No Data

MS250110C122000

- 4.00

- 0.000.00%

- 5D

- Daily

News

Wednesday Market Falls, Quantum Computing Pulls Back Hard on Treasury Yield Crunch | Live Stock

Shake Shack, Morgan Stanley, Synovus Financial And A Communication Services Stock On CNBC's 'Final Trades'

Today's Analyst Rating | UBS Upgrades Bank of America to Buy, Salesforce Price Target Raised to $400 by Needham

Morgan Stanley: Maintains "Shareholding" rating for Giant Biotechnology with a Target Price of 65 Hong Kong dollars.

Morgan Stanley released a research report stating that it expects the stock price of Gigot Biotech (02367) to rise by about 70% to 80% over the next 15 days, setting its Target Price at HKD 65 and giving it a "Shareholding" rating. The bank forecasts the company's earnings growth for the fiscal years 2024 and 2025 to be 37% and 23%, respectively, indicating that the upcoming annual performance may be stronger than that of other companies within the bank's coverage. The report mentioned that Gigot Biotech's stock price has fallen by about 12% since mid-December last year, and the bank has not yet identified a fundamental reason but believes that the relevant performance is mainly influenced by market allocation. The bank also believes that if measured by 2025.

Citigroup expects the Indian stock market to rise by 10% this year, marking the 10th consecutive year of growth.

Citigroup expects that the Indian stock market, which is valued at 5 trillion dollars, will rise for the 10th consecutive year this year, driven by economic growth recovery and strong corporate profits. Citigroup has set a target of 26,000 points for India's benchmark stock index, the Nifty 50 Index, which means the index will rise 10% compared to its closing position at the end of last year. The index is expected to close in 2024 at about 5% higher than the Wall Street bank's forecast of 22,500 points. Strategists at Citigroup, including Surendra Goyal, wrote in a report, "Considering the diversification of listed companies, India"

Morgan Stanley: Set a 'Market Perform' rating for China Tourism Group Duty Free Corporation, with the Target Price adjusted to 55 Hong Kong dollars.

Morgan Stanley released a research report stating that the Target Price for China Tourism Group Duty Free Corporation (01880) has been lowered from 60 Hong Kong dollars to 55 Hong Kong dollars, with a rating of "in line with the market." The report noted that last year, Hainan was the main factor dragging down the Chinese tourism retail market, with offline duty-free store sales dropping by 29% year-on-year to 30.9 billion RMB. Due to a lower base and the possibility of China Tourism Group offering more discounts, offline duty-free store sales in Hainan are expected to narrow their year-on-year decline to 5% by December 2024, with the impact likely diminishing by 2025. Morgan Stanley believes that the recovery of China Tourism Group's port business has already gained traction.

Comments

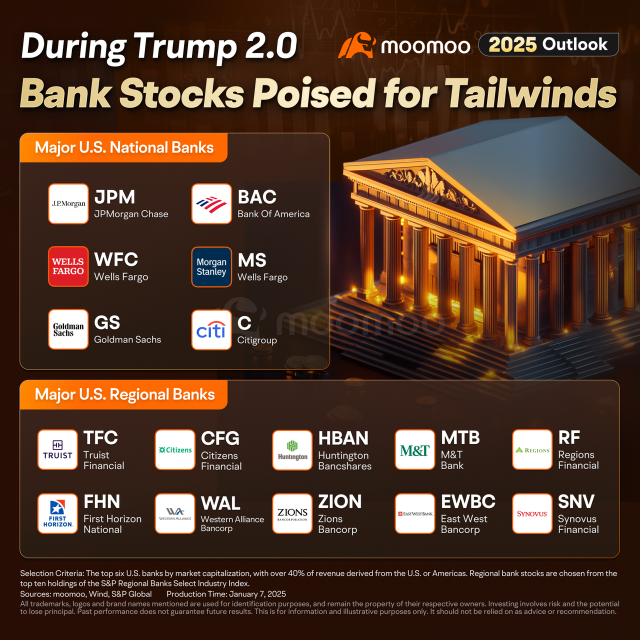

Following the announcement, bank stocks broadly gained, with $Citigroup (C.US)$ and $Morgan Stanley (MS.US)$ rising more than 2%, and regional banks $Synovus Financial (SNV.US)$ and $East West Bancorp (EWBC.US)$ climbing ...

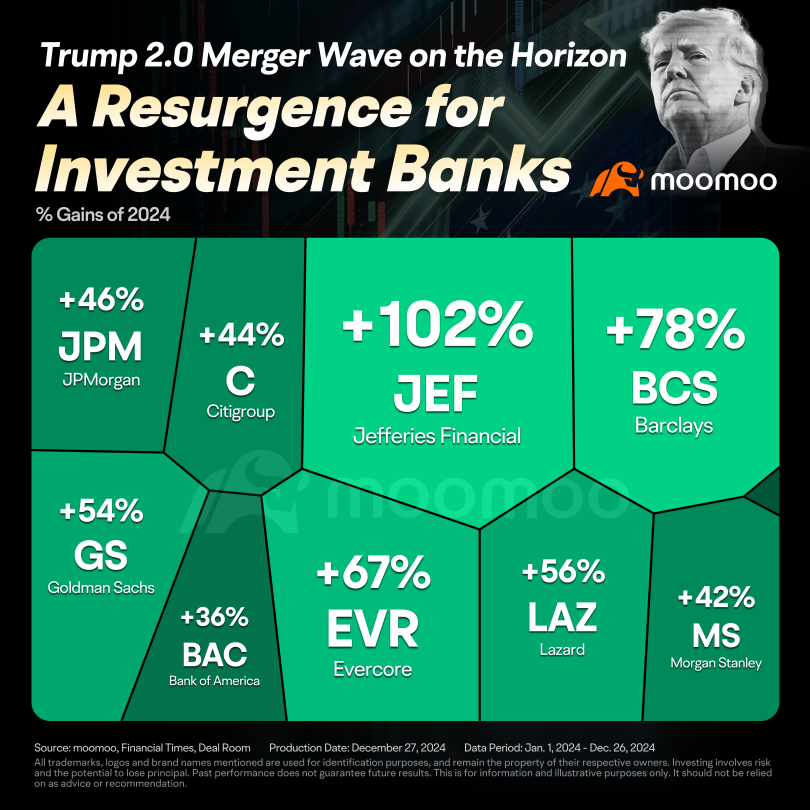

M&A activity is already showing signs of recovery. According to Dealogic, announced M&A deals in 2024 surpassed $1.4 trillion, up from $1.32 trillion in 2023, though slightly bel...

Analysts predict Trump's second-term policies could echo his first, but with a swifter pace and more assertive domestic and foreign agendas. Expectations are for a stronger application of the "A...

Investors have been crazily pouring money into areas and sectors where they think could benefit from Trump administration.

Marker is forward looking, but has it gone way too ahead of itself?

Market is definitely very extended now. Don’t get caught off guard if we get a super red day, one of these days.

$KraneShares CSI China Internet ETF (KWEB.US)$ $GameStop (GME.US)$ $Advanced Micro Devices (AMD.US)$ $Broadcom (AVGO.US)$ $iShares Russell 2000 ETF (IWM.US)$ $Financial Select Sector SPDR Fund (XLF.US)$ $SPDR Gold ETF (GLD.US)$ $Upstart (UPST.US)$ $ProShares Bitcoin ETF (BITO.US)$ $Morgan Stanley (MS.US)$ $Workday (WDAY.US)$ $GlobalFoundries (GFS.US)$ $Logitech International (LOGI.US)$

Why is Portfolio Diversification Important?

1. Risk Reduction:

Diversification...

Buy n Die Together❤ :

Poppie76 : First rat off the Titanic