No Data

JPM JPMorgan

- 249.720

- -0.070-0.03%

- 249.980

- +0.260+0.10%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Invest in Banking Like Warren Buffett: Own a 'Castle' -- WSJ

How Is The Market Feeling About JPMorgan Chase?

10 Financials Stocks Whale Activity In Today's Session

JPMorgan Chase's Dimon Has Been Secretly Talking With Donald Trump for Months: Report

Possible Bearish Signals With JPMorgan Chase Insiders Disposing Stock

Wall Street macro traders see worst annual performance since the epidemic outbreak.

Global banks' forex and interest rate trading revenue is expected to hit the lowest level since the pandemic, influenced by narrowing profit margins and a challenging macroeconomic environment. According to data collected by Coalition Greenwich, Goldman Sachs, JPMorgan, Citigroup, Morgan Stanley, and over 250 other companies' G-10 interest rate trading is projected to collectively generate 32 billion USD in revenue, while forex trading revenue is expected to be 16.7 billion USD, representing year-on-year reductions of approximately 17% and 9%, respectively. Investor confidence in making significant macro trading views has declined this year, as unexpected economic data has undermined expectations of interest rate cuts from major global central banks.

Comments

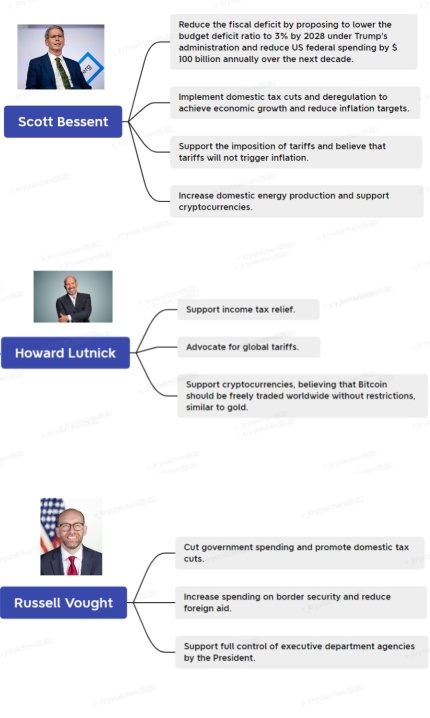

1. Who’s on Trump’s team? What are their primary responsibilities?

2. Economic ideologies of Cabinet members in policy-related roles

3. Economic ideologies of non-Cabinet members in policy-related roles

4. Impacts...

JPMorgan has now paid a whopping $40bn in violations according to fresh data from a corporate misconduct database and tracker.

JPMorgan Chase has reached a staggering milestone, having paid more than $40 billion in fines and settlements due to a series of regulatory violations, anti-competitive practices, and other corporate misconduct.

In just the last seven quarters alone, the banking giant has disbursed approxi...

Analysts predict Trump's second-term policies could echo his first, but with a swifter pace and more assertive domestic and foreign agendas. Expectations are for a stronger application of the "A...

Gapping up

$Comcast (CMCSA.US)$ stock increased by 2.5% following a report by the WSJ that the media giant was nearing approval for a $7 billion spinoff of its cable TV assets.

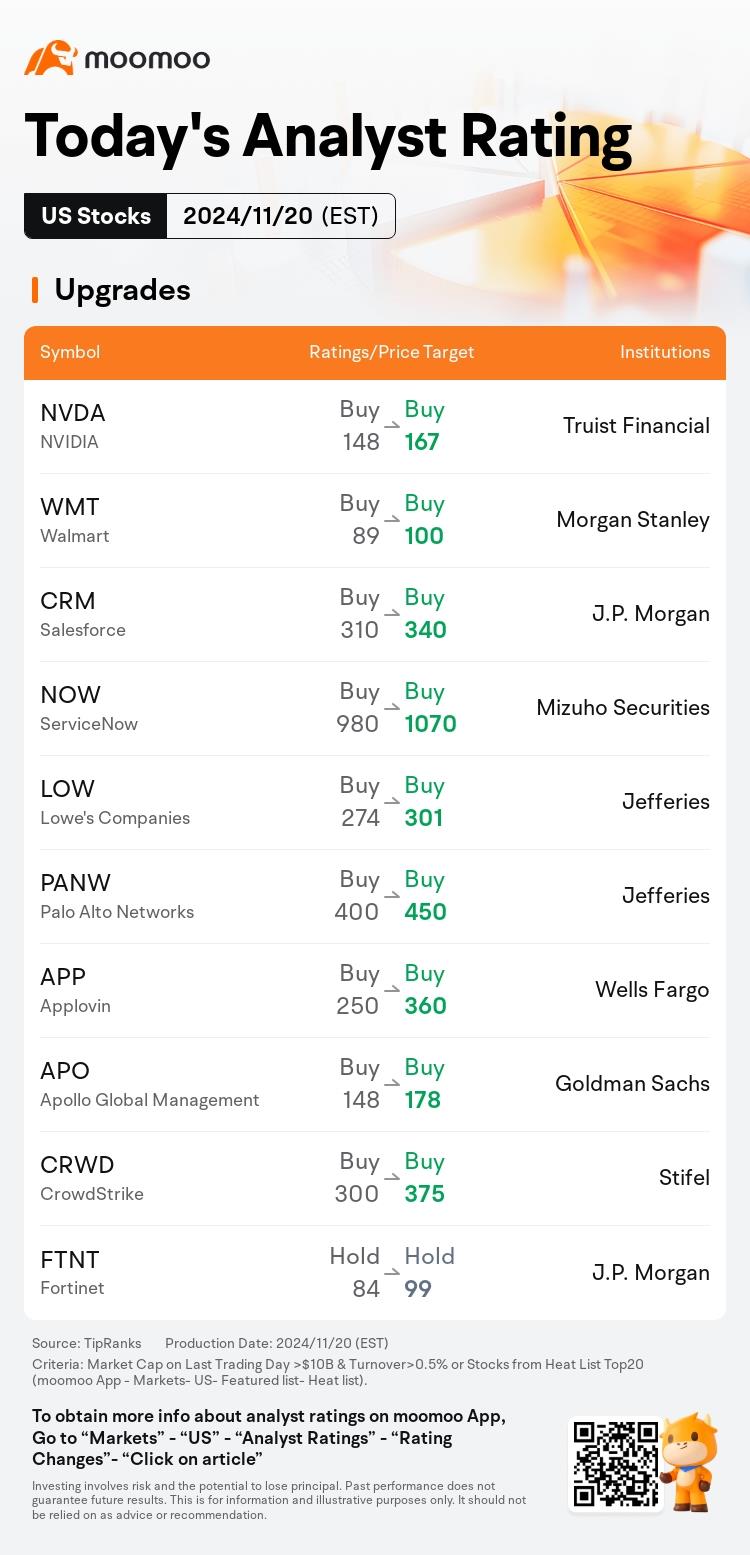

$NVIDIA (NVDA.US)$ stock went up by 0.44%, building on the near 5% gains from the previous session as the market anticipates its upcoming quarterly earnings report.

$Keysight Technologies (KEYS.US)$ stock jumped 9.4% after the company rel...

Analysis

Price Target

No Data

No Data