No Data

MS250103P129000

- 3.41

- +0.01+0.29%

- 5D

- Daily

News

A crisis is approaching! Wall Street's major firms face strong rivals in Trade, as electronic market makers may rise to prominence.

Traditional Wall Street major firms are facing an impending crisis. In 2025, they will notice that electronic market makers in Trade are behaving more and more like Banks.

Morgan Stanley: Maintains XINYI SOLAR 'Shareholding' rating with a Target Price of 4 Hong Kong dollars.

Morgan Stanley released a research report stating that it maintains the "Shareholding" rating for XINYI SOLAR (00968), with a Target Price of 4 Hong Kong dollars unchanged. Morgan Stanley believes that the company's performance will continue to be weak in the short term. Due to weak demand, Photovoltaic Glass manufacturers have been actively maintaining their production lines. With China entering the holiday season in January, supply pressure will remain high in the short term. The report states that the company expects its Net income for 2024 to decrease by 70-80% year-on-year to 769-1.15 billion yuan (the same below), which is lower than the bank's expectations. This indicates a Net loss of 658 million to 1 billion yuan in the second half of 2024, compared to a Net income of

Morgan Stanley: It is believed that XIAOMI-W will continue to expand its Autos production capacity, and this year's delivery targets may be further adjusted upwards.

Morgan Stanley released a research report stating that XIAOMI-W (01810) is expected to deliver more than 0.135 million electric vehicles in 2024, exceeding its annual delivery targets. Due to the company's monthly delivery volume in December last year surpassing 0.025 million units, it has raised its 2025 delivery target to 0.3 million units, up from the previous target of approximately 0.25 million units. The firm believes that the group will continue to enhance its Autos production capacity, which may lead to an upward adjustment of the shipment target for 2025. Morgan Stanley anticipates a positive change in Xiaomi's product lineup in 2025, which may drive average revenue growth and better electric vehicle profit margins. Additionally,

(MS) - Analyzing Morgan Stanley's Short Interest

$1000 Invested In This Stock 10 Years Ago Would Be Worth This Much Today

Morgan Stanley's (NYSE:MS) Investors Will Be Pleased With Their Strong 190% Return Over the Last Five Years

Comments

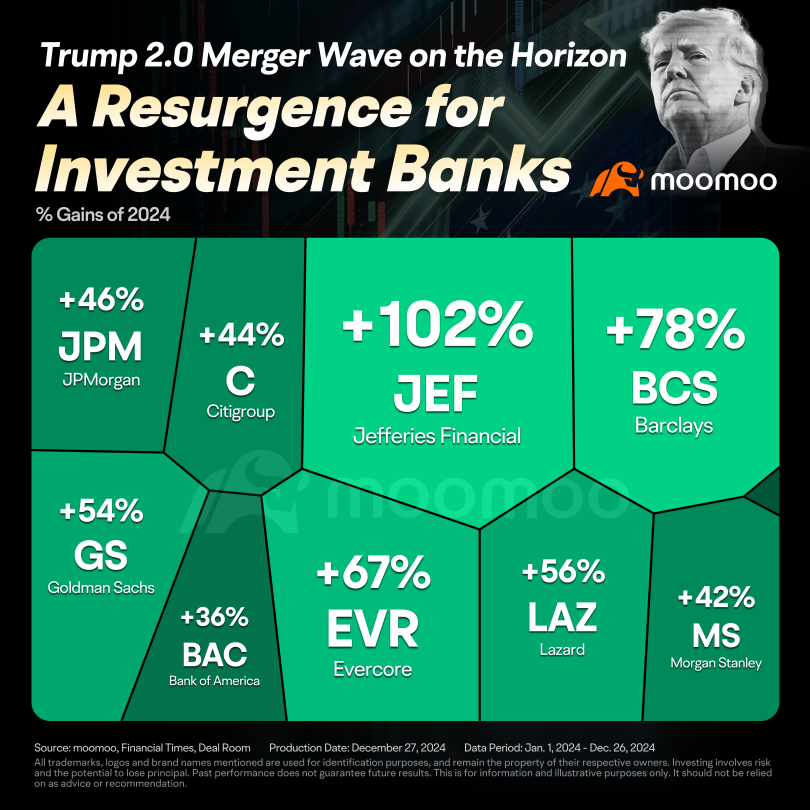

M&A activity is already showing signs of recovery. According to Dealogic, announced M&A deals in 2024 surpassed $1.4 trillion, up from $1.32 trillion in 2023, though slightly bel...

Analysts predict Trump's second-term policies could echo his first, but with a swifter pace and more assertive domestic and foreign agendas. Expectations are for a stronger application of the "A...

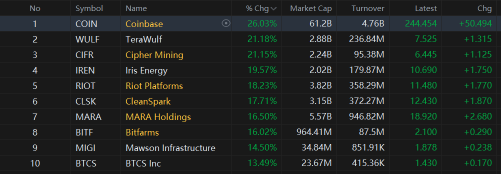

Investors have been crazily pouring money into areas and sectors where they think could benefit from Trump administration.

Marker is forward looking, but has it gone way too ahead of itself?

Market is definitely very extended now. Don’t get caught off guard if we get a super red day, one of these days.

$KraneShares CSI China Internet ETF (KWEB.US)$ $GameStop (GME.US)$ $Advanced Micro Devices (AMD.US)$ $Broadcom (AVGO.US)$ $iShares Russell 2000 ETF (IWM.US)$ $Financial Select Sector SPDR Fund (XLF.US)$ $SPDR Gold ETF (GLD.US)$ $Upstart (UPST.US)$ $ProShares Bitcoin ETF (BITO.US)$ $Morgan Stanley (MS.US)$ $Workday (WDAY.US)$ $GlobalFoundries (GFS.US)$ $Logitech International (LOGI.US)$

Why is Portfolio Diversification Important?

1. Risk Reduction:

Diversification...

Every major index ran past all-time highs, excluding the small-cap Russell 2000, which flew 5% higher. The Dow climbed more than 1,000 points, the most in a single day since November 2022. Bitcoin hit an intra-day high of $...

104088143 : nice to

J Servai (JLAPT) : $MIRA Pharmaceuticals (MIRA.US)$

105232125 :

Tonyco : meanwhile, in reality:

104556909 : good