No Data

JPM241129P150000

- 0.00

- 0.000.00%

- 5D

- Daily

No Data

News

Dealmaker Sees More Urge to Merge Among Smaller Banks - Yours May Be Among Them

Invest in Banking Like Warren Buffett: Own a 'Castle' -- WSJ

How Is The Market Feeling About JPMorgan Chase?

10 Financials Stocks Whale Activity In Today's Session

Europe's bond market: German bonds rise as traders ponder the possibility of a 50 basis point rate cut by the European Central Bank in December.

The bull market for German government bonds is steepening, and the mmf market is increasing bets on deeper interest rate cuts by the european central bank. Previously, jpmorgan economists moved up their expectation of a 50 basis point rate cut by the european central bank from January next year to December. Traders have raised expectations for the european central bank's easing, with a 20% probability of a 50 basis point rate cut next month, and a forecast of a 156 basis point cut by the end of next year, higher than the previous expectation of 150 basis points. The yield on German 2-year government bonds fell by 5 basis points to 1.95%, a new low since 2022; the steepening trend of the German 2s10s curve has continued for 8 months, the longest since 1999.

JPMorgan has brought forward its expectation of the European Central Bank's interest rate cut of 50 basis points to December.

JPMorgan economists are moving up their expectations for a 50 basis point rate cut by the European Central Bank from January next year to December. Greg Fuzesi wrote in a client note: "Given the sharp drop in PMI, the slowdown in service inflation, and the possibility of continued trade uncertainty, this scenario seems quite likely." He pointed out, "The European Central Bank does not need to make advance commitments for subsequent meetings, retaining full flexibility, including possibly staying on hold next." "Confusingly, dovish committee members do not have any clear push for a 50 basis point rate cut in December." He also acknowledged the confusion, but stated, "it is probably a few".

Comments

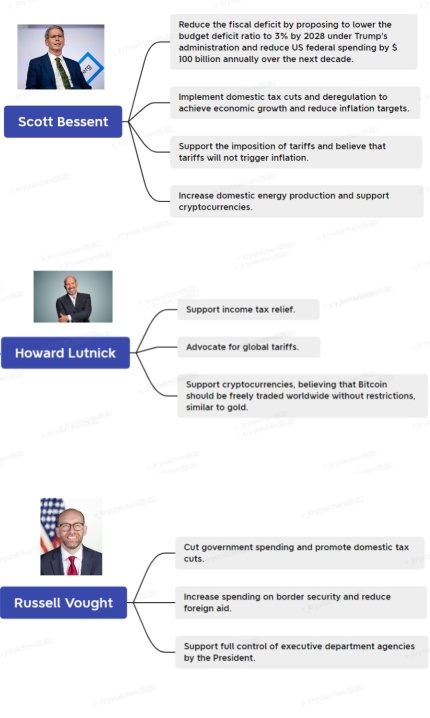

1. Who’s on Trump’s team? What are their primary responsibilities?

2. Economic ideologies of Cabinet members in policy-related roles

3. Economic ideologies of non-Cabinet members in policy-related roles

4. Impacts...

JPMorgan has now paid a whopping $40bn in violations according to fresh data from a corporate misconduct database and tracker.

JPMorgan Chase has reached a staggering milestone, having paid more than $40 billion in fines and settlements due to a series of regulatory violations, anti-competitive practices, and other corporate misconduct.

In just the last seven quarters alone, the banking giant has disbursed approxi...

Analysts predict Trump's second-term policies could echo his first, but with a swifter pace and more assertive domestic and foreign agendas. Expectations are for a stronger application of the "A...

Gapping up

$Comcast (CMCSA.US)$ stock increased by 2.5% following a report by the WSJ that the media giant was nearing approval for a $7 billion spinoff of its cable TV assets.

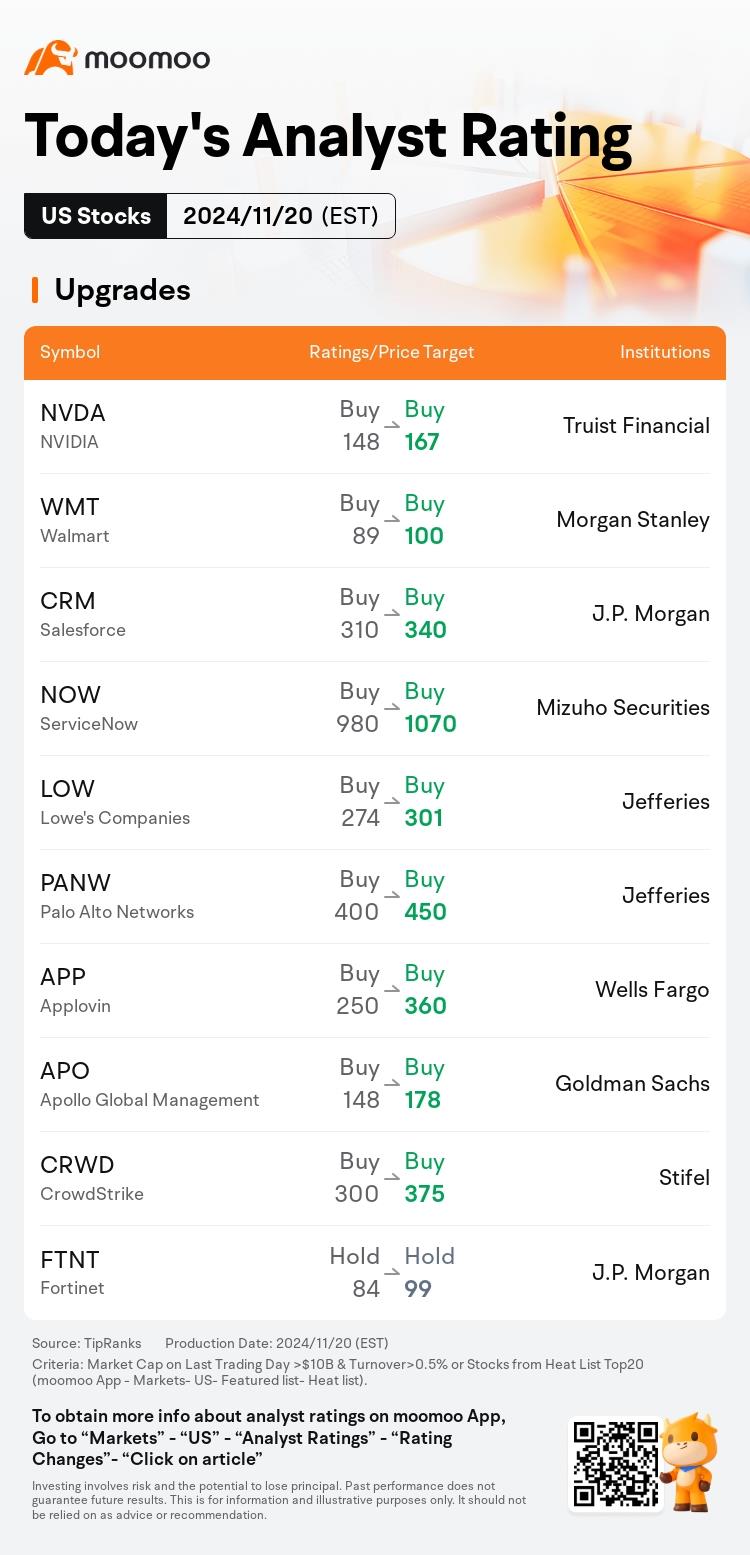

$NVIDIA (NVDA.US)$ stock went up by 0.44%, building on the near 5% gains from the previous session as the market anticipates its upcoming quarterly earnings report.

$Keysight Technologies (KEYS.US)$ stock jumped 9.4% after the company rel...