No Data

US ETFDetailed Quotes

KOLD ProShares UltraShort Bloomberg Natural Gas

- 21.510

- +0.400+1.89%

Close Mar 24 16:00 ET

21.610High20.467Low

21.610High20.467Low6.15MVolume20.700Open21.110Pre Close130.32MTurnover19.54%Turnover Ratio--P/E (Static)31.48MShares85.20052wk High--P/B677.21MFloat Cap16.20452wk Low--Dividend TTM31.48MShs Float1483.718Historical High--Div YieldTTM5.42%Amplitude4.530Historical Low21.184Avg Price1Lot Size

Intraday

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Unit: --

Capital Trend

IntradayDayWeekMonth

No Data

News

Crude Oil Gains as Trump to Impose Secondary Tariffs on Venezuelan Oil; Analysts Split on Impact

BlackRock Sees 'Bright Spots' in Global Stocks Amid Narrowing U.S. Outperformance Gap

Crude Oil Drives Higher With Focus on Geopolitical Risks, OPEC+ Plan to Rein in Production

Crude Oil Gains as Bullish U.S. Data Boosts Demand Outlook

Crude Oil Gives up Gains From Escalating Middle East Tensions, as Economic Worries Persist

U.S. Natural Gas Slips to Two-week Low as Waha Spot Prices Turn Negative

Comments

1

2

$ProShares UltraShort Bloomberg Natural Gas (KOLD.US)$ can raise or not

2

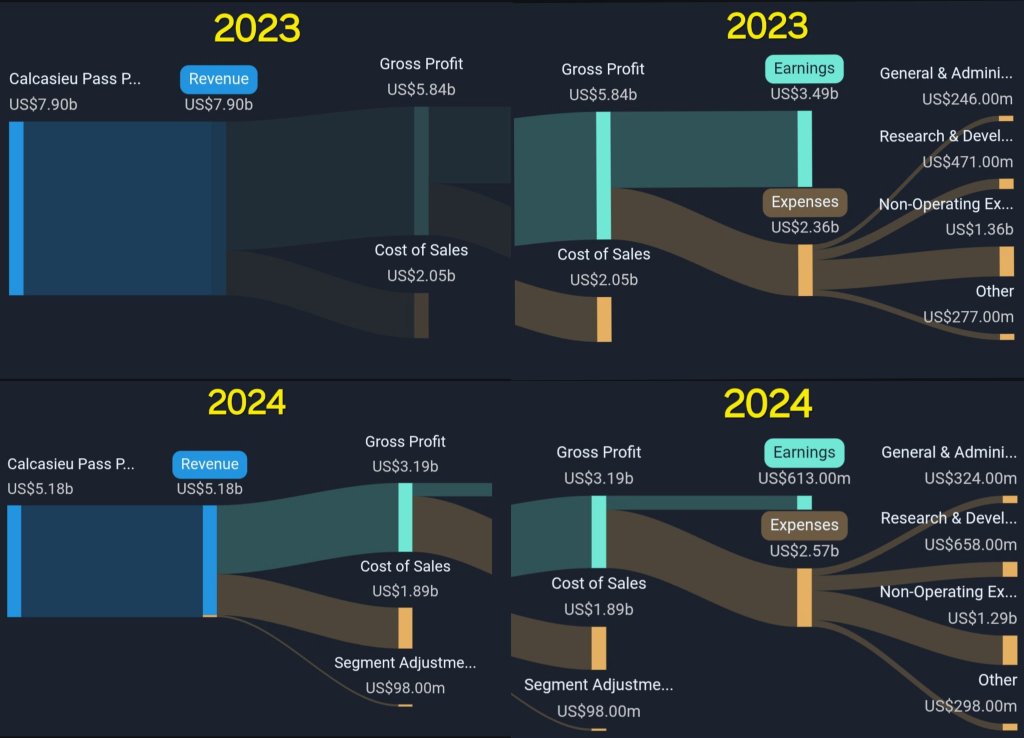

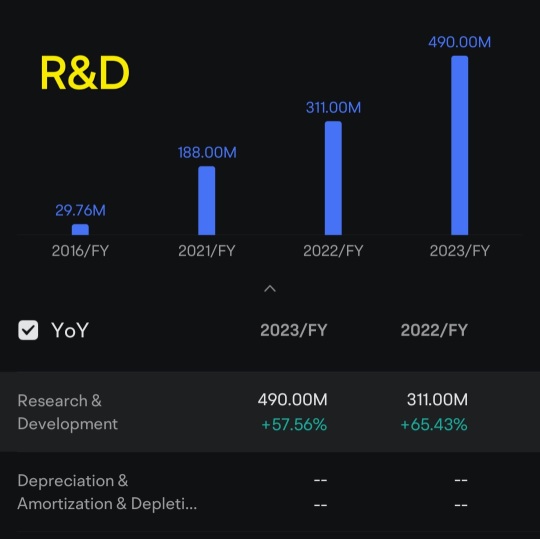

$Venture Global (VG.US)$ Here is the LNG company that IPO'd last Friday (the 2nd biggest US LNG company and the largest LNG IPO ever !)

The price action has consolidated over the last 2 days, going up to $22.14 last Thursday. People are buying more and more. Open interest raised due to the novelty, the $20 options on the "bears" side are popular and the one at $22.50 too. Maybe some are bearish in the short term, but February 21st is far away. I believe that ...

The price action has consolidated over the last 2 days, going up to $22.14 last Thursday. People are buying more and more. Open interest raised due to the novelty, the $20 options on the "bears" side are popular and the one at $22.50 too. Maybe some are bearish in the short term, but February 21st is far away. I believe that ...

+3

7

5

Read more

73863824 : What does this mean?

BIR : A large gap up opening is needed.