No Data

LCS CSOP LOW CARBON S$

- 1.925

- -0.011-0.57%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

What kind of week will this be? Global stock markets are facing a "tariff storm," and U.S. Treasury bonds are back in focus.

Since this quarter, U.S. Treasury bonds have outperformed Stocks, with a cumulative increase of more than 2%, while the S&P 500 Index has declined by about 5%. Analysis suggests that the 'reciprocal tariff' policy may impact the stock of Industries such as Autos, chips, and Pharmaceuticals, while the outlook of economic downturn and declining stock market will continue to elevate U.S. Treasury bonds as a safe haven Assets.

Rating [Securities companies rating]

Downgrade - Bearish Code Stock Name Brokerage Firm Previous After-----------------------------------------------------<4026> Kamisha Ichiyoshi "A" "B" <2678> Askul Iwai Koss Corp "A" "B+" <7203> Toyota CLSA "Hold" "Under P"

List of convertible stocks (Part 5) [List of stocks with Parabolic Cigna Corp signals]

○List of stocks transitioning to Sell Market Code Stock Name Closing Price SAR Tokyo Main Board <6616> Trex Co. 1258 1322 <6644> Ohsaki Electric 8248 75 <6718> Aihon 2668 2748 <6741> Nisshin Signal 9079 24 <6763> Teito Engineering 2471 2570 <6768> Tamura Manufacturing 5355 62 <6770> Alps Alpine 1571 1650 <6787> Meiko 70807

Products can be indirectly applied to the Metal surface of industrial robots. Robot Concept stocks hit the limit up. This week, Institutions conducted intensive research on related listed companies.

① Anhui Shenjian New Materials released a research summary on Thursday indicating that the downstream of the company's polyester Resin products is the powder coating industry, and powder coatings can be applied to the Metal surfaces of industrial Siasun Robot&Automation. In the secondary market, Anhui Shenjian New Materials reached a daily limit on Thursday. ② A summary of the industries that institutions focused on this week (attached table), the list of listed companies (attached stocks), and the latest research in the Siasun Robot&Automation industry.

Due to concerns over Trump tariffs, temporarily fell below 37,000 yen.

The Nikkei average significantly continued to decline, closing down 679.64 yen at 37,120.33 yen (estimated Volume of 1.9 billion 30 million shares). The decline was influenced by the negative sentiment from the previous day in the USA market, following President Trump's announcement of a 25% additional tariff on imported Autos. The Nikkei average opened with a drop of over 400 yen and dipped below the key 37,000 yen level during the mid-morning session. Although there were moments to pick up on dips afterward, in the afternoon session, stocks like Tokyo Electron <8035> and Advantest <6857> were affected.

Mori Hills, Mitsubishi Motors, etc. (additional) Rating.

Upgraded - Bullish Code Stock Name Brokerage Firm Previous Change After --------------------------------------------------------- <6869> Sysmex Morgan Stanley "Equal Weight" "Overweight" Target Price Change Code Stock Name Brokerage Firm Previous Change After --------------------------------------------------------- <3234> Mori Hills Daiwa 1

Comments

§ Chinese equities are enjoying the best start of the year in history, even in the haze of tariff war. The continuing southbound funds and AI-related revaluation made HK stocks stand out, but a catch-up rally in A-shares is still possible.

§ Uncertainties in US tariff policies remain one of the largest threats to the global risk appetite, making the safe-haven assets like gold, US Treasury bonds, and JPY in good demand....

![[CSOP ETF Strategy] New Narratives are Reshaping Chinese Assets](https://ussnsimg.moomoo.com/sns_client_feed/71451441/20250326/web-1742979647803-BBSK5DSDAX.png/thumb?area=999&is_public=true)

![[CSOP ETF Strategy] New Narratives are Reshaping Chinese Assets](https://ussnsimg.moomoo.com/sns_client_feed/71451441/20250326/web-1742979648058-dNh8nCKgFZ.png/thumb?area=999&is_public=true)

![[CSOP ETF Strategy] New Narratives are Reshaping Chinese Assets](https://ussnsimg.moomoo.com/sns_client_feed/71451441/20250326/web-1742979647803-HI8DOSMCnQ.png/thumb?area=999&is_public=true)

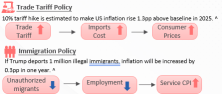

Inflation Crisis will End Soon? Beware of Reflation

High inflation has been a common predicament for countries in the post-pandemic era, leading to an expansion of the wealth gap and an intensification of social conflicts. Many voters have sought new governments to solve the problem of inflation, which was also the reason for the failure of incumbent parties around the world in the past 2024 election year.

However, ...

【 $CSOP LOW CARBON US$ (LCU.SG)$/ $CSOP LOW CARBON S$ (LCS.SG)$】YTD Return: +3.49%

• The week started with President Trump imposing 25% tariffs on all US steel and aluminium imports, applicable to all countries, which unsettled markets, causing investors to seek safety. Nevertheless, Asian equities remained resilient and generally slightly rebounded after falling on Monday. ...

【SQQ/SQU $CSOP SEA TECH ETF S$ (SQQ.SG)$ 】YTD Return: +30.60%

• Sea Ltd's stock outperformed in 2H, rising 59% from mid-year to 29 Nov due to strong 3Q revenue and earnings, easing concerns over margin pressure from increased competition in Southeast Asia.

• Amid potentially higher US tariffs on Chinese goods, this may benefit e-commerce in Southeast Asia.

• JPM notes that since 2019, ASEAN's TMT sectors have ...

![[LCU/LCS] AI Demand Remains Strong, TSMC's Q3 Net Profit Soars 54% YoY!](https://ussnsimg.moomoo.com/sns_client_feed/71451441/20241017/1729154957905-475adf9a56.jpeg/thumb?area=999&is_public=true)