No Data

MS241206P113000

- 0.05

- +0.01+25.00%

- 5D

- Daily

News

Wall Street macro traders see worst annual performance since the epidemic outbreak.

Global banks' forex and interest rate trading revenue is expected to hit the lowest level since the pandemic, influenced by narrowing profit margins and a challenging macroeconomic environment. According to data collected by Coalition Greenwich, Goldman Sachs, JPMorgan, Citigroup, Morgan Stanley, and over 250 other companies' G-10 interest rate trading is projected to collectively generate 32 billion USD in revenue, while forex trading revenue is expected to be 16.7 billion USD, representing year-on-year reductions of approximately 17% and 9%, respectively. Investor confidence in making significant macro trading views has declined this year, as unexpected economic data has undermined expectations of interest rate cuts from major global central banks.

Trade Around the Clock: SEC Approves the 24X National Exchange

Morgan Stanley: maintains meitu 'shareholding' rating with a target price of 4.5 HKD.

Morgan Stanley released a research report stating that the target price of Meitu (01357) is 4.5 Hong Kong dollars, maintaining a "shareholding" rating. Meitu Investor Day showcased its three generative AI-driven products: Meitu Design Studio (DesignKit), Action, and MOKI. The bank expects that Meitu Design Studio, the flagship product in 2024, will contribute approximately 0.2 billion RMB in domestic revenue, double that of 2023. Management believes this is a highlight moment in the year and a half since the product was launched. The gross margin of this product is 60%-70%, with demand exceeding expectations. Investors are currently very focused on Meitu's overseas expansion.

Daiwa: Maintains fuyao glass 'in sync with the market' rating, target price raised to 45 Hong Kong dollars.

Morgan Stanley published a research report stating that due to Fuyao Glass (03606) increasing its market share faster than expected and adopting value-added products, it has raised its net income forecasts for 2024-2026 by 3%-12% to reflect stronger revenue growth and margin expansion. Morgan Stanley has adjusted Fuyao Glass's target price up by 13%, from 40 Hong Kong dollars to 45 Hong Kong dollars. The rating remains "in line with the market".

Wednesday Ends With Index Decline | Wall Street Today

CFRA Predicts That Banks Will Outperform the Benchmark S&P 500 in 2025

Comments

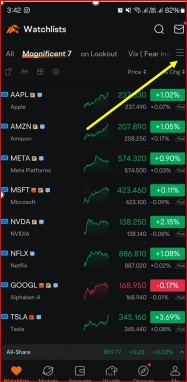

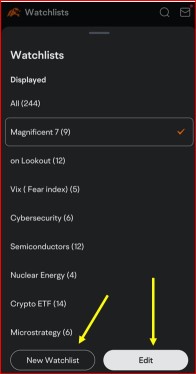

In this post, I will be share some of the features I used most often in the Moomoo mobile app for me to keep track of my portfolio whenever I go after using the app for 3 years.

1) –Cus...

Analysts predict Trump's second-term policies could echo his first, but with a swifter pace and more assertive domestic and foreign agendas. Expectations are for a stronger application of the "A...

Investors have been crazily pouring money into areas and sectors where they think could benefit from Trump administration.

Marker is forward looking, but has it gone way too ahead of itself?

Market is definitely very extended now. Don’t get caught off guard if we get a super red day, one of these days.

$KraneShares CSI China Internet ETF (KWEB.US)$ $GameStop (GME.US)$ $Advanced Micro Devices (AMD.US)$ $Broadcom (AVGO.US)$ $iShares Russell 2000 ETF (IWM.US)$ $Financial Select Sector SPDR Fund (XLF.US)$ $SPDR Gold ETF (GLD.US)$ $Upstart (UPST.US)$ $ProShares Bitcoin ETF (BITO.US)$ $Morgan Stanley (MS.US)$ $Workday (WDAY.US)$ $GlobalFoundries (GFS.US)$ $Logitech International (LOGI.US)$

Why is Portfolio Diversification Important?

1. Risk Reduction:

Diversification...

Every major index ran past all-time highs, excluding the small-cap Russell 2000, which flew 5% higher. The Dow climbed more than 1,000 points, the most in a single day since November 2022. Bitcoin hit an intra-day high of $...