No Data

KWEB KraneShares CSI China Internet ETF

- 35.170

- -0.560-1.57%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Is the "East rises and West falls" trend continuing? Morgan Stanley and Goldman Sachs are in agreement on being bullish about the Chinese stock market: the trend of rising valuations is far from over.

Morgan Stanley, which has always been cautious about the China market, has once again raised its target point for the Chinese stock market, emphasizing that profits and valuations continue to rise significantly.

Asia Markets Rise Following Strong Wall Street Lead; Australia Rises on Soft CPI

Choosing between A-shares or Hong Kong stocks, Technology or non-Technology? Goldman Sachs' Research Reports respond to two major hot topics in investing in China.

① Currently, should investors continue investing in Hong Kong Stocks or shift to the A-share market? Should the focus be on the Technology Sector or shift to Consumer, Real Estate, and other non-Technology sectors? ② On Wednesday, Goldman Sachs' chief China Stocks strategist, Liu Jinjing, provided an analysis in his report.

"On the eve of April 2nd," the China strategy teams of Goldman Sachs and Morgan Stanley sang in unison about optimism.

Goldman Sachs stated that based on its investor research, investors remain calm regarding tariff concerns. It believes that China's AI narrative is seen as a game changer, expected to attract over 200 billion dollars in Inflow within the next decade. Morgan Stanley holds that the Chinese market is experiencing three solid Bullish factors: the first performance surprise in three and a half years, upward revisions in profit forecasts, and potential elimination of long-term discount in valuations.

Kuaishou's Q4 revenue increased by 8.7% year-on-year, Short Video e-commerce GMV grew over 50.0%, and cumulative income from Keling AI exceeded 0.1 billion yuan | Earnings Reports insights.

Kuaishou's revenue in Q4 grew by 8.7% year-on-year to 35.384 billion yuan, and net income increased by 7.8%, with user growth remaining stable. The Keling AI independent app has officially launched, and from the start of monetization until February 2025, it has accumulated revenue exceeding 0.1 billion yuan.

Alibaba's Tsai Sounds Alarm On Signs Of AI Bubble In US: 'People Are Building Data Centers On Speculation'

Comments

This is likely why the market has been rallying since late Friday.

But all that said, some investors may still feel a bit edgy over a potential uptick in inflation and slowing economic growth.

Speaking of inflation, pay attention to the Federal Reserve's preferred inflation gauge PCE, which is set to release this Friday.

$SPDR S&P 500 ETF (SPY.US)$ $S&P 500 Index (.SPX.US)$ $Invesco QQQ Trust (QQQ.US)$ $Trump Media & Technology (DJT.US)$ $Palantir (PLTR.US)$ $Tesla (TSLA.US)$ $NVIDIA (NVDA.US)$ $Microsoft (MSFT.US)$ $Meta Platforms (META.US)$ $Alphabet-A (GOOGL.US)$ $Netflix (NFLX.US)$ $Amazon (AMZN.US)$ $KraneShares CSI China Internet ETF (KWEB.US)$ $GameStop (GME.US)$ $Strategy (MSTR.US)$

why?

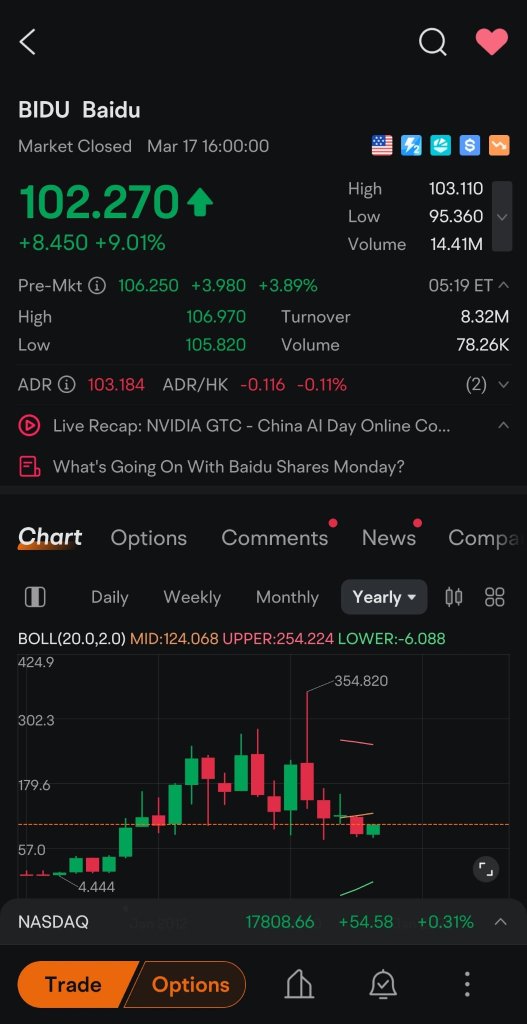

Baidu, Inc. (NASDAQ:BIDU) shares are trading higher on Monday after the company announced the launch of ERNIE 4.5 and deep-thinking model ERNIE X1. Said to be better than ChatGpt in many areas.

Alot of room for it to run. This can be Baba 2.0!

$Alibaba (BABA.US)$ $SPDR S&P 500 ETF (SPY.US)$ $KraneShares CSI China Internet ETF (KWEB.US)$

Not tough to understand why - all thanks to Trump’s and his very fluid tariff plans.

But all these are short term sentiment driven volatility. Eventually, fundamentally strong companies will come out stronger than ever.

$HANG SENG BANK (00011.HK)$ $Hang Seng Index (800000.HK)$ $SPDR S&P 500 ETF (SPY.US)$ $S&P 500 Index (.SPX.US)$ $KraneShares CSI China Internet ETF (KWEB.US)$ $Tesla (TSLA.US)$ $Super Micro Computer (SMCI.US)$ $Trump Media & Technology (DJT.US)$ $Palantir (PLTR.US)$ $MARA Holdings (MARA.US)$ $Apple (AAPL.US)$ $Meta Platforms (META.US)$ $Microsoft (MSFT.US)$ $SPDR Dow Jones Industrial Average Trust (DIA.US)$ $Advanced Micro Devices (AMD.US)$