No Data

MCO250117C680000

- 0.00

- 0.000.00%

- 5D

- Daily

No Data

News

Moody's: The Bank of Japan may raise interest rates by 25 basis points on Friday.

Economists at Moody's Analytics indicate that the Bank of Japan may raise interest rates by 25 basis points on Friday. The economists state that the recent hawkish remarks made by Bank of Japan Governor Kazuo Ueda and Deputy Governor Ryozo Himino suggest that further tightening policies are on the horizon. Since the Bank of Japan skipped the interest rate hike in December, the weak yen, coupled with a series of inflation signs exceeding expectations among consumers, producers, and import prices, has increased the likelihood of taking MMF action. The economists suggest that the December CPI, to be released on Friday, may show higher annual consumer price inflation, but with deeper layers.

An Early Look at What the California Wildfires Could Do to the U.S. Economy -- Barrons.com

Weekly Buzz: Finally a Good Week for 2025

Wall Street Today: Trump's on Deck After Market Nearly Hits Year High

Fund Update: Rothschild & Co Wealth Management UK Ltd Just Disclosed New Holdings

(MCO) - Analyzing Moodys's Short Interest

Comments

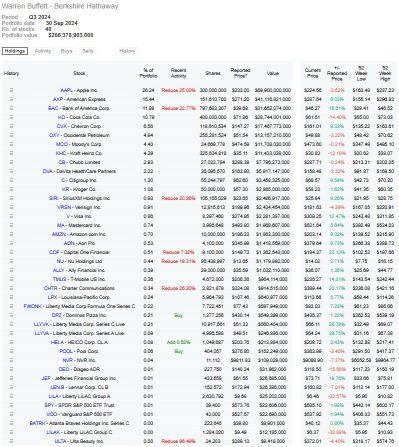

Top Holdings:

1. $Apple (AAPL.US)$ 26.2% of the portfolio, valued at $69.9 billion. Despite recent trimming of the stake, Apple remains the largest holding.

2. $American Express (AXP.US)$ 15.4%, valued at $41.1 billion.

3. $Bank of America (BAC.US)$ 11.9%, worth $31.7 billion, though the stake was reduced by 23% in Q3.

4. $Coca-Cola (KO.US)$ 10.8%, va...

$Warren Buffett Portfolio (LIST2999.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Apple (AAPL.US)$ $American Express (AXP.US)$ $Bank of America (BAC.US)$ $Coca-Cola (KO.US)$ $Chevron (CVX.US)$ $Occidental Petroleum (OXY.US)$ $Moody's (MCO.US)$ $Citigroup (C.US)$ $Visa (V.US)$

2) $Bank of America (BAC.US)$

3) $American Express (AXP.US)$

4) $Coca-Cola (KO.US)$

5) $Occidental Petroleum (OXY.US)$

6) $The Kraft Heinz (KHC.US)$

7) $Chevron (CVX.US)$

8) $Moody's (MCO.US)$

9) $Chubb Ltd (CB.US)$

10) $DaVita (DVA.US)$

11) $MITSUBISHI MOTOR CORP (MMTOF.US)$

12) $Mitsui (8031.JP)$

13) $ITOCHU (8001.JP)$

Old Timer Trader : He sold 80 BILLION DOLLARS of AAPL stock. Just a year ago, he stated that Apple was a stock that he would never sell… can you explain that?

Value trading : when did he say he’d never sell apple stock? not sure where u get that from

咖波猫 Old Timer Trader : He never stated Apple is a stock he would never sell before.