US Stock MarketDetailed Quotes

NEE NextEra Energy

- 70.030

- +0.300+0.43%

Close Mar 27 16:00 ET

- 70.420

- +0.390+0.56%

Post 16:15 ET

144.05BMarket Cap20.78P/E (TTM)

71.020High69.612Low8.72MVolume69.760Open69.730Pre Close613.24MTurnover0.43%Turnover Ratio20.78P/E (Static)2.06BShares84.82752wk High2.88P/B143.78BFloat Cap59.62852wk Low2.06Dividend TTM2.05BShs Float86.014Historical High2.94%Div YieldTTM2.02%Amplitude2.062Historical Low70.314Avg Price1Lot Size

NextEra Energy Stock Forum

$GE Vernova (GEV.US)$ $NextEra Energy (NEE.US)$ $NuScale Power (SMR.US)$ $Oklo Inc (OKLO.US)$

this is the quickest way to provide all the power that data centers need

we mount a shaft to his body he generates enough power the same as a nuclear reactor the same as what GE vernova is selling the big gas powered turbines.. and there's your solution

x.com/Dudespost...

this is the quickest way to provide all the power that data centers need

we mount a shaft to his body he generates enough power the same as a nuclear reactor the same as what GE vernova is selling the big gas powered turbines.. and there's your solution

x.com/Dudespost...

8

6

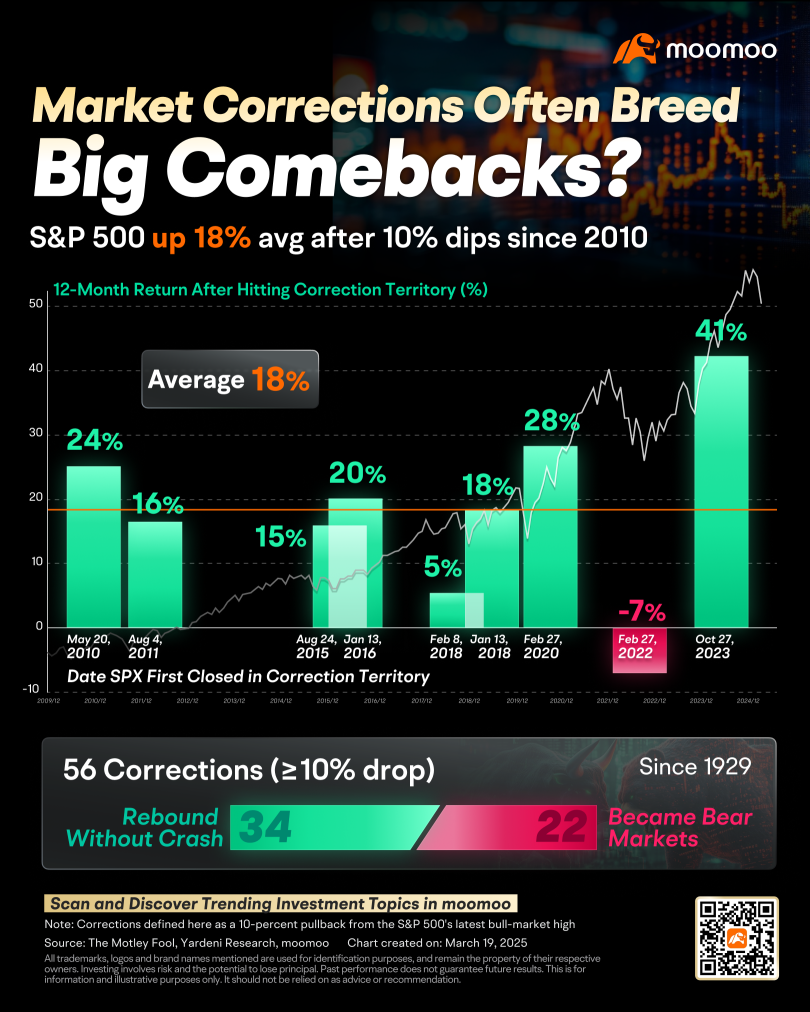

Market Status: Multiple Pressures Behind the Correction

On March 18, the S&P 500 closed at 5,614.66, down 10.1% from its February 19 peak, marking the first correction since October 2023. This decline occurred in just 3.5 weeks, much faster than the nearly 3-month correction in 2023. The index erased all gains from the "Trump rally" since November 2024, reflecting concerns over tariffs, stagflation, and supply chain issues...

On March 18, the S&P 500 closed at 5,614.66, down 10.1% from its February 19 peak, marking the first correction since October 2023. This decline occurred in just 3.5 weeks, much faster than the nearly 3-month correction in 2023. The index erased all gains from the "Trump rally" since November 2024, reflecting concerns over tariffs, stagflation, and supply chain issues...

80

3

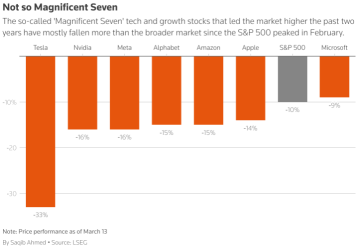

141

The S&P 500's worst single-day drop since 2022—a 2.7% plunge led by tech giants—has crystallized a tectonic shift in global markets. As momentum stocks like $Tesla (TSLA.US)$ and $Palantir (PLTR.US)$ cratered (down 10% and 15%, respectively, on Monday), Citigroup's latest Global Macro Strategy report, "A Pause in US Exceptionalism," is gaining traction. The message is clear: Investors are rewriting playbooks to navigate what one trader ...

25

11

37

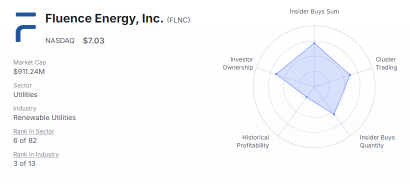

Multiple insiders at $Fluence Energy (FLNC.US)$ made significant purchases last week amid the stock trading near its 52-week low of $6.05. CEO Julian Nebreda acquired 23,500 shares ($149,286), CFO Pasha Ahmed bought 15,500 shares ($100,440), Director Elizabeth Fessenden purchased 1,700 shares ($10,931), and Director Herman Bulls added 30,000 shares ($195,900).

Market Context

The insider buying cluster comes after FLNC shares plummeted over 41% following disappointing Q1 20...

Market Context

The insider buying cluster comes after FLNC shares plummeted over 41% following disappointing Q1 20...

3

1

$Cardano (ADA.CC)$ I also Walmart holders invest 2yrs. wow see news Walmart and Cardano link in future projects maybe. no wonder my Walmart up $102.

9

$NextEra Energy (NEE.US)$ will be reporting their fourth-quarter earnings on 24 Jan 2025 before the market opens. Consensus estimate for the revenues is pegged at $6.49 billion, indicating a decline of 5.62% from the year-ago reported figure.

The consensus estimate for earnings is pegged at 52 cents per share. Consensus Estimate for NEE’s fourth-quarter earnings has declined by 7.3% in the past 60 days. The estimate sugge...

The consensus estimate for earnings is pegged at 52 cents per share. Consensus Estimate for NEE’s fourth-quarter earnings has declined by 7.3% in the past 60 days. The estimate sugge...

16

1

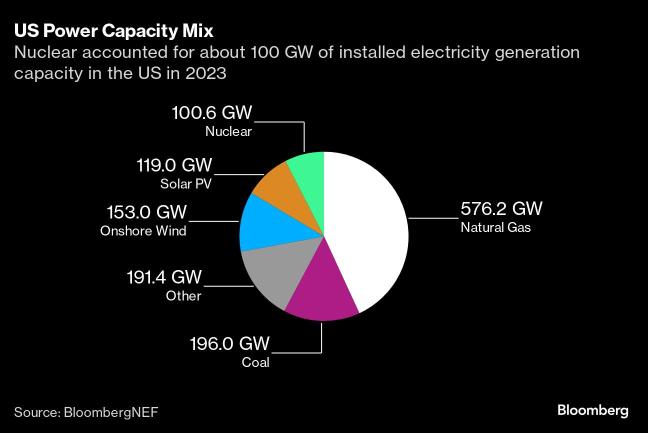

The U.S. stock market has recently seen exceptional performance in the nuclear power sector. Companies like $Constellation Energy (CEG.US)$ and $Vistra Energy (VST.US)$ have surged nearly 41% and 26% year-to-date, respectively. As a stable and clean energy source, nuclear power holds profound potential for future development.

Nuclear energy is emerging as a cornerstone solution for achieving global carbon neutrality.Globalnuclear power ca...

Nuclear energy is emerging as a cornerstone solution for achieving global carbon neutrality.Globalnuclear power ca...

14

1

3

$NextEra Energy (NEE.US)$ y is this dropping?

1

1

Mark your Calendar Jan 20. Donald Trump’s anticipated return to influence has sparked widespread discussions about his bold economic strategies for 2025. Alongside his revived interest in acquiring Greenland, Trump has unveiled plans to establish a U.S. Bitcoin Strategic Reserve. This bold move has the potential to redefine financial markets, drive technological adoption, and impact global economic dynamics. In this post...

+5

27

4

7

No comment yet

smoothshoe : what are your thoughts on $Centrus Energy (LEU.US)$

smoothshoe : I also opened a position in $New Fortress Energy (NFE.US)$

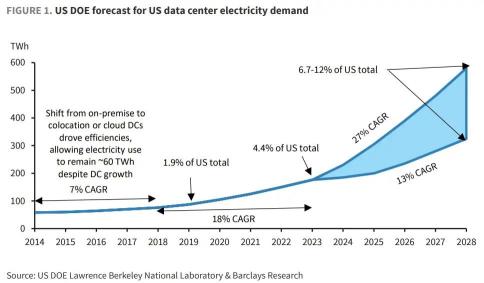

10baggerbamm OP smoothshoe : I see why you're looking at this one or at least I think I see why with The insider transactions last year and this year. my concern would be the decline in revenue. I know that from a data center standpoint and build out natural gas is the quickest solution is that why you're looking at this company or are you looking at their long-term chart and you see this bottoming that's taking place potentially here where historically it's traded significantly higher?

if you're thinking about it from a data center play the companies that are in the exploration side of oil or natural gas under Trump they're not going to be benefactors I don't believe so because as the prices come down for oil and natural gas their margins deteriorate even further. when I first looked at this I saw New York and my initial inclination was Trump wants to build that pipeline throughout New York New England all natural gas which will reduce energy costs by about 30% and I thought that this company was going to be one that I'd heard that potentially would be involved but they're just based out of New York they're not involved in pipeline distribution of natural gas.

centrus that one has more of what I like and I'm going to spend some time this weekend reading about it I like when you have that earnings beat Gap up and now the consolidation it mirrors so many other companies perfectly well and money is going to go back in if we can get a few days of a rally or we get past this whole tariff issue and tax season I think beyond that we have the potential for a sustained rally.

ASteffie : I'm just gonna sit here and wait

smoothshoe 10baggerbamm OP : It's definitely a nat gas for data center power play for me. for nat gas play, I'm thinking $Flex LNG (FLNG.US)$

View more comments...