No Data

JPM241206C295000

- 0.00

- 0.000.00%

- 5D

- Daily

No Data

News

JP Morgan Fined S$2.4 Million Over Unsupervised Conduct Of Relationship Managers

Singapore's central bank: JPMorgan was fined 1.8 million US dollars for improper conduct by relationship managers.

The Monetary Authority of Singapore (MAS) stated on Monday that it has imposed a civil penalty of 2.4 million Singapore dollars (1.79 million US dollars) on the US-based JPMorgan Chase Bank. MAS mentioned that JPMorgan's relationship managers provided inaccurate or incomplete information to clients in 24 over-the-counter bond trades, charging clients spreads higher than agreed. The country's central bank said that JPMorgan has acknowledged responsibility for failing to prevent or detect the misconduct and has paid the civil penalty to MAS.

Morgan Stanley: Reiterates boc hong kong 'shareholding' rating with a target price of 28 Hong Kong dollars

JPMorgan released a research report stating that boc hong kong (02388) saw a 6% drop in its stock price last week, underperforming the Hang Seng Index and peers by 6 to 9%. This weak performance is believed to be caused by concerns over asset quality, although the market may have overreacted. The bank believes that the group's financial results for the 2024 fiscal year, to be announced in the first quarter of next year, will bring substantial risk rewards, reiterating its "shareholding" rating with a target price of HKD 28. The bank anticipates that over the next 6 to 12 months, as management increases shareholder returns in a capital-rich environment, the net interest margin and resilience of asset quality, along with the continued growth of average interest-earning assets (AIEA), will support the group.

JPMorgan: Maintains 'overweight' rating on Meituan-W, target price raised to HK$200.

JPMorgan released a research report stating that they believe Meituan is one of the best consumer and internet companies in China, maintaining a 'shareholding' rating for Meituan-W (03690) with a target price raised to HKD 200. The company's profitability remains strong, with forecasted adjusted earnings per share growth of 33% next year, 9% higher than market expectations, making it one of the fastest-growing companies covered by the bank. The report mentioned that Meituan is one of the best-performing stocks among China's internet stocks this year, and still believes that its stock price has room to rise in the next 6 to 12 months, mainly due to the increasing monetization level and the revenue from on-site and hotel services.

Express News | Singapore's MAS - Imposes Civil Penalty of S$2.4 Million on JPMorgan Chase Bank, N.a.

"Doomsday Doctor" Rubini warns of Trump 2.0: higher inflation, lower economic growth.

Renowned economist, supported by the nickname "Dr. Doom," Nouriel Roubini recently expressed his concerns about the second term of US President Donald Trump. Roubini, dubbed "Dr. Doom" for correctly predicting the 2008 global financial crisis, shared his economic forecast for Trump's second term in a recent interview. Roubini acknowledged that some of Trump's economic strategies may stimulate economic growth, but he warned that others could lead to worsening inflation and a slowdown in economic expansion. During the interview, he specifically mentioned Trump's proposal to impose tariffs on products from Mexico, Canada, and other countries.

Comments

In this post, I will be share some of the features I used most often in the Moomoo mobile app for me to keep track of my portfolio whenever I go after using the app for 3 years.

1) –Cus...

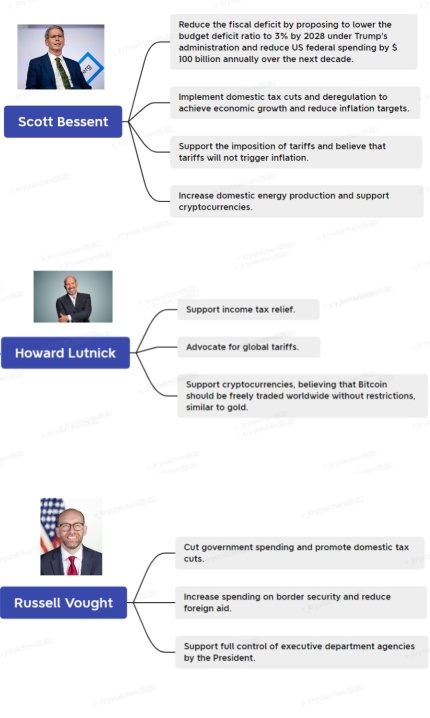

1. Who’s on Trump’s team? What are their primary responsibilities?

2. Economic ideologies of Cabinet members in policy-related roles

3. Economic ideologies of non-Cabinet members in policy-related roles

4. Impacts...

JPMorgan has now paid a whopping $40bn in violations according to fresh data from a corporate misconduct database and tracker.

JPMorgan Chase has reached a staggering milestone, having paid more than $40 billion in fines and settlements due to a series of regulatory violations, anti-competitive practices, and other corporate misconduct.

In just the last seven quarters alone, the banking giant has disbursed approxi...

Analysts predict Trump's second-term policies could echo his first, but with a swifter pace and more assertive domestic and foreign agendas. Expectations are for a stronger application of the "A...