US OptionsDetailed Quotes

NFLX250103C1050000

- 0.01

- 0.000.00%

15min DelayClose Jan 3 16:00 ET

0.00High0.00Low

0.00Open0.01Pre Close0 Volume322 Open Interest1050.00Strike Price0.00Turnover0.00%IV22.36%PremiumJan 3, 2025Expiry Date0.00Intrinsic Value100Multiplier-15DDays to Expiry0.01Extrinsic Value100Contract SizeAmericanOptions Type--Delta--Gamma85810.00Leverage Ratio--Theta--Rho--Eff Leverage--Vega

Netflix Stock Discussion

Hi mooers!

Need a quick update on this week's events? Check out moomoo's fresh earnings & economic calendars to start this week!

For more details, check out the earnings calendar and economic calendar!

This week, various companies including $Netflix (NFLX.US)$, $Johnson & Johnson (JNJ.US)$, $American Airlines (AAL.US)$ are releasing their earnings. How will the market react to the companies' results? Let's make a guess!

For more companies' detailed earnings results...

Need a quick update on this week's events? Check out moomoo's fresh earnings & economic calendars to start this week!

For more details, check out the earnings calendar and economic calendar!

This week, various companies including $Netflix (NFLX.US)$, $Johnson & Johnson (JNJ.US)$, $American Airlines (AAL.US)$ are releasing their earnings. How will the market react to the companies' results? Let's make a guess!

For more companies' detailed earnings results...

9

4

1

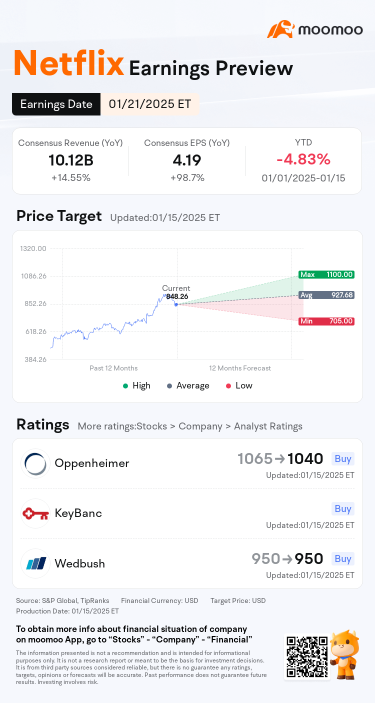

$Netflix (NFLX.US)$ will be reporting its earnings results for the fourth quarter of 2024 on 21 Jan (Tuesday) after the market close.

Netflix’s Q4 sales are thought to have increased 14% to $10.12 billion, compared to $8.83 billion in the comparative quarter. More impressive, the streaming giant’s Q4 EPS is expected to climb 98% to $4.21 versus $2.11 per share a year ago. Netflix is slated to round out fiscal 2024 with a 15% increase ...

Netflix’s Q4 sales are thought to have increased 14% to $10.12 billion, compared to $8.83 billion in the comparative quarter. More impressive, the streaming giant’s Q4 EPS is expected to climb 98% to $4.21 versus $2.11 per share a year ago. Netflix is slated to round out fiscal 2024 with a 15% increase ...

+1

4

$Netflix (NFLX.US)$ where your power

2

$Netflix (NFLX.US)$ is NFLX PE ratio too high?

Hi, mooers!![]()

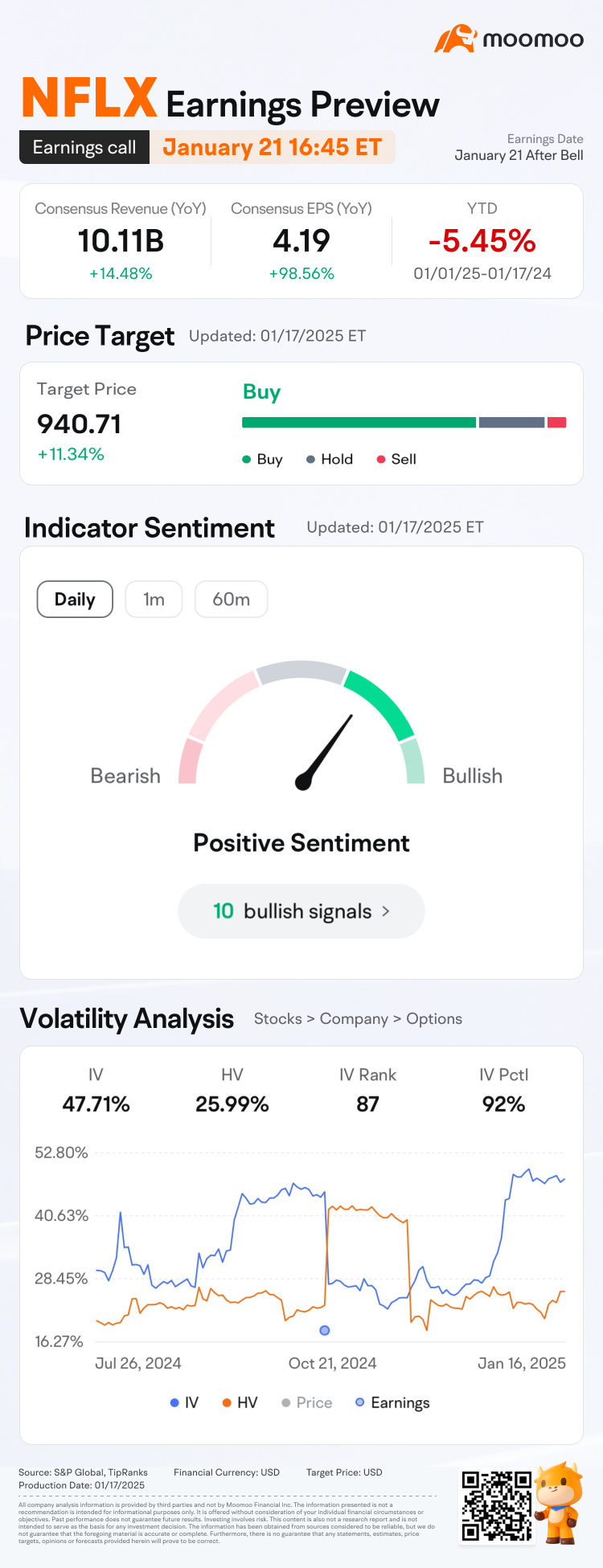

$Netflix (NFLX.US)$ is releasing its Q4 2024 earnings on January 21 after the bell. Unlock insights with NFLX Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q3 2024 earnings release, shares of $Netflix (NFLX.US)$ have seen an increase of 20%. How will the market react to the upcoming results? Make your guess now!

Rewards

● An equal share of 5,000 points: For mooers who c...

$Netflix (NFLX.US)$ is releasing its Q4 2024 earnings on January 21 after the bell. Unlock insights with NFLX Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q3 2024 earnings release, shares of $Netflix (NFLX.US)$ have seen an increase of 20%. How will the market react to the upcoming results? Make your guess now!

Rewards

● An equal share of 5,000 points: For mooers who c...

10

7

$Netflix (NFLX.US)$

Netflix Q4 2024 earnings conference call is scheduled for January 21 at 4:45 PM ET /January 22 at 5:45 AM SGT /January 22 at 8:45 AM AEDT. Subscribe to join the live earnings conference with management NOW!

Beat or Miss?

What do you expect from Netflix's Q4 earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what Netflix's management has to say!

Disclaimer:

This presentation is for informa...

Netflix Q4 2024 earnings conference call is scheduled for January 21 at 4:45 PM ET /January 22 at 5:45 AM SGT /January 22 at 8:45 AM AEDT. Subscribe to join the live earnings conference with management NOW!

Beat or Miss?

What do you expect from Netflix's Q4 earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what Netflix's management has to say!

Disclaimer:

This presentation is for informa...

Netflix Q4 2024 earnings conference call

Jan 21 15:45

Book

Book 9

Expect the broad indices too probably break higher

While US earnings season continues to deliver better than expected profit results from S&P500 $S&P 500 Index (.SPX.US)$ companies. As we stand right now, on Friday 17 January the Nasdaq 100 $NASDAQ 100 Index (.NDX.US)$ is 4.6% down from its record high. And the S&P500 is just 2.5% away from its record. Both app...

While US earnings season continues to deliver better than expected profit results from S&P500 $S&P 500 Index (.SPX.US)$ companies. As we stand right now, on Friday 17 January the Nasdaq 100 $NASDAQ 100 Index (.NDX.US)$ is 4.6% down from its record high. And the S&P500 is just 2.5% away from its record. Both app...

From YouTube

12

1

7

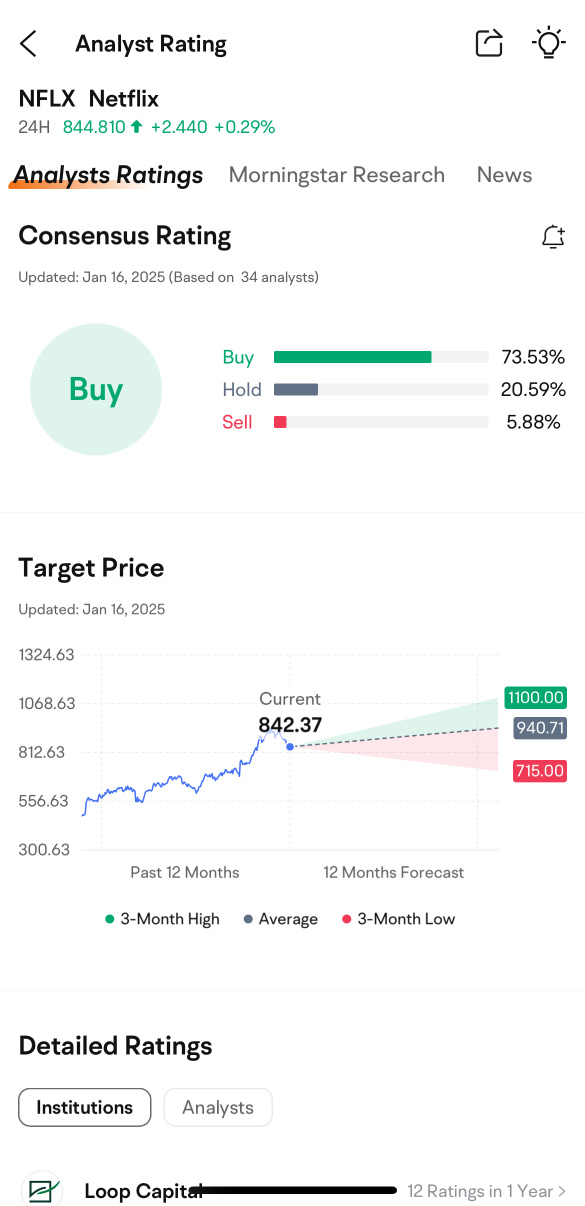

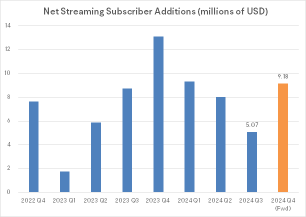

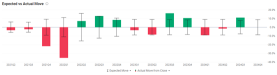

Streaming giant $Netflix (NFLX.US)$ is set to report its Q4 2024 earnings after the bell on 21 January, with analysts expecting revenue, profit, and subscriber figures to have grown from a year ago.

Consensus Estimates

● Netflix is expected to report adjusted earnings per share of $4.19, marking a substantial 98.7% increase from the previous year.

● Revenue forecasts point to $10.12 billion, representing 14.55% year-over-year (YoY) growth. T...

Consensus Estimates

● Netflix is expected to report adjusted earnings per share of $4.19, marking a substantial 98.7% increase from the previous year.

● Revenue forecasts point to $10.12 billion, representing 14.55% year-over-year (YoY) growth. T...

+1

6

2

1

No comment yet

104712493 : Here's an overview of the earnings prospects for Netflix (NFLX), Johnson & Johnson (JNJ), and American Airlines Group Inc. (AAL):

Netflix (NFLX):

Netflix is scheduled to report its fourth-quarter earnings on January 21, 2025. The company's stock has appreciated nearly 80% over the past year, underscoring its leading position in the streaming industry. Analysts anticipate that Netflix will continue to bolster its revenue through strategic price increases and the expansion of its ad-supported subscription tiers. The introduction of live events and sports content is also expected to attract and retain subscribers. However, challenges such as foreign exchange fluctuations and the residual effects of industry disruptions, including the 2023 writers and actors strikes, may impact financial performance.

Johnson & Johnson (JNJ):

Johnson & Johnson is set to release its earnings on January 21, 2025. The company has historically demonstrated stable performance, driven primarily by its pharmaceutical division. Recent developments in its innovative medicine segment, particularly with treatments like Tremfya for Crohn’s disease and ulcerative colitis, have shown promising results. While J&J maintains a solid balance sheet and consistent return on capital, it faces potential headwinds from global healthcare supply chain disruptions and geopolitical risks. Investors will be keen to assess how recent divestments and the pharmaceutical pipeline influence future earnings growth.

American Airlines Group Inc. (AAL):

American Airlines is expected to report its earnings on January 23, 2025. The airline industry has been experiencing a rebound, with carriers like Delta Air Lines forecasting a strong year ahead, driven by demand for premium-class seats and upsell opportunities. Analysts anticipate that American Airlines will reflect similar trends, benefiting from the resurgence in corporate travel and growth in international routes. However, the company must navigate challenges such as fluctuating fuel costs and competitive pressures within the industry.

Overall, while each company operates in distinct sectors, they share common themes of leveraging strategic initiatives to drive growth amid external challenges

ZnWC :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Buy n Die Together❤ :

Lucas Cheah : $Netflix (NFLX.US)$

Netflix’s earnings prospects are strong, driven by international expansion, the ad-supported tier, and content investments. Its push into mobile-only plans in markets like India and Africa has broadened its subscriber base. For example, its ad-supported subscription tier is expected to add billions in revenue annually by attracting cost-sensitive users. However, rising competition and high content costs remain challenges.

$Johnson & Johnson (JNJ.US)$

J&J’s earnings are supported by its diversified business model, spanning pharmaceuticals, medical devices, and consumer health products. The separation of its consumer health division (Kenvue) allows J&J to focus on high-margin pharmaceutical and med-tech innovations. For instance, its oncology and immunology drugs, such as Darzalex, continue to drive growth. Risks include potential litigation costs and competitive pressures in its key markets.

$American Airlines (AAL.US)$

American Airlines faces mixed earnings prospects. While strong travel demand and higher ticket prices have boosted revenues, rising fuel costs and high debt levels weigh on profitability. The company’s focus on optimizing capacity and expanding international routes offers growth potential. For example, robust demand for transatlantic travel has supported revenue in its premium cabins. However, economic uncertainty and operational costs remain key risks.

Each company offers unique opportunities and risks, making them suitable for investors with specific objectives, from growth (Netflix) to stability (J&J) or cyclical recovery (AAL).