No Data

JEF241220C22500

- 0.00

- 0.000.00%

- 5D

- Daily

No Data

News

10 Financials Stocks With Whale Alerts In Today's Session

Full text | Meituan Q3 earnings conference transcript: The total investment in the "Dining Merchant Support Initiative" is 1 billion yuan.

Meituan (HKEX: 3690) released its financial report for the third quarter of 2024 today: revenue was 93.6 billion yuan, an increase of 22.4% year-on-year. Net income was 12.9 billion yuan, compared to 3.6 billion yuan in the same period of 2023; adjusted net income under non-International Financial Reporting Standards was 12.83 billion yuan, a year-on-year increase of 124.0%. After the financial report was released, Meituan's chairman and CEO Wang Xing, along with senior vice president and CFO Chen Shaohui, participated in a subsequent analyst conference call to interpret the financial report. The following is a transcript of the Q&A session during the conference call: Citic Securities analyst Ya Jiang: I

Japanese banks are reportedly planning to maintain their business relationship with Adani, while Barclays and other international banks are cautiously reassessing their exposures.

Despite the accusations of bribery against Gautam Adani by the usa, several major banks in japan plan to maintain business relations with the billionaire, while other global companies like Barclays are reassessing their risk exposure to this india conglomerate. According to informed sources, mizuho financial expects that the latest incident involving Adani will not have a lasting impact and intends to continue supporting the group. Sources also indicate that sumitomo mitsui financial and mitsubishi ufj financial have not withdrawn their plans and will remain open to providing new financing if needed in the future. Spokespersons for these three banks in Tokyo declined to comment. A representative of the Adani group did not respond.

Global Equities Roundup: Market Talk

Market Chatter: Deutsche Bank-Led Group Seeking to Offload $700 Million Loan for FitCrunch Acquisition

Top Gap Ups and Downs on Thursday: SNOW, ANET, PDD and More

Comments

As the company's core business, d...

Here's the top 10 by deal volume:

1) $Goldman Sachs (GS.US)$ - $508.1bn

2) $JPMorgan (JPM.US)$ - $426.2bn

3) $Morgan Stanley (MS.US)$ - $408.4bn

4) $Citigroup (C.US)$ - $259.0bn

5) $Bank of America (BAC.US)$ - $238.5bn

6) $Evercore (EVR.US)$ - $199.9bn

7) $Barclays (BCS.US)$ - $156.0bn

8) $UBS Group (UBS.US)$ - $155.0bn

9) $Jefferies Financial (JEF.US)$ - $137.5bn

10)Centerview Partners- $136.5bn

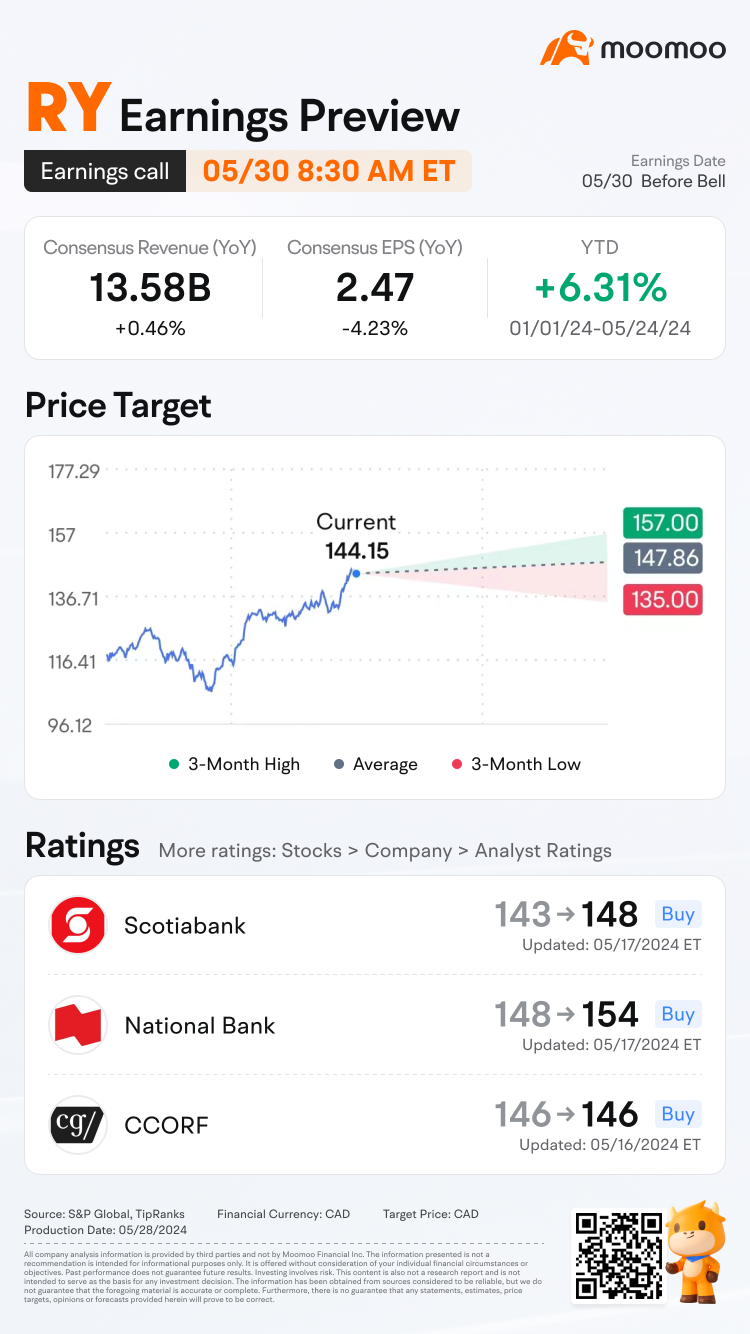

Consensus Estimates

• RBC is expected to post quarterly earnings of...

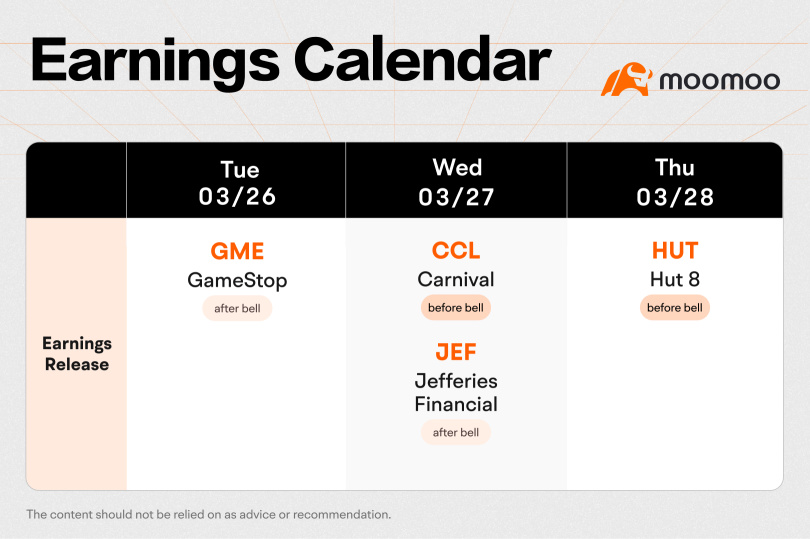

Earnings for $McCormick & Co (MKC.US)$ and $GameStop (GME.US)$ will be released on Tuesday, followed by $Carnival (CCL.US)$ and $Jefferies Financial (JEF.US)$ on Wednes...