No Data

US Stock MarketDetailed Quotes

MU Micron Technology

- 100.790

- +5.910+6.23%

Close Mar 14 16:00 ET

- 100.720

- -0.070-0.07%

Post 20:01 ET

112.30BMarket Cap28.88P/E (TTM)

102.780High98.750Low24.62MVolume98.750Open94.880Pre Close2.48BTurnover2.27%Turnover Ratio143.99P/E (Static)1.11BShares157.01452wk High2.40P/B109.56BFloat Cap83.43152wk Low0.46Dividend TTM1.09BShs Float157.014Historical High0.46%Div YieldTTM4.25%Amplitude1.556Historical Low100.653Avg Price1Lot Size

Full Hours

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Unit: --

Capital Trend

IntradayDayWeekMonth

No Data

News

TD Cowen Maintains Micron Technology(MU.US) With Buy Rating, Maintains Target Price $125

Promising Outlook for Micron: Buy Rating Reaffirmed Amid AI Market Growth and Improved Pricing Conditions

Cautiously Optimistic Outlook for Micron Amid Pricing and Market Share Gains

Nike, Carnival, Micron Technology, Fed Interest Rate, and More to Watch This Week -- Barrons.com

Earnings Week Ahead: FDX, GIS, NIO, XPEV, MU, NKE, CCL, ACN and More

What to Expect in the Week Ahead (MU, NKE, and FDX Earnings; Fed Interest Rate Decision)

Comments

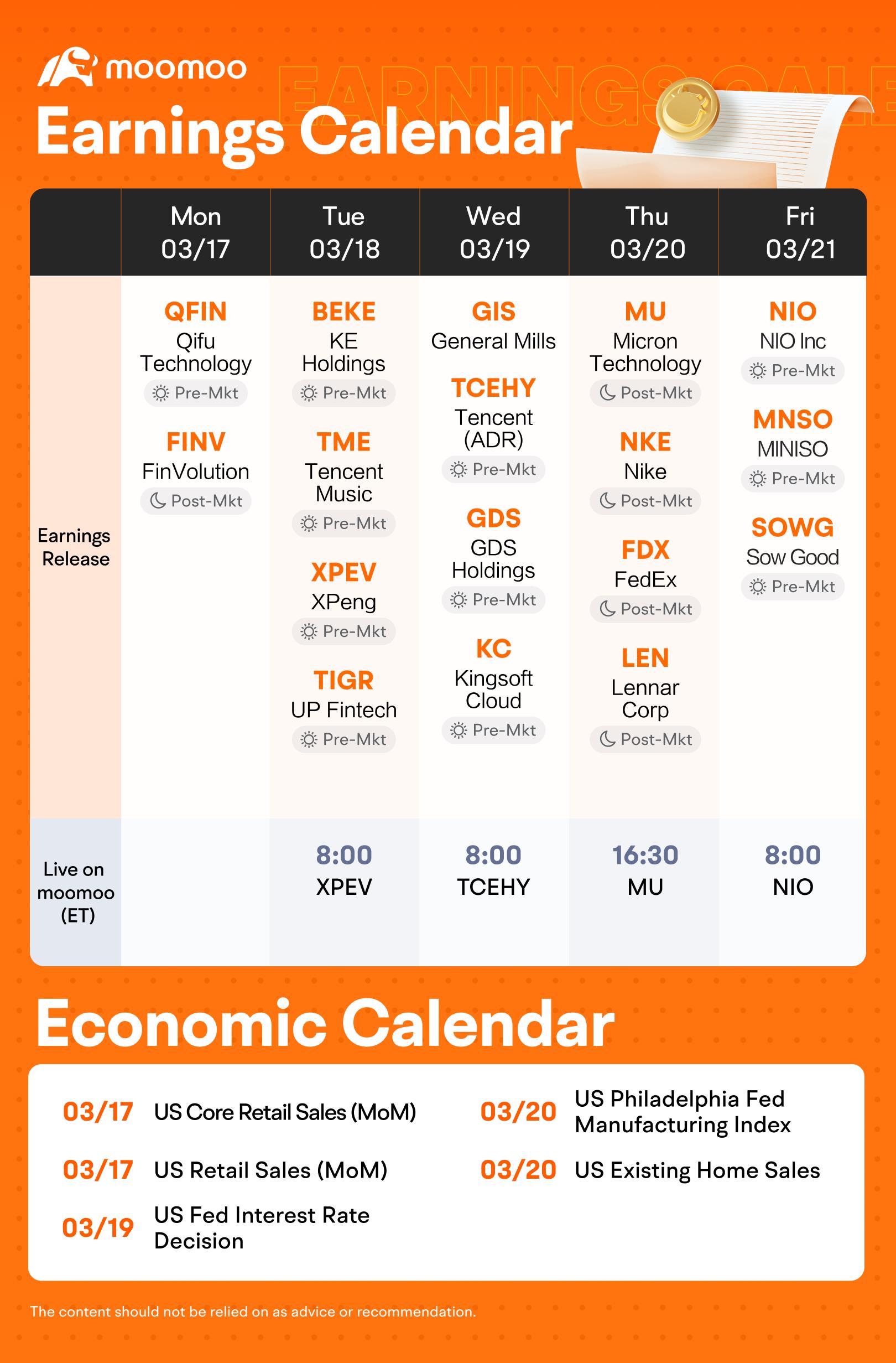

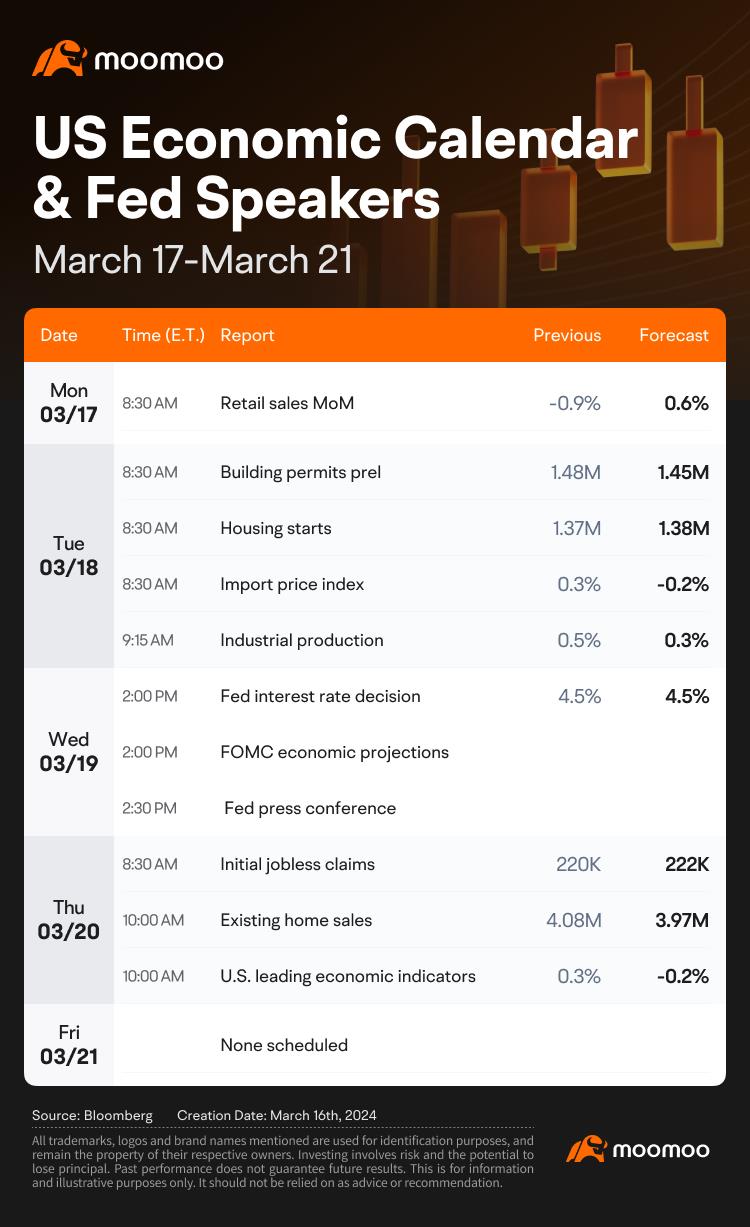

Hi mooers! Need a quick update on this week's events? Check out moomoo's fresh earnings & economic calendars to start this week!

For more details, check out the earnings calendar and economic calendar! This week, various companies including $XPeng (XPEV.US)$, $Tencent (TCEHY.US)$, $Micron Technology (MU.US)$ and $NIO Inc (NIO.US)$ are releasing their earnings. How will the market react to the companies' results? Let's make a guess!...

For more details, check out the earnings calendar and economic calendar! This week, various companies including $XPeng (XPEV.US)$, $Tencent (TCEHY.US)$, $Micron Technology (MU.US)$ and $NIO Inc (NIO.US)$ are releasing their earnings. How will the market react to the companies' results? Let's make a guess!...

+2

2

2

Earnings Preview

The semiconductor industry, particularly memory and storage, has seen volatility due to AI-driven demand and supply chain dynamics. $Micron Technology (MU.US)$'s focus on high-bandwidth memory (HBM) and data center DRAM aligns with the growing needs of AI applications. However, challenges in consumer segments, such as PCs and smartphones, may have contributed to the cautious outlook for Q2 FY2...

The semiconductor industry, particularly memory and storage, has seen volatility due to AI-driven demand and supply chain dynamics. $Micron Technology (MU.US)$'s focus on high-bandwidth memory (HBM) and data center DRAM aligns with the growing needs of AI applications. However, challenges in consumer segments, such as PCs and smartphones, may have contributed to the cautious outlook for Q2 FY2...

+3

73

6

44

Read more

Trending Stocks

U.S. Crypto Concept Stocks U.S. Crypto Concept Stocks

Companies involved in the creation, trade, and services of digital forms of money.Displayed third-party logos, brands, or trademark images on screens or web pages are only for identification purposes and remain the property of their respective owners.Displayed third-party logos, brands, or trademark images on screens or web pages are only for identification purposes and remain the property of their respective owners. Information is provided by Futu and is a non-exhaustive list of all thematic stocks for reference purposes only.

This section presents the top 5 stocks in U.S. Crypto Concept Stocks, ranked from highest to lowest based on real-time market data. Companies involved in the creation, trade, and services of digital forms of money.Displayed third-party logos, brands, or trademark images on screens or web pages are only for identification purposes and remain the property of their respective owners.Displayed third-party logos, brands, or trademark images on screens or web pages are only for identification purposes and remain the property of their respective owners. Information is provided by Futu and is a non-exhaustive list of all thematic stocks for reference purposes only.

This section presents the top 5 stocks in U.S. Crypto Concept Stocks, ranked from highest to lowest based on real-time market data.

70552586 : who cares

Lucas Cheah : $XPeng (XPEV.US)$

Key Revenue Drivers & Growth Catalysts

1. Strong Vehicle Deliveries & Sales Growth

o XPeng delivered 91,507 vehicles in Q4 2024, marking a 52.1% YoY increase and a 96.6% rise from the previous quarter.

o The G6 SUV and X9 MPV models contributed significantly to the strong delivery numbers.

o XPeng’s X9 MPV and new models could drive premium sales and increase its ASP (Average Selling Price), helping improve profit margins.

2. International Expansion & Smart Driving Technology

o XPeng is expanding into European and Southeast Asian markets, increasing its revenue base.

o Its XPilot autonomous driving technology and partnership with Volkswagen are key differentiators in the EV space.

Challenges & Risks

• Intense Competition from Tesla, Nio, and BYD in the Chinese EV market.

• Economic Slowdown in China affecting EV demand.

Outlook

XPeng is positioned for continued revenue growth, but profitability remains a key challenge. Its focus on technology, cost efficiency, and global expansion makes it a long-term EV player to watch.

$Tencent (TCEHY.US)$

Key Revenue Drivers & Growth Catalysts

1. Gaming Revenue Recovery

o Tencent remains the largest gaming company globally, with hits like Honor of Kings and PUBG Mobile.

o Gaming revenue grew by 7% YoY in 2024, and new game releases in 2025 could accelerate growth.

2. Cloud & AI Investments

o Tencent Cloud’s AI-driven services and enterprise cloud adoption are boosting revenue.

o The company is leveraging AI and big data to enhance digital advertising.

3. WeChat & Fintech Growth

o WeChat Pay and Tencent’s fintech services continue to expand, generating significant transaction-based revenue.

o Advertising revenue rebounded 8% YoY in Q4 2024, driven by higher engagement across WeChat ecosystem.

o WeChat Pay’s integration into global platforms and e-commerce ecosystems could drive transaction growth and monetization.

Challenges & Risks

• China’s regulatory environment remains a risk for gaming and fintech operations.

• Cloud business faces competition from Alibaba Cloud and Huawei Cloud.

Outlook

Tencent’s diversified business model, gaming recovery, cloud growth, and fintech expansion, support a strong long-term earnings outlook

$Micron Technology (MU.US)$

Key Revenue Drivers & Growth Catalysts

1. AI-Driven Demand for Memory Chips

o Micron’s HBM (High Bandwidth Memory) chips are in high demand due to AI and data center expansion.

o Micron’s partnership with Nvidia for HBM chips could significantly boost revenue as AI adoption scales up.

2. Rebounding DRAM & NAND Market

o DRAM prices rebounded 20% in 2024, and further price increases are expected in 2025.

o NAND flash memory prices are stabilizing, helping improve margins.

3. Expansion in Automotive & Mobile Markets

o Micron’s automotive and mobile DRAM products are growing, driven by EVs and 5G smartphone adoption.

Challenges & Risks

• Cyclical nature of the semiconductor industry could lead to demand fluctuations.

• China’s trade restrictions could impact sales to key customers.

Outlook

Micron is well-positioned to benefit from AI and cloud computing growth, but geopolitical risks and cyclical pricing remain challenges.

$NIO Inc (NIO.US)$

Key Revenue Drivers & Growth Catalysts

1. Strong Vehicle Delivery Growth

o Nio’s EV deliveries grew 42.7% YoY in 2024, reaching 240,000 units.

o The ET7, ES8, and EC7 models are driving premium sales.

2. Battery Swap Network & Energy Solutions

o Over 2,500 battery swap stations deployed, enhancing customer convenience.

o Nio’s Battery-as-a-Service (BaaS) model helps lower upfront EV costs, boosting adoption.

o Nio’s Battery-as-a-Service model differentiates it from Tesla and BYD, attracting cost-conscious customers.

3. International Expansion

o Entry into Germany, the Netherlands, and the UK is expanding its global footprint.

Challenges & Risks

• Continued net losses due to high R&D and expansion costs.

• Competition from Tesla, XPeng, and BYD in China’s premium EV segment.

Outlook

Nio’s revenue growth remains strong, but profitability and cost efficiency improvements are needed.