No Data

JPXN Ishares Jpx-Nikkei 400 Etf

- 75.620

- -0.080-0.11%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

The uncertainty surrounding Trump's tariffs is leading to a sense of stagnation.

The Nikkei average fell slightly for three consecutive trading days, ending at 37,608.49 yen, down 68.57 yen (Volume approximately 1.6 billion 50 million shares). Initially, buying began due to the rise in U.S. stocks at the end of last week, but after peaking at 37,841.68 yen at the open, the market showed a strong sense of stagnation. Uncertainty surrounding the Trump administration's tariff policies became a burden, leading to a slight movement as it ended at today's low. In the Main Board of the Tokyo Stock Exchange, the number of falling stocks exceeded 1,100, accounting for more than 60% of the total.

Ariake, Kuriyama HD, ETC (additional) Rating

Downgrade - Bearish Code Stock Name Brokerage Firm Previous After ------------------------------------------------------------- <2267> Yakult Morgan Stanley "Equal W" "Under W" <2810> House Food Group Mizuho "Buy" "Hold" Target Price Change Code Stock Name Brokerage Firm Previous After ----------------------------------------------

As it approaches 38,000 yen, the heaviness of the upper range comes into focus.

The Nikkei average fell slightly, ending trading at 37,677.06 yen, down 74.82 yen (with an estimated Volume of 2.6 billion 60 million shares). In the morning, influenced by the decline of U.S. stocks from the previous day and a pause in the depreciation of the yen, selling started out first. However, after the opening, it was bought back at a low, and by the end of the first half, it was purchased up to 37,968.02 yen. When the good earnings outlook from U.S. semiconductor memory giant Micron Technology Inc was conveyed, some semiconductor-related stocks were bought. Additionally, against the backdrop of expectations for further interest rate hikes by the Bank of Japan, there was anticipation for an improvement in profit margins.

Asahi, MonotaRO ETC (additional) Rating

Upgrades - Bullish Code Stock Name Securities Company Previous Change After -------------------------------------------------------------- <4385> Mercari Morgan Stanley "Equal Weight" "Overweight" Downgrades - Bearish Code Stock Name Securities Company Previous Change After ----------------------------------------------------------------- <3

SBI Securities (before closing) has a strong Sell for Mitsubishi Corporation and a strong Buy for Mitsubishi Heavy Industries.

Sell Code Stock Name Transaction Amount (7011) Mitsubishi Heavy Industries 38,626,542,061 (5803) Fujikura 26,600,358,781 (8306) Mitsubishi UFJ Financial Group 19,997,540,150 (7012) Kawasaki Heavy Industries 14,461,582,720 (7013) IHI 11,333,718,950 (6857) Advantest 10,916,882,074 (1570

Fujitsu, Iwatani Industrial, etc. [List of stock materials from the newspaper]

*Fujitsu <6702> achieves the world's highest efficiency of 85.2% with GaN (Nikkankogyo, page 1) -○*SoftBank Group <9984> acquires a US semiconductor design company to enhance AI infrastructure (Nikkankogyo, page 3) -○*Mitsubishi Electric Corp. Unsponsored ADR <6503> establishes a new FA headquarters in China to promote product planning and sales locally (Nikkankogyo, page 4) -○*Iwatani Corporation <8088> cancels hydrogen business in Australia and will consider future policies including alternatives (Nikkankogyo, page 4) -○*Insource <6200> undertakes employee training from Oita and Nakatsu (Nikkankogyo, page 5) -

Comments

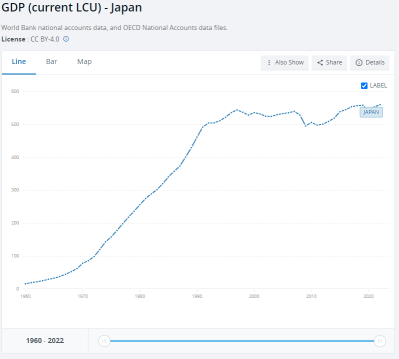

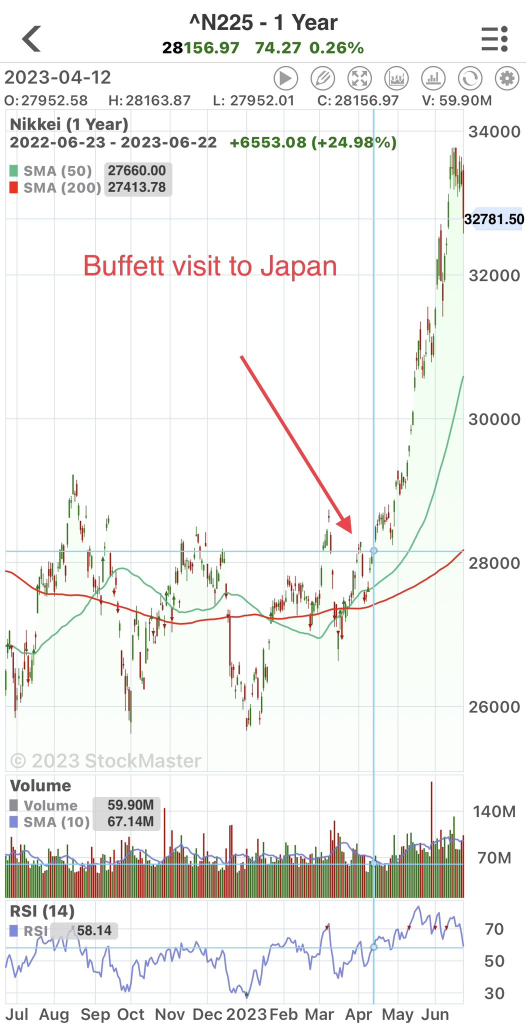

The Japanese stock market has experienced a significant narrative shift, with robust and enticing performance since 2023. The Nikkei Index has recorded its largest gains since 1989, consistently benefiting from growing corporate profits, enhanced capital efficiency, and supportive policy environments for market liquidity. As of today, the Nikkei 225 index closed up 0.5%, at 40,109.23 points, marking the fi...

Short-Term Rally in the Yen

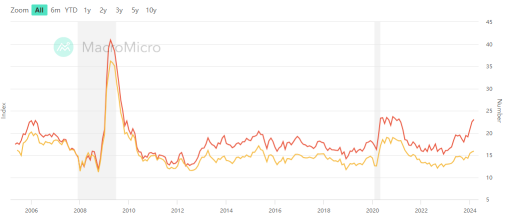

The yen has been on a big rally for over a month now. This is mostly due to the expectation that the Fed will stop cutting interest rates. Ueda also hinted towards the idea of increasing interest rates in his previous comments. This would add strength to the yen. But I won't believe it until I actually see it.

Forex Machanics

There are a few variables that could affect the path of yen ...

$FTSE Singapore Straits Time Index (.STI.SG)$ declined 0.4 per cent or 13.16 points to 3,265.14, with 14 of the 30 constituents including the banking trio finishing lower.

China’s fiscal conditions still face persistent challenges this year, especially from falling land sales revenue and...

$Warren Buffett Portfolio (LIST2999.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Sumitomo Mitsui Financial (SMFG.US)$ $Mitsubishi Electric (ADR) (MIELY.US)$ $Mitsubishi Estate (ADR) (MITEY.US)$ $OSE Nikkei 225 mini Futures(JUN5) (NK225Mmain.JP)$ $OSE Nikkei 225 Futures(JUN5) (NK225main.JP)$ $Nikkei/USD Futures(JUN5) (NKDmain.US)$ $Ishares Jpx-Nikkei 400 Etf (JPXN.US)$

Regional markets ended the day mixed. The Nikkei 225 was down 0.7 per cent, the KLCI lost 0.3 per cent, and the Kospi shed 0.2 per cent. Meanwhile, the Hang Seng rose 0.3 per cent, and the ASX 200 added 1.3 per cent.

About 951.7 million securities worth S$740.8 million changed hands on the local bourse $SGX (S68.SG)$ , with ad...