US Stock MarketDetailed Quotes

KR The Kroger Co.

- 65.400

- +0.680+1.05%

Close Mar 21 16:00 ET

- 65.273

- -0.127-0.19%

Post 20:01 ET

43.03BMarket Cap17.12P/E (TTM)

65.640High64.680Low8.03MVolume64.720Open64.720Pre Close524.07MTurnover1.23%Turnover Ratio17.82P/E (Static)658.00MShares68.51052wk High3.44P/B42.59BFloat Cap48.24152wk Low1.22Dividend TTM651.22MShs Float68.510Historical High1.87%Div YieldTTM1.48%Amplitude3.930Historical Low65.282Avg Price1Lot Size

The Kroger Co. Stock Forum

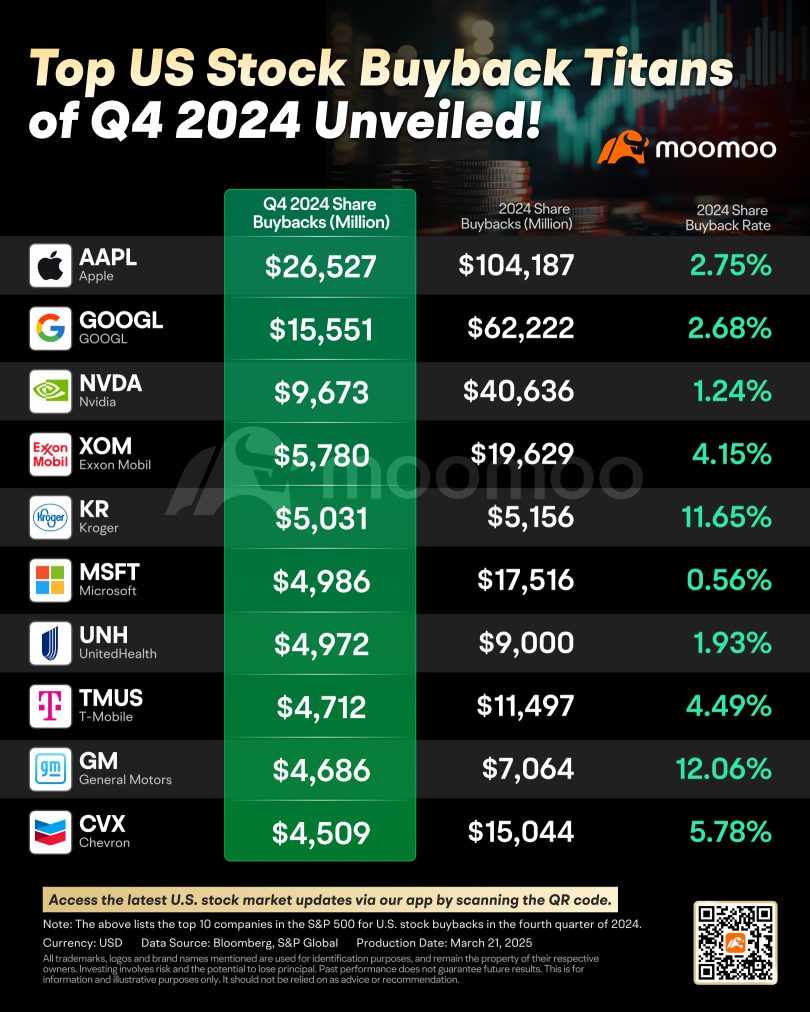

In the fourth quarter of 2024, S&P 500 companies set a new record by repurchasing $243.2 billion of their own stock, a 7.4% jump from the prior quarter and an 11% increase year-over-year. For the full year, buybacks surged to an unprecedented $942.5 billion, up 18.5% from 2023.

Top Buyback Leaders

The top three players in the buyback arena are Apple, Google, and Nvidia.

– $Apple (AAPL.US)$: In Q4 2024, Apple repurchased $26.5 billion...

Top Buyback Leaders

The top three players in the buyback arena are Apple, Google, and Nvidia.

– $Apple (AAPL.US)$: In Q4 2024, Apple repurchased $26.5 billion...

30

2

19

$The Kroger Co. (KR.US)$ Time to load some put option. This ain't gonna make any new high this week

Happy Thursday investors, it's March 6th, the market opened lower even after two days of reaching toward the lowest prices since before the U.S. election in November.

The Trump Administration halted tariffs for Mexican Trade, which is already covered under the USMCA free trade agreement, until April 2nd. Commerce Secretary Howard Lutnick had told CNBC that a decision would come on Thursday over goods exempt from the new...

The Trump Administration halted tariffs for Mexican Trade, which is already covered under the USMCA free trade agreement, until April 2nd. Commerce Secretary Howard Lutnick had told CNBC that a decision would come on Thursday over goods exempt from the new...

17

2

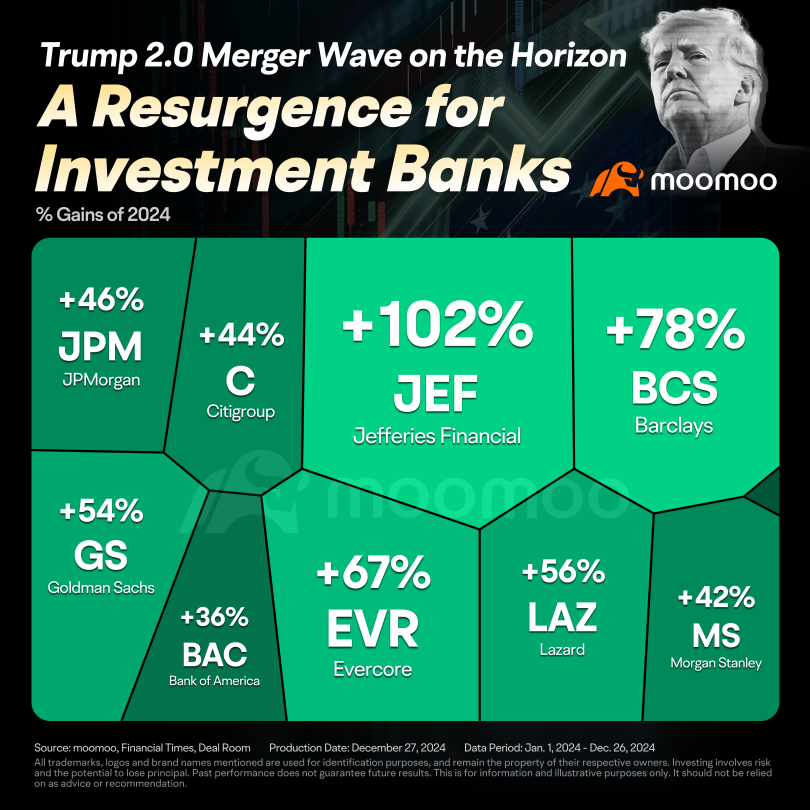

Deregulation was a hallmark of Trump's policy framework, and his previous term saw M&A-friendly regulatory reforms. With Trump poised for a White House comeback and an M&A market primed to rebound, many market observers foresee a surge in deals over the coming years.

M&A activity is already showing signs of recovery. According to Dealogic, announced M&A deals in 2024 surpassed $1.4 trillion, up from $1.32 trillion in 2023, though slightly bel...

M&A activity is already showing signs of recovery. According to Dealogic, announced M&A deals in 2024 surpassed $1.4 trillion, up from $1.32 trillion in 2023, though slightly bel...

62

5

29

$Albertsons Companies (ACI.US)$ So who backstab who here ? 🤣🤣🤣 Albertsons filing lawsuit against $The Kroger Co. (KR.US)$ after merger is blocked two years waiting lol .. Albertsons still has some value

4

3

$Albertsons Companies (ACI.US)$ $The Kroger Co. (KR.US)$ US District Judge Adrienne Nelson Issues Preliminary Injunction on Antitrust Grounds

2

1

Berkshire Hathaway’s most recent portfolio update, based on filings as of Q3 2024, reveals several key holdings and recent changes:

Top Holdings:

1. $Apple (AAPL.US)$ 26.2% of the portfolio, valued at $69.9 billion. Despite recent trimming of the stake, Apple remains the largest holding.

2. $American Express (AXP.US)$ 15.4%, valued at $41.1 billion.

3. $Bank of America (BAC.US)$ 11.9%, worth $31.7 billion, though the stake was reduced by 23% in Q3.

4. $Coca-Cola (KO.US)$ 10.8%, va...

Top Holdings:

1. $Apple (AAPL.US)$ 26.2% of the portfolio, valued at $69.9 billion. Despite recent trimming of the stake, Apple remains the largest holding.

2. $American Express (AXP.US)$ 15.4%, valued at $41.1 billion.

3. $Bank of America (BAC.US)$ 11.9%, worth $31.7 billion, though the stake was reduced by 23% in Q3.

4. $Coca-Cola (KO.US)$ 10.8%, va...

17

3

12

No comment yet

Tchildress84 : isn’t that the money that was supposed to trickle down thru the tax breaks they gave wealthy and large companies. you know reinvest in the workers like was promised when the tax cut was passed. lol i think we all seen this coming.

只需转一点 : Is T-Mobile included? This is Deutsche Telekom.