US Stock MarketDetailed Quotes

MRVL Marvell Technology

- 112.860

- +2.530+2.29%

Close Jan 31 16:00 ET

- 112.450

- -0.410-0.36%

Post 20:01 ET

97.66BMarket Cap-66.39P/E (TTM)

115.790High111.200Low15.21MVolume112.450Open110.330Pre Close1.73BTurnover1.76%Turnover RatioLossP/E (Static)865.30MShares127.48052wk High7.30P/B97.30BFloat Cap53.11952wk Low0.24Dividend TTM862.11MShs Float127.480Historical High0.21%Div YieldTTM4.16%Amplitude1.695Historical Low113.809Avg Price1Lot Size

Marvell Technology Stock Forum

Happy weekend investors! Welcome back to Weekly Buzz where we talk about the top ten buzzing stocks on moomoo this week! Comment below to answer the Weekly Topic question for a chance to win an award!

Click here for more moomoo produced news!!

Make Your Choice

Follow me on Twitter! @kevobt

Weekly Buzz

Friday marks the end of the first month of the new year, and so far, it has been volatile for big and small stocks. Trump said Friday he would implement...

Click here for more moomoo produced news!!

Make Your Choice

Follow me on Twitter! @kevobt

Weekly Buzz

Friday marks the end of the first month of the new year, and so far, it has been volatile for big and small stocks. Trump said Friday he would implement...

+11

25

21

5

Answer: Yes.

After all these earnings report plays, everyone should be shifting their focus to $Marvell Technology (MRVL.US)$

After all these earnings report plays, everyone should be shifting their focus to $Marvell Technology (MRVL.US)$

4

Morning Movers

Gapping up

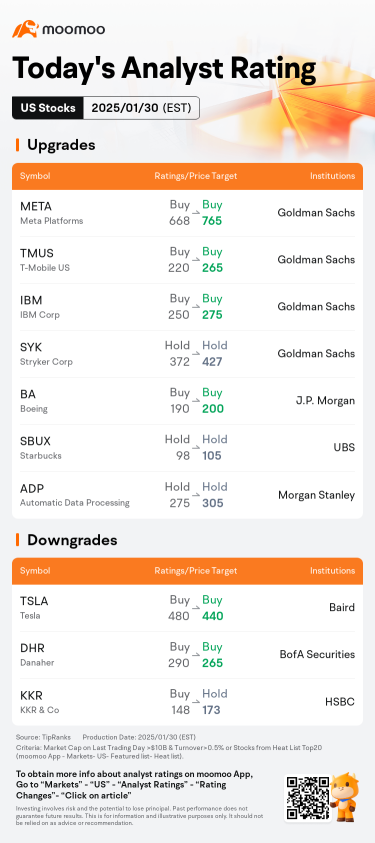

$Tesla (TSLA.US)$ rose 4.2% in premarket trading. Tesla reported declines in automotive revenue and operating margin, but growth in energy-storage products and regulatory credit sales. CEO Elon Musk emphasized future growth through self-driving cars and robotics, despite challenges such as competition in China and potential U.S. tariffs.

$IBM Corp (IBM.US)$ rose 9.3% in premarket trading. IBM reported $1...

Gapping up

$Tesla (TSLA.US)$ rose 4.2% in premarket trading. Tesla reported declines in automotive revenue and operating margin, but growth in energy-storage products and regulatory credit sales. CEO Elon Musk emphasized future growth through self-driving cars and robotics, despite challenges such as competition in China and potential U.S. tariffs.

$IBM Corp (IBM.US)$ rose 9.3% in premarket trading. IBM reported $1...

39

1

12

$Marvell Technology (MRVL.US)$ it's nice to see this stock in the green trending higher as chairman Mao speaks

1

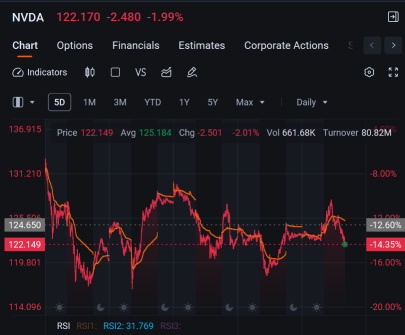

$NVIDIA (NVDA.US)$

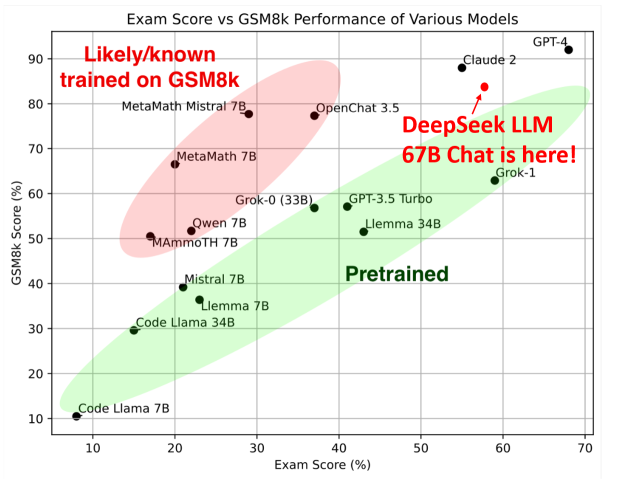

"If DeepSeek's innovations are adopted broadly, an argument can be made that model training costs could come down significantly even at U.S. hyperscalers, potentially raising questions about the need for 1-million XPU/GPU clusters as projected by some," Raymond James analyst Srini Pajjuri wrote in a note to clients over the weekend.

In a post titled "The Short Case for Nvidia Stock," former quant investor and current Web3 entrepreneur Jeffrey Emanuel said DeepSeek's success "s...

"If DeepSeek's innovations are adopted broadly, an argument can be made that model training costs could come down significantly even at U.S. hyperscalers, potentially raising questions about the need for 1-million XPU/GPU clusters as projected by some," Raymond James analyst Srini Pajjuri wrote in a note to clients over the weekend.

In a post titled "The Short Case for Nvidia Stock," former quant investor and current Web3 entrepreneur Jeffrey Emanuel said DeepSeek's success "s...

1

1

Monday was a dark day for AI and Semiconductor stocks. Many, like, $NVIDIA (NVDA.US)$ have climbed astronomically in value in the past year on the growing hype that big industry would shell out billions for competingly larger and larger data centers. Even last week, Trump announced multiple public and private companies would focus on reaching $500 billion in AI investment in the U.S.

Monday, traders woke up to the rea...

Monday, traders woke up to the rea...

40

7

30

Happy Monday, investors, it's January 27th. The market is pulling back hard this morning, led by a tech drop after a Chinese startup large language model shot to the top of the app store over the weekend and introduced the question: is the market overpaying to teach AI?

$NVIDIA (NVDA.US)$ fell 15%, and it is on track for the largest one-day pullback since 2020, according to MarketWatch. It was the highest percen...

$NVIDIA (NVDA.US)$ fell 15%, and it is on track for the largest one-day pullback since 2020, according to MarketWatch. It was the highest percen...

54

56

24

$Marvell Technology (MRVL.US)$ I am buying this when it drops, there should be one within the first half of 2025 (I guess?)![]()

No comment yet

Trending Stocks

U.S. Crypto Concept Stocks U.S. Crypto Concept Stocks

Companies involved in the creation, trade, and services of digital forms of money.Displayed third-party logos, brands, or trademark images on screens or web pages are only for identification purposes and remain the property of their respective owners.Displayed third-party logos, brands, or trademark images on screens or web pages are only for identification purposes and remain the property of their respective owners. Information is provided by Futu and is a non-exhaustive list of all thematic stocks for reference purposes only.

This section presents the top 5 stocks in U.S. Crypto Concept Stocks, ranked from highest to lowest based on real-time market data. Companies involved in the creation, trade, and services of digital forms of money.Displayed third-party logos, brands, or trademark images on screens or web pages are only for identification purposes and remain the property of their respective owners.Displayed third-party logos, brands, or trademark images on screens or web pages are only for identification purposes and remain the property of their respective owners. Information is provided by Futu and is a non-exhaustive list of all thematic stocks for reference purposes only.

This section presents the top 5 stocks in U.S. Crypto Concept Stocks, ranked from highest to lowest based on real-time market data.

ZnWC : Thanks for the event![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Alphabet:

EPS consensus $2.12 per share, 29.27% year-over-year growth.

Revenues consensus $81.38 billion, 12.52% year-ago quarter.

Amazon:

EPS consensus $1.52 per share year-over-year change of +50.5%.

Revenues consensus $187.28 billion, up 10.2% from the year-ago quarter.

Like Tesla and Microsoft, the price movement may not be consistent with the earnings. Despite the earnings of Alphabet and Amazon beat estimate, it may not be reflected on the share price.

The determining factors are still macroeconomics and geopolitical in the short term. Trump's new policy on AI chip restriction and further tariff announcement on China may affect the tech stocks movement in the coming week.

Lnova :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Silverbat : Looking up!

70580865 : Thanks for the quote, and nice article.

Allow me to finish then quote and give some context: I said that if you like an asset, just buy it, don’t buy options. I heard Michael Saylor say it about his Apple investment in options, and I wholeheartedly agree.

A bit more about LAES: The product is cyber for quantum computers. If you can find any competitors, let me know. LAES is piling us successes, deals, and hype. In a couple of weeks, they’ll ring the NASDAQ bell.

The week was full of great news for LAES, on a daily basis. As a result, people bought the 3.5 calls which expire today like crazy. This, in turn, caused a market maker to interfere and push the stock price down, so that calls finish OTM. This also allowed for cheaper covering - CTB is almost 40% so they looked for a way out - but more shorts just substituted them. So effectively, the same situation as this week just rolls over to next week.

So yes, there is an interesting opportunity here, but if you want to come in, choose stocks, not options; otherwise, you’ll probably lose both. I suggest the following rule of thumb: Options are for insiders or Nancy Pelosi.

Jaguar8 : Tariffs function as a tax on imports, effectively raising the price of foreign goods in the domestic market. Who ultimately bears the cost—producers or consumers—depends on the price elasticity of demand and supply. When demand for the imported good is inelastic, consumers absorb most of the cost through higher prices since their purchasing behavior remains relatively unchanged. On the other hand, if demand is elastic, foreign producers may have to lower their prices to stay competitive, cutting into their profit margins.

Beyond direct price effects, tariffs create inefficiencies by distorting market equilibrium, leading to reduced consumer surplus and misallocation of resources. Over time, domestic firms, shielded from foreign competition, may also increase prices, contributing to inflationary pressures. While governments gain short-term revenue from tariffs, prolonged protectionism can trigger retaliatory trade measures, disrupt global supply chains, and ultimately slow economic growth.

So the answer if tariffs will be a pain will depend on the good’s price elasticity of supply and demand.

View more comments...