No Data

MNQCURRENT Micro E-mini Nasdaq-100 Index Futures Current Contract

- 21760.50

- +109.25+0.50%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Weekly Buzz: Tech stocks hit high scores on ominous day

Palantir, MicroStrategy Could Be Added to Nasdaq 100. Moderna, Super Micro Could Be Dropped

Friday the 13th Ends with Flat S&P 500 | Wall Street Today

Investors who have leveraged the "Musk Trade" have received substantial returns, with one Fund even surging by 500%.

Whether it's Wall Street funds or small short-term traders, as long as there's a bold bet on Elon Musk's business empire, this year's end could lead to substantial earnings, especially with Donald Trump winning the USA election significantly boosting the wealth of this world's richest person. Musk's support for Trump during the campaign and his appointment to lead the newly established Department of Efficiency have made his companies, including Tesla and the private unicorn companies SpaceX and xAI, become hot Assets. The Market Cap of these companies has soared this year, propelling Musk's personal wealth to exceed 40 billion dollars. Closed-end Fund.

Wall Street's “last bear” Stifel: U.S. stocks will fall to 5,000 points by the end of 2025.

① Barry Bannister, the chief investment strategist at Stifel, one of the few bears on Wall Street, expects that U.S. stocks will be below current levels by the end of 2025; ② Bannister believes that persistently high inflation may prompt the Federal Reserve to maintain high interest rates, impacting the stock market's upward momentum; ③ In contrast, other strategists are focusing on the trajectory of economic growth rather than the extent of interest rate cuts.

The Fed Is Poised to Cut Rates Next Week. But 2025 Is Another Matter

Comments

• Nasdaq Composite:

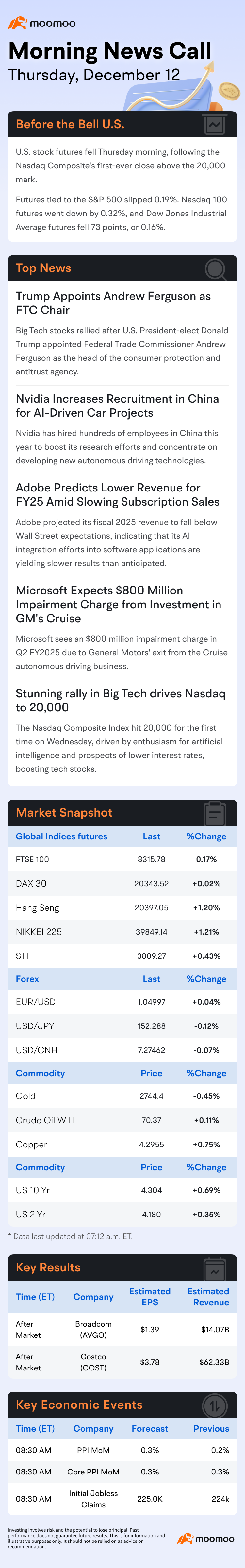

After hitting a record high the previous day. The pullback reflects profit-taking amid concerns about stretched valuations. Despite the correction, tech sentiment remains broadly positive, with market participants eyeing potential catalysts such as upcoming earnings and macroeconomic policy shifts.

• S&P 500:

Narrowly holding above the critical 6,000-point support level. A break below th...

Amid the artificial intelligence frenzy and expectations of Federal Reserve rate cuts, along with ...

1. 1st half was generally good with $S&P 500 Index (.SPX.US)$ up also 15% by end June. Did some shorts in Jan and Feb and got short squeezed and had to cut loses. Was thinking market might pull back and try to position my trades.