US Stock MarketDetailed Quotes

MPC Marathon Petroleum

- 156.060

- +1.970+1.28%

Close Feb 14 16:00 ET

- 156.060

- 0.0000.00%

Post 19:59 ET

49.31BMarket Cap15.48P/E (TTM)

158.450High154.570Low2.41MVolume154.570Open154.090Pre Close377.13MTurnover0.77%Turnover Ratio15.48P/E (Static)316.00MShares217.74752wk High2.03P/B49.17BFloat Cap130.54052wk Low3.39Dividend TTM315.06MShs Float217.747Historical High2.17%Div YieldTTM2.52%Amplitude8.115Historical Low156.362Avg Price1Lot Size

Marathon Petroleum Stock Forum

We saw that the stock market displaying a positive bias which was helped by how the tariffs is developing and how tariffs could impact inflation and corporate earnings.

The most significant events would be Canada received a 30-day reprieve from tariff actions, while China's retaliatory measures seemed more symbolic.

Despite high expectations, President Trump did not engage in talks with Chinese President Xi Jinping. The S&P 500 gained 0.72%,...

The most significant events would be Canada received a 30-day reprieve from tariff actions, while China's retaliatory measures seemed more symbolic.

Despite high expectations, President Trump did not engage in talks with Chinese President Xi Jinping. The S&P 500 gained 0.72%,...

+1

9

2

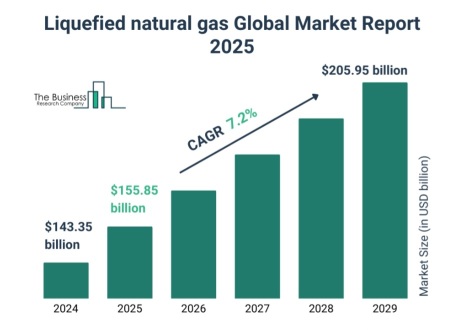

$Venture Global (VG.US)$ Following its market introduction (IPO) this Friday, Venture Global ended it's first day with a 4% drop. Its shares were heavily shorted, the 6th most shorted stock according to Moomoo. Short sales represent in volume 6.98 out of 36.85 millions; the short ratio is 18.94% (which is a lot). The majority of traders bought it at $24. But Friday's decline was attributable to the market as a whole.

Venture Global is THE ...

Venture Global is THE ...

+1

1

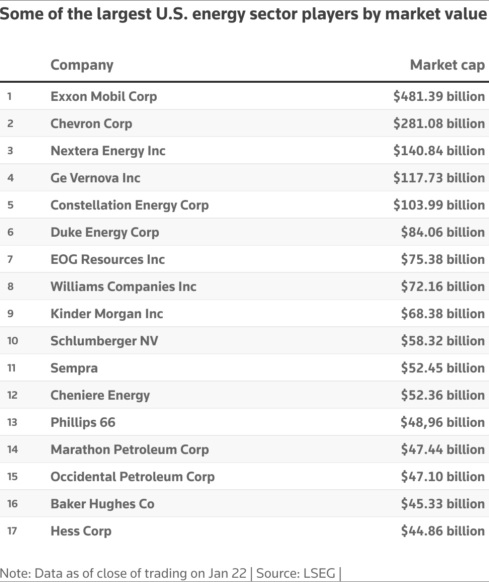

President Donald Trump’s pro-oil policies have significantly impacted various sectors within the energy industry. Companies involved in oil and gas exploration, production, and services have notably benefited from these policy shifts.

Oil and Gas Exploration and Production Companies:

• $Exxon Mobil (XOM.US)$: As a major player in the oil industry, Exxon Mobil stands to gain from policies that encourage increased fossil fuel production and reduced regulatory const...

Oil and Gas Exploration and Production Companies:

• $Exxon Mobil (XOM.US)$: As a major player in the oil industry, Exxon Mobil stands to gain from policies that encourage increased fossil fuel production and reduced regulatory const...

9

$Marathon Petroleum (MPC.US)$ Im no longer buying this crap. I’m down 15.00 for this stock.

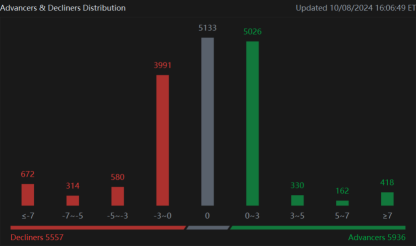

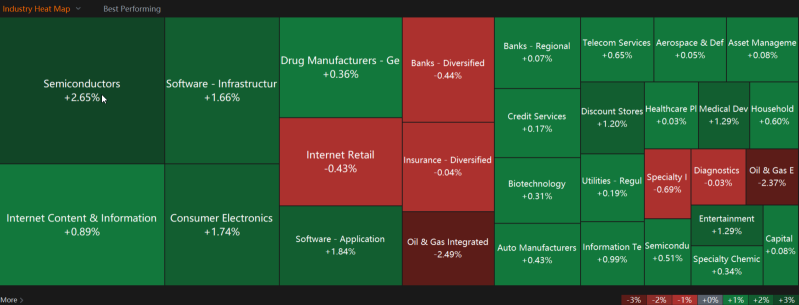

The market overall climbed Tuesday, and Chinese tech stocks and Oil futures fell. Overnight, a Chinese economic planning agency press conference disappointed investors who were hoping for further stimulus, according to Wall Street Journal. Oil and energy, meanwhile, declined without a clear, incoming response from Israel for Iranian missiles to drive up fuel consumption.

Just past 4 pm ET the $S&P 500 Index (.SPX.US)$ traded...

Just past 4 pm ET the $S&P 500 Index (.SPX.US)$ traded...

48

6

9

Good morning, traders. Happy Tuesday, October 8th. Chinese stocks are finally pulling back, alongside Crude Oil Futures. Stimulus jumps can only go so far, and analysts like George Pavel from Capex.com told Wall Street Journal the energy market is no longer expecting an all-out Israeli attack on Iran.

My name is Kevin Travers; here stonks and stories you have to hear about from Wall Street Today.

$Marathon Petroleum (MPC.US)$ fell 8%, ...

My name is Kevin Travers; here stonks and stories you have to hear about from Wall Street Today.

$Marathon Petroleum (MPC.US)$ fell 8%, ...

32

15

7

$Marathon Petroleum (MPC.US)$ value stock

The oil market saw significant volatility as Brent crude and WTI oil futures surged by 5% following geopolitical tensions in the Middle East.

This spike was influenced by U.S. President Joe Biden's discussions about potential Israeli strikes on Iran's oil facilities after a missile attack on Israel.

This development has put pressure on global markets as they await Israel's response. The Israeli military's warnings in southern Lebanon further signal escalating ...

This spike was influenced by U.S. President Joe Biden's discussions about potential Israeli strikes on Iran's oil facilities after a missile attack on Israel.

This development has put pressure on global markets as they await Israel's response. The Israeli military's warnings in southern Lebanon further signal escalating ...

+1

14

1

1

$Marathon Petroleum (MPC.US)$

this should be $300 over

this should be $300 over

No comment yet

piyush : real selling will come after NvDA results. wait for it

nerdbull1669 OP piyush : I think there are some opportunities to look at also while waiting for NVDA earnings