No Data

JPM241227P160000

- 0.07

- 0.000.00%

- 5D

- Daily

News

Goldman Sachs: The yen is at a "sweet spot" that will attract foreign investment to purchase Japanese Stocks.

Bruce Kirk, chief Japan stocks strategist at Goldman Sachs, stated that the current level of the yen against the dollar is beneficial for overseas investors to purchase Japanese stocks. He believes the risk of the exchange rate dropping below the 160 mark is limited, considering it might trigger some form of intervention by Japanese authorities. On Tuesday in the Tokyo market, the yen was around 157.13 against the dollar. This provides overseas funds with a "sweet spot" to buy Japanese stocks at a relatively low price, reducing the likelihood of a decline in the dollar value of these stocks due to yen depreciation in the future. Kirk believes that if the yen appreciates, this would also bring some.

J.P. Morgan Asset Management Quietly Appoints New Head of U.S. Equity -- Barrons.com

Fed to Seek Public Comment on Bank Stress Test Process

JPMorgan Wants to Win More DIY Investors. Here's How. -- Barrons.com

Apple Stock Edges Up. How the iPhone 16 Could Send It Even Higher. -- Barrons.com

Market Chatter: JPMorgan Chase No Longer a Shareholder in Star Entertainment

Comments

1. Industry Overview

The U.S. banking industry is one of the most complex and diversified banking systems in the world, encompassing commercial banks, investment banks, regional and local banks, and a growing number of financial technology (Fintech) companies. Through a wide range of financial products and services, the U.S. banking system meets the needs of individuals, businesses, an...

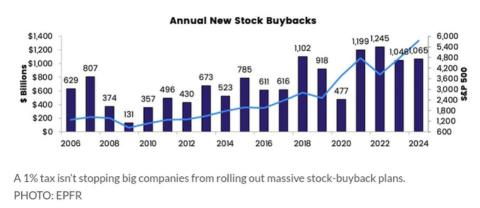

In 2024, companies in the U.S. stock market have been feverishly announcing plans to buy back their shares, signaling a momentous surge as the year draws to a close. For investors and corporations alike, major firms like $Apple (AAPL.US)$ , $Alphabet-C (GOOG.US)$ , and $Meta Platforms (META.US)$ have ramped up their buyback programs. Announced buyback plans have already ex...

Dark pools are private trading platforms where institutional investors can buy and sell large quantities of securities outside of public stock exchanges. They are designed to allow trades to be executed without immediately revealing the transaction details to the broader market, thereby minimizing price impact and maintaining anonymity.

Key Features of Dark Pools

1. Privacy:

• Dark pools conceal the size and price of orders until the trade is executed, r...

J Servai (JLAPT) : Wait and See ...

102468020 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

A Humble Mooer : banks have a very poor track record under lower regulation.

the race to outperform in banking creates perverse incentives and offloading responsibilities under "too big to fail" conditions.

I'm taking a wait and see approach.

103774197 : Election day is November 5th, VOO closing price is 530.1, it only increased by 2.89% to 538.94 by December 19th. How is your S&P 500 increase of over 6% calculated?

kyneo :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)