US Stock MarketDetailed Quotes

NOW ServiceNow

- 867.090

- -48.700-5.32%

Close Mar 6 16:00 ET

- 867.090

- 0.0000.00%

Post 20:01 ET

178.62BMarket Cap126.77P/E (TTM)

907.900High858.250Low2.16MVolume890.000Open915.790Pre Close1.90BTurnover1.05%Turnover Ratio126.77P/E (Static)206.00MShares1198.09052wk High18.59P/B178.13BFloat Cap637.99052wk Low--Dividend TTM205.44MShs Float1198.090Historical High--Div YieldTTM5.42%Amplitude22.620Historical Low878.409Avg Price1Lot Size

ServiceNow Stock Forum

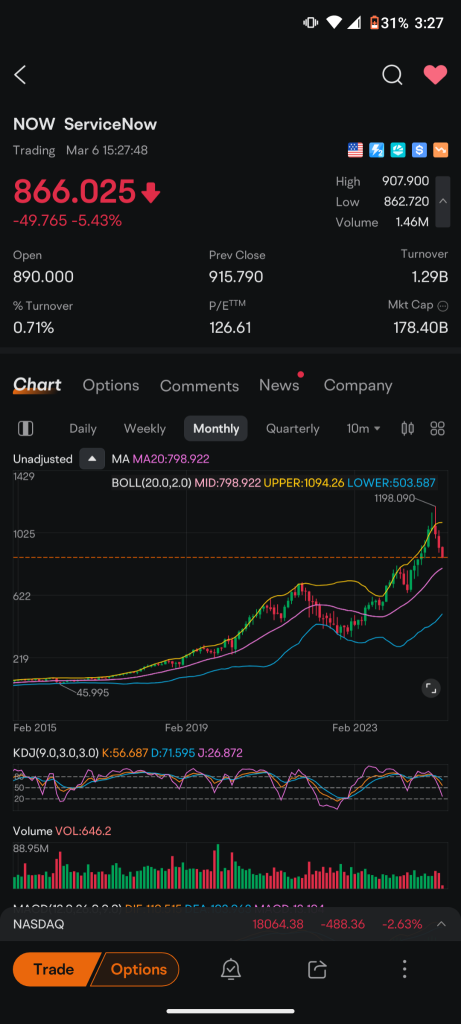

$ServiceNow (NOW.US)$ looking at a long-term chart you will see that in Market sell-offs this stock has gone down and touched it's middle moving average. you're talking right about 800 bucks it says 798 but it's not an exact science

I don't know if it's going to reach there I hope it doesn't because if it does that means the S&P 500 has broken it will be down about 10% maybe a little bit more within a day to two days you will see a crash in the S&P.. if it were to happen and you can pick up serv...

I don't know if it's going to reach there I hope it doesn't because if it does that means the S&P 500 has broken it will be down about 10% maybe a little bit more within a day to two days you will see a crash in the S&P.. if it were to happen and you can pick up serv...

1

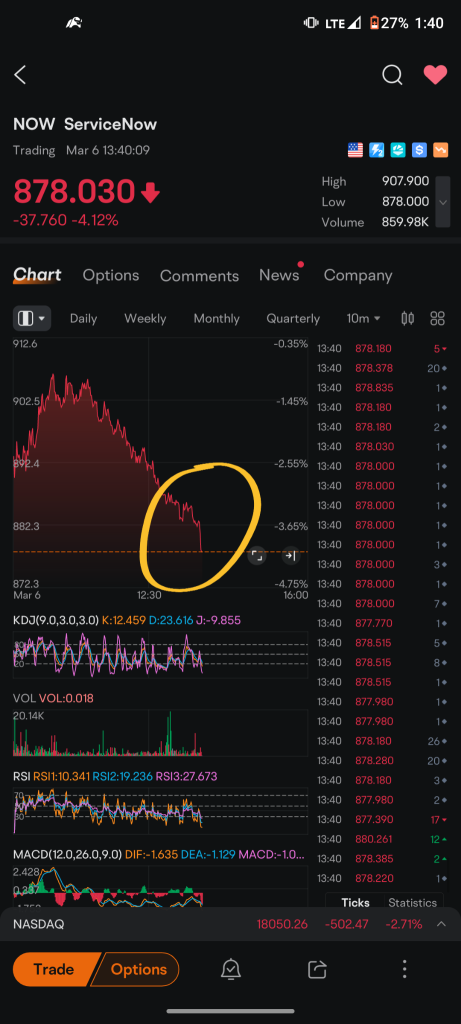

$ServiceNow (NOW.US)$ food for thought

we've tested the 250 day moving average once it looks like this morning it's going to come close again

the reason for the breakdown in service now if you go back to the conference call and listen had to do with the strength in the US dollar.

what's happening right now with the US dollar?

it's getting crushed!

this reverses the guidance warning of service now the strong US dollar hurt them when they converted from foreign currencies back to the US dollar...

we've tested the 250 day moving average once it looks like this morning it's going to come close again

the reason for the breakdown in service now if you go back to the conference call and listen had to do with the strength in the US dollar.

what's happening right now with the US dollar?

it's getting crushed!

this reverses the guidance warning of service now the strong US dollar hurt them when they converted from foreign currencies back to the US dollar...

1

$DXC Technology (DXC.US)$ $ServiceNow (NOW.US)$

DXC and ServiceNow Launch AI Solution to Cut Insurance Operational Costs by 40%

DXC and ServiceNow Launch AI Solution to Cut Insurance Operational Costs by 40%

1

$ServiceNow (NOW.US)$

How ServiceNow's Quality 360 Acquisition Targets the 20% Revenue Drain in Manufacturing

How ServiceNow's Quality 360 Acquisition Targets the 20% Revenue Drain in Manufacturing

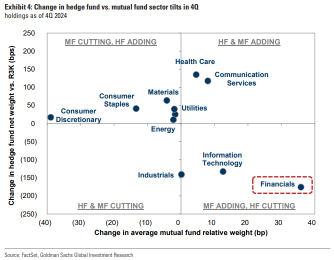

According to the latest fund holdings analysis report released by Goldman Sachs, 695 hedge funds and 544 large - cap actively managed mutual funds demonstrated distinctly different investment strategies in the first quarter of 2025.

Especially, they showed divergence in the allocation of the financial sector and the "Magnificent Seven" stocks in the U.S. stock market.

Institutional investors have generally deliver...

Especially, they showed divergence in the allocation of the financial sector and the "Magnificent Seven" stocks in the U.S. stock market.

Institutional investors have generally deliver...

33

23

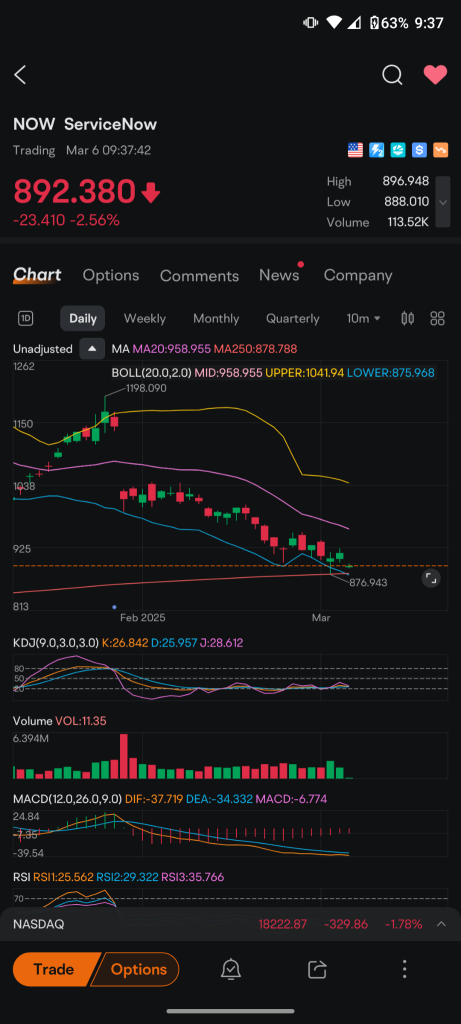

$ServiceNow (NOW.US)$ the last two sell-offs for service now when it broke through the 20-day moving average it traded all the way down to the lower Bollinger band. if this were to happen this time it would be right around $920 and it could be a few dollars more could be a little less before it reverses. what would cause this gap down potentially is if we get a market sell-off the significant NASDAQ correction will take this right down.

the lower support is right around $902 now but it's in an...

the lower support is right around $902 now but it's in an...

4

The emergence of DeepSeek will shift the focal value of the AI industry chain from front-end computing power to the middle and end stages. Currently, the clearest direction is undoubtedly cloud computing.

The core innovation of DeepSeek lies in the significant improvement in algorithm efficiency and the substantial reduction in costs. This provides a new approach for small and medium-sized enterprises to enter the field of ...

The core innovation of DeepSeek lies in the significant improvement in algorithm efficiency and the substantial reduction in costs. This provides a new approach for small and medium-sized enterprises to enter the field of ...

89

10

121

The stock market have the trading showing little conviction as investors awaits the FOMC policy decision at 2pm ET, and follow by the Fed Chair’s press conference at 2.30pm ET.

The stock market ended the session with mixed performance on Wednesday (29 Jan). Stocks closed lower Wednesday after the Federal Reserve left its influential interest rate unchanged amid persistent inflation, as investors prepared for a slew of earnings reports f...

The stock market ended the session with mixed performance on Wednesday (29 Jan). Stocks closed lower Wednesday after the Federal Reserve left its influential interest rate unchanged amid persistent inflation, as investors prepared for a slew of earnings reports f...

+1

3

1

$ServiceNow (NOW.US)$ Getting smoked

2

2

No comment yet

TWIMO (151403908) : ServiceNow and SalesForce has similar business characteristics… However, compared to IBM market cap it’s gosh one is almost all software while the latter has the future of quantum in its R&D centre… I’m not going to buy this stock at 800 hoping for 25% gain, and there’s better alternatives to buying this stock at 650-700 hoping for 10% gain.