November 15th, 120.62K Contracts Were Traded, With 1.98 Million Open Interest

JD.com Is Maintained at Buy by Citigroup

Comments

Last week he reported that he upped his stake in 3 Chinese stocks

$JD.com (JD.US)$ - added 100%

$Baidu (BIDU.US)$ - added 66.7%

$Alibaba (BABA.US)$ - added 29%

David Tepper, who is extremely bullish on China, owns all three of these stocks in his portfolio as well

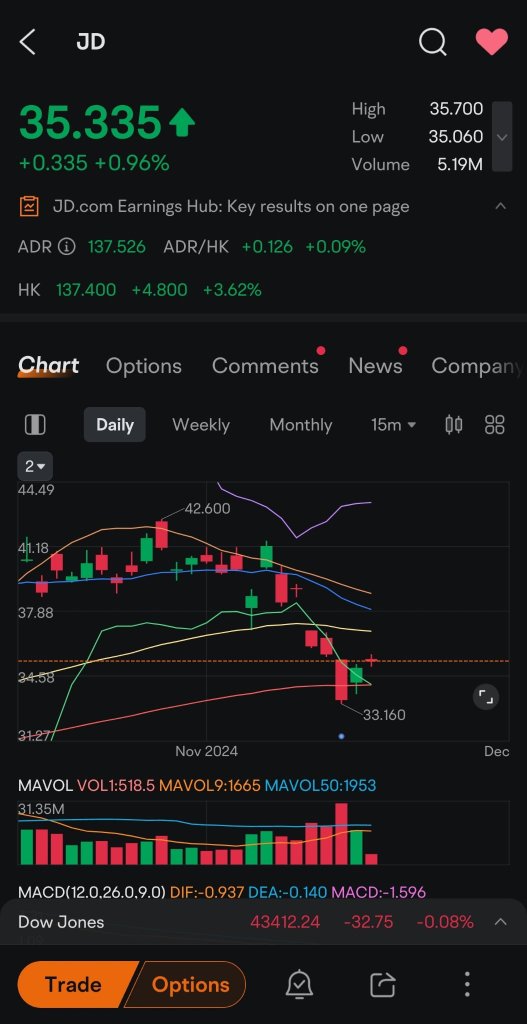

watch for 33.16 to hold, if not next stop is 30. Chart is developing nicely, double bottom, higher highs and higher lows.

$KraneShares CSI China Internet ETF (KWEB.US)$

Alster : He knows now is definitely undervalued

水月老师 : when u saw this type of news, you just have to do the opposite.