No Data

JEF241220C25000

- 0.00

- 0.000.00%

- 5D

- Daily

No Data

News

Japanese banks are reportedly planning to maintain their business relationship with Adani, while Barclays and other international banks are cautiously reassessing their exposures.

Despite the accusations of bribery against Gautam Adani by the usa, several major banks in japan plan to maintain business relations with the billionaire, while other global companies like Barclays are reassessing their risk exposure to this india conglomerate. According to informed sources, mizuho financial expects that the latest incident involving Adani will not have a lasting impact and intends to continue supporting the group. Sources also indicate that sumitomo mitsui financial and mitsubishi ufj financial have not withdrawn their plans and will remain open to providing new financing if needed in the future. Spokespersons for these three banks in Tokyo declined to comment. A representative of the Adani group did not respond.

Global Equities Roundup: Market Talk

Market Chatter: Deutsche Bank-Led Group Seeking to Offload $700 Million Loan for FitCrunch Acquisition

Top Gap Ups and Downs on Thursday: SNOW, ANET, PDD and More

Full text | Baidu Q3 earnings conference record: expected to release new version Wenzhen early next year

Baidu (Nasdaq: BIDU; HKEX: 9888) released the financial report for the third quarter of 2024 ending on September 30th today: total revenue was 33.6 billion yuan, a 3% year-on-year decrease. The net income attributable to Baidu was 7.6 billion yuan. Using non-US GAAP, the net income attributable to Baidu was 5.9 billion yuan. After the financial report was released, Baidu's Chairman and CEO, Robin Li, President of the Mobile Ecosystem Business Group, Lu Rong, President of the Intelligent Cloud Business Group, Shen Dou, and Acting CFO He Junjie and other executives attended the subsequent earnings conference call to explain the key points of the financial report and answer analysts' questions. The following is the analysis and Q&A section.

Overnight news: usa stocks show mixed results, nvidia's revenue nearly doubled year-on-year, Q4 guidance failed to impress Wall Street, and the import volume at the busiest ports in usa continues to rise significantly.

For more global financial news, please visit the 24-hour real-time financial news market closing: Dow Jones up 140 points, S&P flat, market focuses on Nvidia's financial report. Top 20 US stock turnover on November 20: Bitcoin concept stock MicroStrategy's market cap exceeds 100 billion US dollars. China concept stocks on Wednesday had mixed performances, Full Truck Alliance up 15%, Wunong Zhixing down 8.2%. US WTI crude oil fell 0.75% on Wednesday, New York futures gold rose 0.8%, back above $2650. Major European stock indices collectively fell, with the German DAX30 index down 0.26%. Nvidia's revenue increased by 94% year-on-year.

Comments

As the company's core business, d...

Here's the top 10 by deal volume:

1) $Goldman Sachs (GS.US)$ - $508.1bn

2) $JPMorgan (JPM.US)$ - $426.2bn

3) $Morgan Stanley (MS.US)$ - $408.4bn

4) $Citigroup (C.US)$ - $259.0bn

5) $Bank of America (BAC.US)$ - $238.5bn

6) $Evercore (EVR.US)$ - $199.9bn

7) $Barclays (BCS.US)$ - $156.0bn

8) $UBS Group (UBS.US)$ - $155.0bn

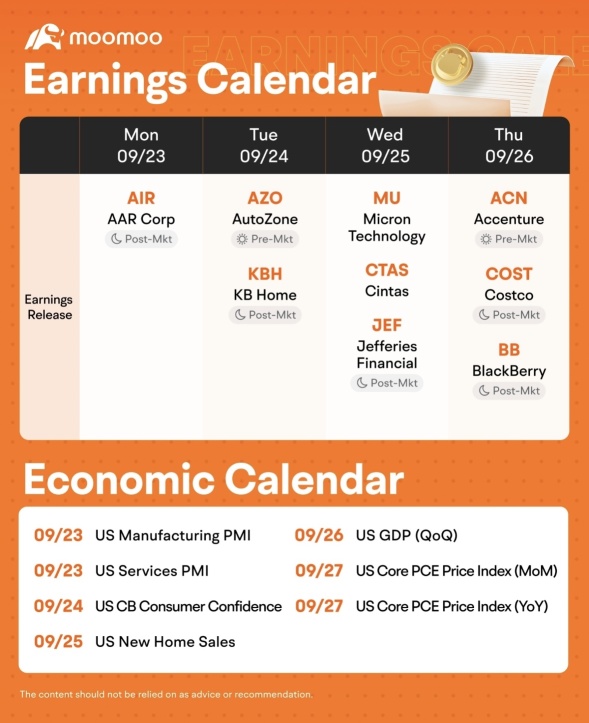

9) $Jefferies Financial (JEF.US)$ - $137.5bn

10)Centerview Partners- $136.5bn

Consensus Estimates

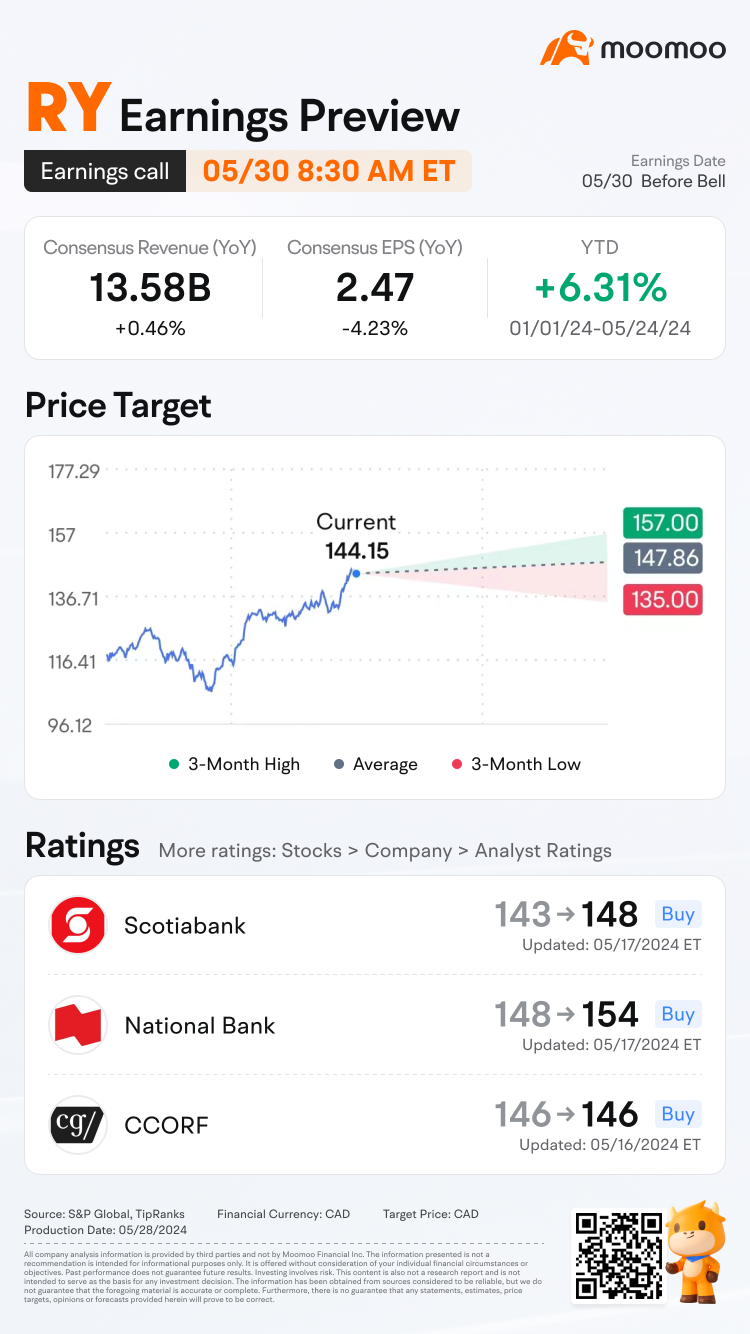

• RBC is expected to post quarterly earnings of...

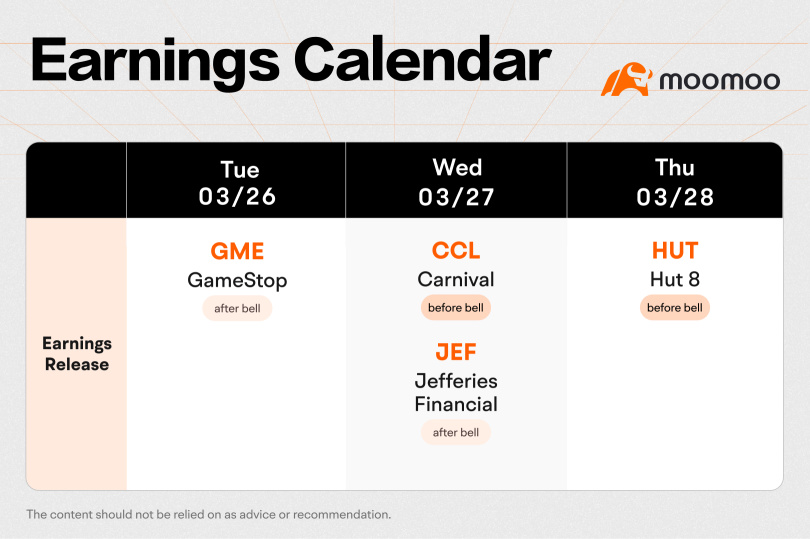

Earnings for $McCormick & Co (MKC.US)$ and $GameStop (GME.US)$ will be released on Tuesday, followed by $Carnival (CCL.US)$ and $Jefferies Financial (JEF.US)$ on Wednes...