No Data

MS250103P128000

- 2.55

- +0.59+30.10%

- 5D

- Daily

News

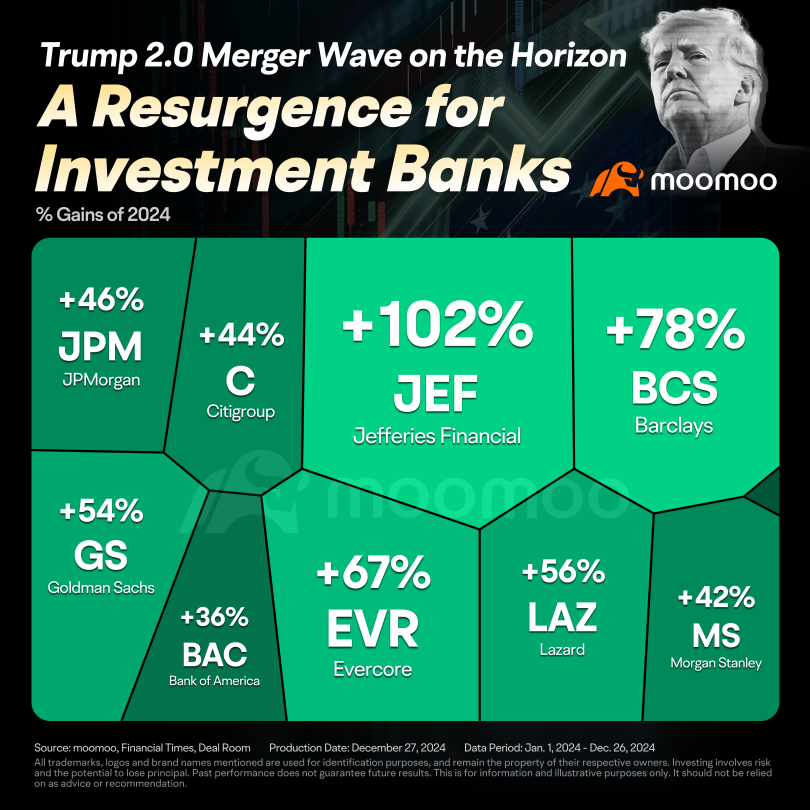

Global Investment Banks Start 2025 With Positive Setup -- Market Talk

Morgan Stanley: Maintains CATHAY PAC AIR "In line with the market" rating, Target Price raised to 9.1 Hong Kong dollars.

Morgan Stanley released a research report stating that it has raised the Target Price for CATHAY PAC AIR (00293) from HKD 8.1 to HKD 9.1, maintaining a "Market Perform" rating. The firm indicated that it has increased its profit forecasts for CATHAY PAC AIR for 2024 to 2026 by 13.5%, 7.4%, and 14% respectively, to reflect the assumption of lower aviation RBOB Gasoline prices; a strong passenger volume performance in November, along with robust cargo business. Meanwhile, the firm also considered adjustments to the fully diluted share count after CATHAY's future repurchase of convertible Bonds.

Barclays Maintains Morgan Stanley(MS.US) With Buy Rating, Raises Target Price to $155

Express News | Morgan Stanley : Barclays Raises Target Price to $155 From $135

MORGAN STANLEY: Maintains Shareholding rating for POP MART with a Target Price of HKD 113.

Morgan Stanley published a research report stating that POP MART (09992) plans to restock, which may boost sales in the fourth quarter of last year and the first half of this year, while also taking measures to enhance customer experience. The investment themes proposed by the bank, namely "overseas expansion extends popularity" and "IP product rotation" are still valid. Morgan Stanley's rating and Target Price for the company are "Shareholding" and 113 Hong Kong dollars. The bank suggests that investors can take advantage of the low prices to buy in. It is expected that this year's sales growth will be 35%, and POP MART is considered to achieve the fastest sales growth among the large consumer companies tracked.

Strategists: The downside potential for 10-year Japanese government bond yields is limited, and the market is paying attention to the Bank of Japan's monetary policy.

Japanese government bond prices fell in early Tokyo trading, following the decline in US Treasury prices on Friday. Fixed income strategists at Mitsubishi UFJ Morgan Stanley Securities stated in a recent research report that market participants may closely monitor any news from the Bank of Japan to understand whether it will raise interest rates later this month. Strategists mentioned: "The Bank of Japan still intends to gradually raise its policy interest rate, and coupled with the high likelihood of significant increases in base wages during the 2025 wage negotiations, it intensifies market expectations for the future.

Comments

M&A activity is already showing signs of recovery. According to Dealogic, announced M&A deals in 2024 surpassed $1.4 trillion, up from $1.32 trillion in 2023, though slightly bel...

Analysts predict Trump's second-term policies could echo his first, but with a swifter pace and more assertive domestic and foreign agendas. Expectations are for a stronger application of the "A...

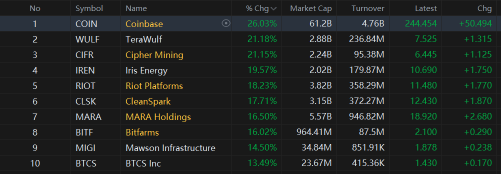

Investors have been crazily pouring money into areas and sectors where they think could benefit from Trump administration.

Marker is forward looking, but has it gone way too ahead of itself?

Market is definitely very extended now. Don’t get caught off guard if we get a super red day, one of these days.

$KraneShares CSI China Internet ETF (KWEB.US)$ $GameStop (GME.US)$ $Advanced Micro Devices (AMD.US)$ $Broadcom (AVGO.US)$ $iShares Russell 2000 ETF (IWM.US)$ $Financial Select Sector SPDR Fund (XLF.US)$ $SPDR Gold ETF (GLD.US)$ $Upstart (UPST.US)$ $ProShares Bitcoin ETF (BITO.US)$ $Morgan Stanley (MS.US)$ $Workday (WDAY.US)$ $GlobalFoundries (GFS.US)$ $Logitech International (LOGI.US)$

Why is Portfolio Diversification Important?

1. Risk Reduction:

Diversification...

Every major index ran past all-time highs, excluding the small-cap Russell 2000, which flew 5% higher. The Dow climbed more than 1,000 points, the most in a single day since November 2022. Bitcoin hit an intra-day high of $...

104088143 : nice to

J Servai (JLAPT) : $MIRA Pharmaceuticals (MIRA.US)$

105232125 :

Tonyco : meanwhile, in reality:

104556909 : good