No Data

JPM241206C255000

- 0.71

- -0.08-10.13%

- 5D

- Daily

News

jpmorgan (JPM.US) withdraws lawsuit related to stock warrants of Tesla (TSLA.US)

JPMorgan agreed last Friday to withdraw its lawsuit against Tesla, which accused Tesla of "flagrantly" violating the contract signed between the two companies regarding the warrants related to Tesla's sale to the bank in 2014.

JP Morgan Fined S$2.4 Million Over Unsupervised Conduct Of Relationship Managers

Singapore's central bank: JPMorgan was fined 1.8 million US dollars for improper conduct by relationship managers.

The Monetary Authority of Singapore (MAS) stated on Monday that it has imposed a civil penalty of 2.4 million Singapore dollars (1.79 million US dollars) on the US-based JPMorgan Chase Bank. MAS mentioned that JPMorgan's relationship managers provided inaccurate or incomplete information to clients in 24 over-the-counter bond trades, charging clients spreads higher than agreed. The country's central bank said that JPMorgan has acknowledged responsibility for failing to prevent or detect the misconduct and has paid the civil penalty to MAS.

Morgan Stanley: Reiterates boc hong kong 'shareholding' rating with a target price of 28 Hong Kong dollars

JPMorgan released a research report stating that boc hong kong (02388) saw a 6% drop in its stock price last week, underperforming the Hang Seng Index and peers by 6 to 9%. This weak performance is believed to be caused by concerns over asset quality, although the market may have overreacted. The bank believes that the group's financial results for the 2024 fiscal year, to be announced in the first quarter of next year, will bring substantial risk rewards, reiterating its "shareholding" rating with a target price of HKD 28. The bank anticipates that over the next 6 to 12 months, as management increases shareholder returns in a capital-rich environment, the net interest margin and resilience of asset quality, along with the continued growth of average interest-earning assets (AIEA), will support the group.

JPMorgan: Maintains 'overweight' rating on Meituan-W, target price raised to HK$200.

JPMorgan released a research report stating that they believe Meituan is one of the best consumer and internet companies in China, maintaining a 'shareholding' rating for Meituan-W (03690) with a target price raised to HKD 200. The company's profitability remains strong, with forecasted adjusted earnings per share growth of 33% next year, 9% higher than market expectations, making it one of the fastest-growing companies covered by the bank. The report mentioned that Meituan is one of the best-performing stocks among China's internet stocks this year, and still believes that its stock price has room to rise in the next 6 to 12 months, mainly due to the increasing monetization level and the revenue from on-site and hotel services.

Express News | Singapore's MAS - Imposes Civil Penalty of S$2.4 Million on JPMorgan Chase Bank, N.a.

Comments

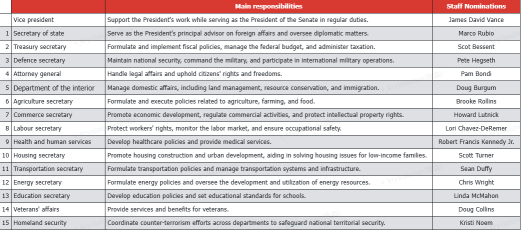

1. Who’s on Trump’s team? What are their primary responsibilities?

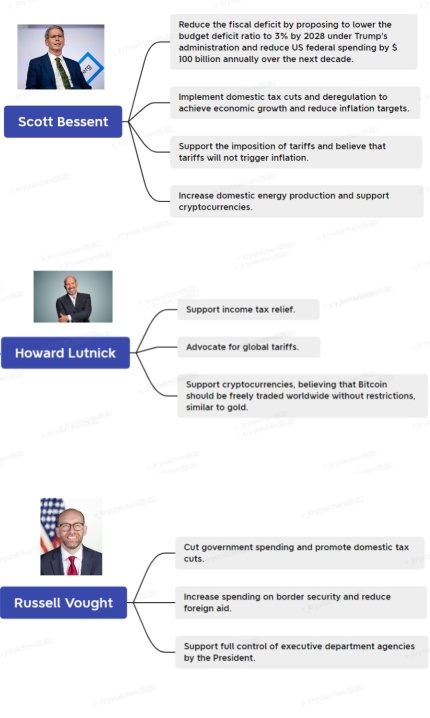

2. Economic ideologies of Cabinet members in policy-related roles

3. Economic ideologies of non-Cabinet members in policy-related roles

4. Impacts...

JPMorgan has now paid a whopping $40bn in violations according to fresh data from a corporate misconduct database and tracker.

JPMorgan Chase has reached a staggering milestone, having paid more than $40 billion in fines and settlements due to a series of regulatory violations, anti-competitive practices, and other corporate misconduct.

In just the last seven quarters alone, the banking giant has disbursed approxi...

Analysts predict Trump's second-term policies could echo his first, but with a swifter pace and more assertive domestic and foreign agendas. Expectations are for a stronger application of the "A...

Gapping up

$Comcast (CMCSA.US)$ stock increased by 2.5% following a report by the WSJ that the media giant was nearing approval for a $7 billion spinoff of its cable TV assets.

$NVIDIA (NVDA.US)$ stock went up by 0.44%, building on the near 5% gains from the previous session as the market anticipates its upcoming quarterly earnings report.

$Keysight Technologies (KEYS.US)$ stock jumped 9.4% after the company rel...

MACKGforEver : Clear and crisp! Thanks for sharing!