US Stock MarketDetailed Quotes

LITE Lumentum

- 100.210

- +2.760+2.83%

Trading Jan 22 12:50 ET

6.88BMarket Cap-12.06P/E (TTM)

104.000High99.100Low1.44MVolume99.490Open97.450Pre Close146.07MTurnover2.27%Turnover RatioLossP/E (Static)68.70MShares104.00052wk High7.68P/B6.36BFloat Cap38.28552wk Low--Dividend TTM63.51MShs Float112.080Historical High--Div YieldTTM5.03%Amplitude13.970Historical Low101.210Avg Price1Lot Size

Lumentum Stock Forum

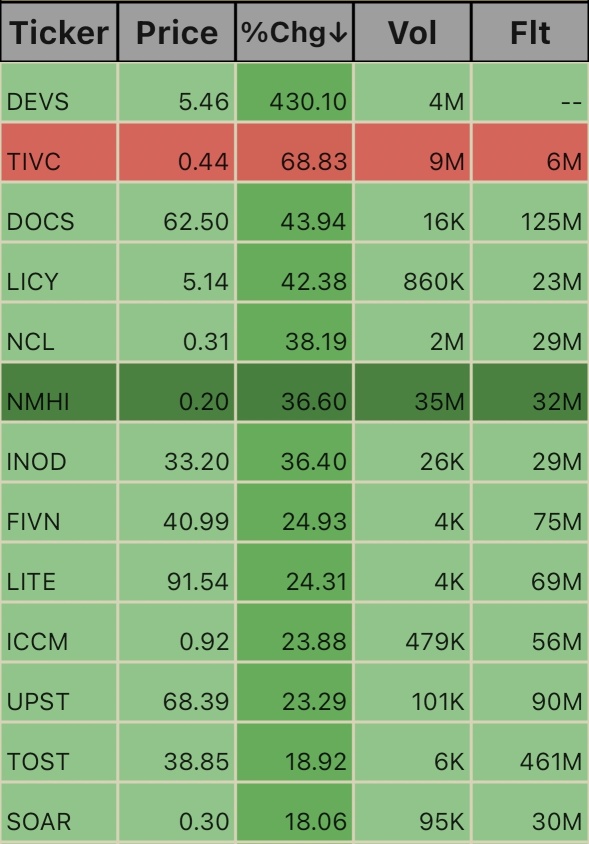

$Volato Group (SOAR.US)$ $Toast (TOST.US)$ $Upstart (UPST.US)$ $Icecure Medical (ICCM.US)$ $Five9 (FIVN.US)$ $Lumentum (LITE.US)$ $Nature's Miracle (NMHI.US)$ $Innodata (INOD.US)$ $Northann (NCL.US)$ $LI-CYCLE (LICY.US)$ $Doximity (DOCS.US)$ $Tivic Health Systems (TIVC.US)$ $DevvStream (DEVS.US)$

📊⚡️📊

📊⚡️📊

6

6

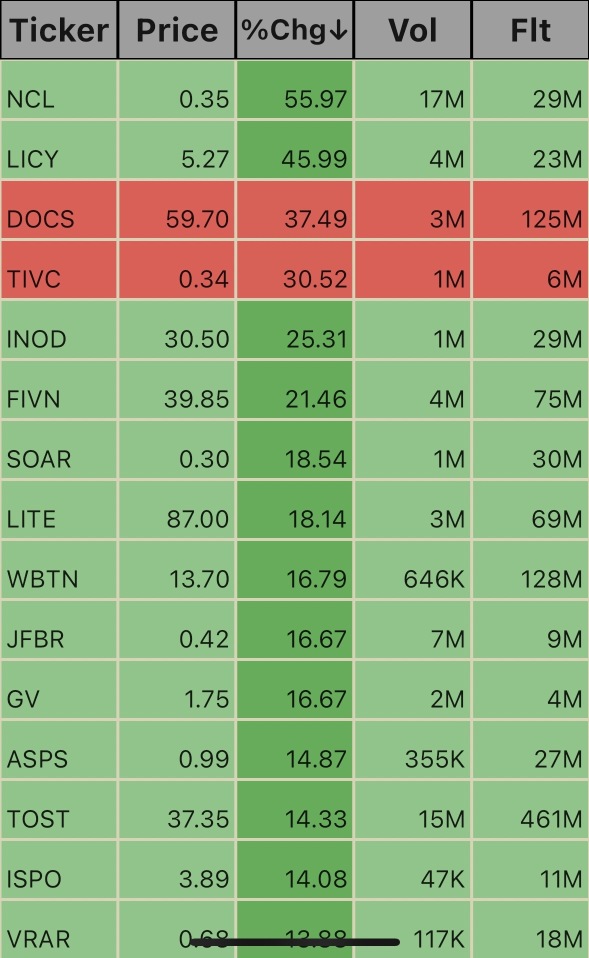

$The Glimpse (VRAR.US)$ $Inspirato (ISPO.US)$ $Toast (TOST.US)$ $Altisource Portfolio (ASPS.US)$ $Visionary Holdings (GV.US)$ $Jeffs' Brands (JFBR.US)$ $WEBTOON Entertainment (WBTN.US)$ $Lumentum (LITE.US)$ $Volato Group (SOAR.US)$ $Five9 (FIVN.US)$ $Innodata (INOD.US)$ $Tivic Health Systems (TIVC.US)$ $Doximity (DOCS.US)$ $LI-CYCLE (LICY.US)$ $Northann (NCL.US)$

📊⚡️📊

📊⚡️📊

4

$Ciena (CIEN.US)$ In June 2024, Nokia Corporation announced its agreement to acquire Infinera for approximately $2.3 billion. This strategic move aims to bolster Nokia’s optical networking capabilities.

When considering potential acquisition targets for larger companies like $AT&T (T.US)$ or $Verizon (VZ.US)$ , several factors come into play, including strategic alignment, market position, and financial health. Among the U.S. optical network equi...

When considering potential acquisition targets for larger companies like $AT&T (T.US)$ or $Verizon (VZ.US)$ , several factors come into play, including strategic alignment, market position, and financial health. Among the U.S. optical network equi...

3

Matthew Sepe's recent sale suggests he considered a lower price fair, questioning the higher valuation of shares. Despite significant insider ownership indicating alignment, the absence of insider purchases and history of sales call for caution before buying Lumentum Holdings shares.

1

Despite Lumentum Holdings' recent revenue drop, the market may anticipate a reversal, justifying its high P/S ratio. The company's projected revenue growth, surpassing the Communications industry, could be maintaining share price and shareholder confidence.

The company's balance sheet is strained due to debt and EBIT level loss. Its use of debt is risky, given it burned through US$9.7m of cash last year.

1

Lumentum Holdings is being seen as a valuable investment opportunity due to its future outlook and the fact that it is being undervalued by the stock market. The optimistic growth projections have not yet been fully accounted for in the share price.

Bristol Myers may bolster its treatments portfolio with Karuna acquisition. Ansys' possible undervaluation hinted by takeover speculation. ASML's gear shipment to Intel viewed positively, fostering quicker semiconductor production. Lumentum's upgrade signals bullish prospects for 2024.

3

Craig-Hallum analysts predict that the telecom market, a strong base for Lumentum, is set to bottom out. Recent Cloud Light acquisition is seen to boost Lumentum's footprint in the affluent datacom market. Reduced Apple exposure, previously a stumbling block, is now seen as a positive stride.

Investors are urged to examine warning signs in Lumentum Holdings' performance. The rise in CEO pay, despite the company's poor performance, could be a contentious issue at the upcoming AGM.

No comment yet

imma sink a bit in there!

imma sink a bit in there!

Paddyal : No more of $Vision Marine Technologies (VMAR.US)$?

Stock_Drift OP Paddyal : It’s running right meow. $Vision Marine Technologies (VMAR.US)$

Paddyal Stock_Drift OP : yup!! it bounced back to surprise me![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Paddyal : @Stock_Drift and now, I want to ask hoe about $Nature's Miracle (NMHI.US)$ ?![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Stock_Drift OP Paddyal : Not sure but I actually almost took a position in AH’s yesterday. Lol.

View more comments...