No Data

MNSO241220C35000

- 0.00

- 0.000.00%

- 5D

- Daily

No Data

News

Before the Federal Reserve's decision, the rally of U.S. stocks faltered, the Nasdaq said goodbye to record highs, the Dow fell for nine consecutive days, Broadcom dropped over 4%, Chinese concept stocks rebounded against the trend, and Bitcoin reached a

The Dow Jones has seen its first nine consecutive declines since 1978; NVIDIA has seen four consecutive declines, while Tesla has risen over 3% against the trend, hitting new highs for three consecutive days. Chinese concept stocks rebounded nearly 2%, with PDD Holdings rising nearly 3% and Bilibili increasing over 4%. Salaries in the United Kingdom have grown faster than expected, with two-year UK bond yields rising 10 basis points in one day. The USD has rebounded; the Canadian dollar has hit a more than four-year low since the pandemic; Bitcoin surged over $0.108 million during trading, hitting a new historical high for two consecutive days. Crude Oil Product has fallen for two consecutive days, with US oil dropping more than 2% at one point; Gold has hit a new low for the week.

Mama's Creations Posts Weak Earnings, Joins EVgo, Red Cat Holdings And Other Big Stocks Moving Lower In Tuesday's Pre-Market Session

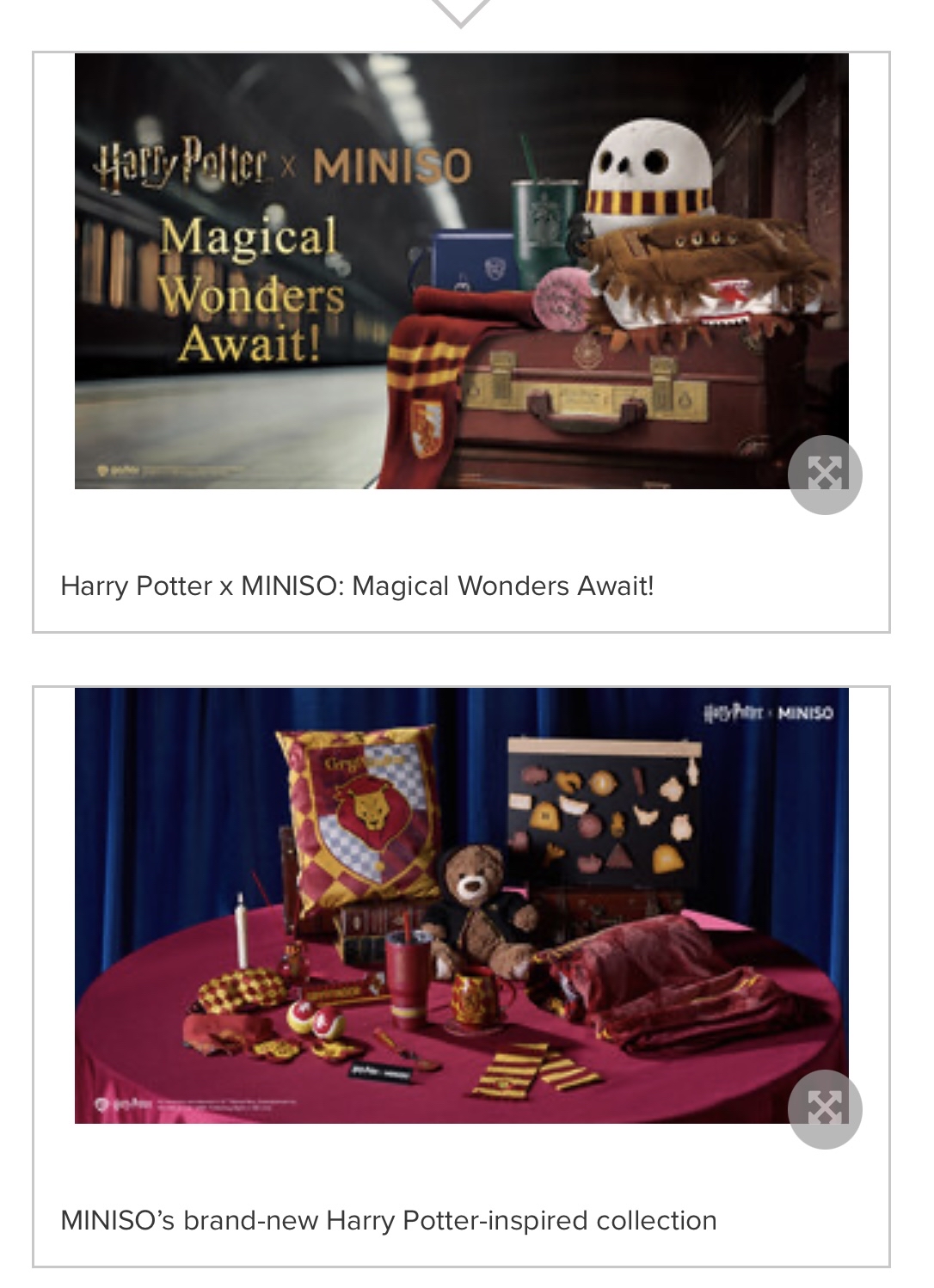

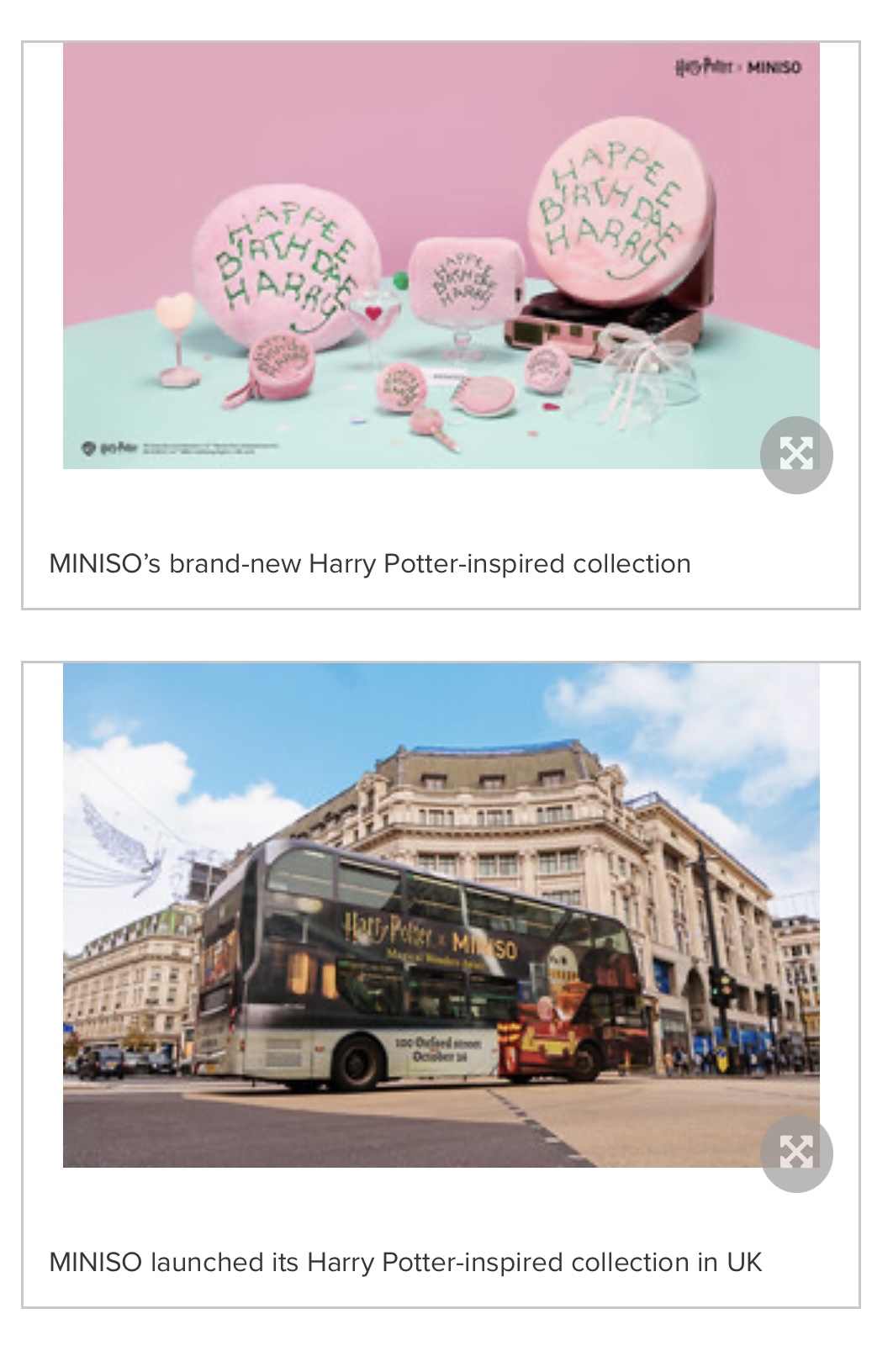

Hong Kong stock movement | MINISO (09896) rose more than 5% in the morning. The company will launch self-developed millet-related products next year, and the Yonghui Trade is expected to be implemented in the first half of next year.

MINISO (09896) rose over 5% in early trading, as of the time of writing, up 5.24%, at 49.25 Hong Kong dollars, with a transaction amount of 0.113 billion Hong Kong dollars.

Huachuang Securities: raised the Target Price for MINISO (09896) to 64-70.4 Hong Kong dollars and upgraded the rating to 'Strong Buy'.

Huachuang Securities predicts MINISO's net income for 2024-2026 will be 2.734 billion/3.745 billion/4.82 billion.

Consumer Cos Up on Signs of Strong Holiday Sales -- Consumer Roundup

Calm Before Storm? Import Inflation Is Low Now, but Trump Tariffs Pose Fresh Threat

Comments

Mr Careful : it is not likely that Chinese companies will be keen to invest in US. see what happens to tic tok first.