No Data

JPM241115P175000

- 0.02

- 0.000.00%

- 5D

- Daily

News

Jim Cramer Is Bullish on JPMorgan Chase & Co (JPM), Top Banks After Trump Victory – Here's Why

JPMorganChase to Present at the Goldman Sachs U.S. Financial Services Conference

Jim Cramer on JPMorgan Chase & Co. (JPM): 'It Will Come Down, You Can Buy'

The US dollar rose to a two-year high, with Wall Street unanimously bullish.

A week after Donald Trump won the US presidential election, the momentum of the rising US dollar is increasing, sweeping through other currencies with unstoppable force, prompting Wall Street strategists to prepare for further increases. The Bloomberg US Dollar Index rose to its highest level since November 2022 on Tuesday, pushing the euro to its lowest level in a year, while other currencies were also under pressure. The yen and the Canadian dollar also fell, heading towards a key psychological barrier. "We believe that the strong momentum of the US dollar will continue into next year, even 2026," said Monex forex trader Helen Given, "The Trump administration has substantially altered forecast calculations, as national

Will the euro fall to parity with the US dollar? deutsche bank believes it may even go lower.

After the US election, forex strategists have retracted their previous views on the euro and provided a new forecast: the euro will fall to parity with the US dollar. Barclays, ING Groep, Nomura International, and at least 10 other banks significantly lowered their forecasts last week. This marks a significant turnaround in recent months. Swiss-based Pictet Wealth Management is one of the institutions predicting parity. Deutsche Bank believes the euro may fall to even lower levels. The options market shows that shorting the euro is one of the traders' favorite strategies ahead of Trump's potential return to the White House next year. After Trump's return to the White House next year, global trade restrictions could become a key pillar of his economic policy.

Tuesday Market Finally Slows Down, Takes a Post Veterans Day Breather | Live Stock

Comments

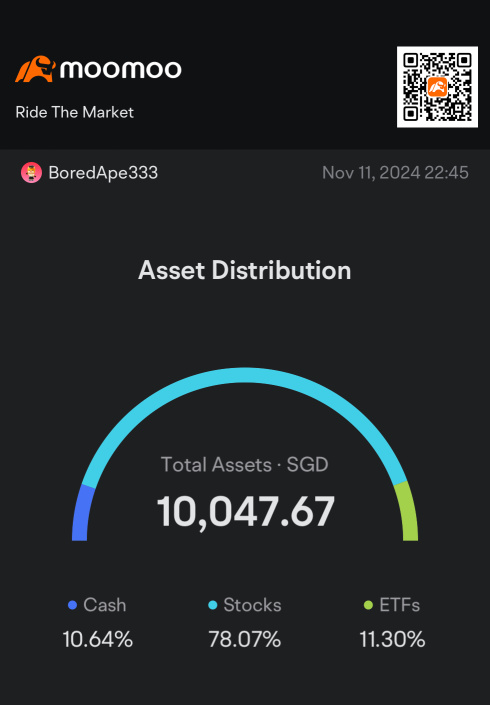

p.s. My capital has reached 5 digit number - $10,000 😊

At its core, bloc...