No Data

KBA Kraneshares Tr Bosera Msci China A Sh Etf

- 24.800

- -0.200-0.80%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

China's Manufacturing PMI Rises Above Expectation in October

Asian Markets Mostly Lower, Japan Extends Gains

On the eve of the "historical" financial report, byd company limited sees a mass exodus of short sellers.

Data shows that the short-selling ratio of BYD Company Limited's Hong Kong stocks decreased from 7.7% earlier this year to 0.9% last Friday, close to the lowest level since July 2022. Currently, the market expects BYD's third-quarter revenue to be 204.8 billion yuan, aiming to achieve a historic high and surpass tesla.

wanhua chemical group Q3 net income fell by 29.41% due to product price decreases and rising raw material costs | Financial report insights

In the third quarter, due to the year-on-year decrease in product prices and the year-on-year increase in main raw material prices, product costs increased, gross profit decreased. Net income of wanhua chemical group was 2.919 billion yuan, a year-on-year decrease of 29.41%, total revenue was 50.537 billion yuan, a year-on-year increase of 12.48%.

Kweichow Moutai's performance in the first three quarters meets expectations. The timing for interim dividends and buybacks has not been determined yet. | Interpretations

①Kweichow Moutai's third-quarter earnings announced tonight basically meet expectations, with revenue growth exceeding the annual guidance; ②The proportion of direct sales in the first three quarters of this year has declined, which is related to the poor performance of the company's direct sales platform "i Moutai". In the first three quarters, i Moutai achieved a tax-free revenue of 14.766 billion yuan for alcoholic beverages, a slight decrease compared to the same period last year; ③Against the backdrop of current consumer softness, it is highly anticipated whether Kweichow Moutai will lower its operation targets next year.

BRICS Eyes Challenging Western Dominance, but Will It Be Successful?

Comments

$Kraneshares Tr Bosera Msci China A Sh Etf (KBA.US)$ $Kraneshares Tr Msci All China Index Etf (KALL.US)$ $iShares MSCI China ETF (MCHI.US)$ $KraneShares CSI China Internet ETF (KWEB.US)$

$BANK OF CHINA (03988.HK)$ $Kraneshares Tr Bosera Msci China A Sh Etf (KBA.US)$ $iShares MSCI China ETF (MCHI.US)$ $iShares China Large-Cap ETF (FXI.US)$

I believe that much of the growth in electricity demand in China is coming from new electric vehicles hitting the roads. Soon, China will have as many new NEVs on the roads each year as the entire US car market.

We can see that Beijing is taking a multi-pronged appr...

The ETF market has played a vital role in the success of the US equity markets, holding approximately 13% of US equity assets—the largest share among mature markets. In particular, passive ETFs significantly influence the demand for shares of the largest listed companies, known as the Mag 7.

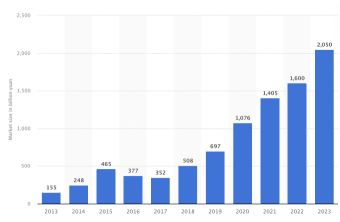

Currently, ETFs in China, valued at RMB 3 trillion ($428 billion), represent only 3% to 4% of the country's total equity ass...