No Data

NTES NetEase

- 88.870

- +1.390+1.59%

- 88.870

- 0.0000.00%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Hong Kong stock market morning report on December 3: The NASDAQ and S&P in the US set new highs again. China Resources consortium acquired a land plot for 18.5 billion yuan.

① The manufacturing index from the usa Supply Management Association rose by 1.9 points, with most categories in the index showing improvement. ② The French Prime Minister announced a bypass of parliament to forcibly pass the budget bill. ③ Federal Reserve Governor Waller expressed a tendency to lower interest rates again in December. ④ The usa Department of Commerce released new export control measures on semiconductors to China, and the Department responded. ⑤ The usa stock market's Nasdaq and s&p 500 index both reached new historical highs.

Nasdaq, S&P hit new highs, French stock and bond yields fluctuate and rise, Euro once fell more than 1%, Dollar rose.

On the first trading day of December, Cyber Monday shopping amounts will break records, with the Nasdaq and Chinese concept stocks rising about 1%, and the chip index leading with a 2.6% increase, while the Dow fell from its peak. Tesla soared over 4% during the day, intel rose nearly 6% before turning negative, super micro computer surged nearly 29%, and Xpeng autos climbed over 5%, but Li Auto dropped nearly 4%. The French government faces a vote of no confidence, causing French stocks to briefly fall over 1%, and the spread between French and German government bond yields approached the widest in twelve years. US henry hub natural gas fell over 4%, the indian rupee hit a new low, and the offshore yuan dropped over 400 points, falling below 7.29 yuan.

US stocks closed: Chinese concept stock index 'three consecutive rises,' technology giants prop up NASDAQ, S&P to reach new highs.

① Technology giants continue to rise, with the S&P and Nasdaq hitting new highs; ② Musk's high salary once again rejected by a judge; ③ Super micro computer announces no inappropriate behavior found; ④ Intel CEO suddenly retires, reportedly forced out by the board of directors.

Netease denies all layoffs in Shenzhen, stating that it is fake news and refers to adjustments made several months ago.

Sina Technology News, November 29th, noon, there were online rumors that netease's Shenzhen office laid off all employees, "the gaming department left with none." In response, a netease insider said, "This was an adjustment made several months ago, specifically for a single product, many colleagues have already been transferred to other products, it is definitely not true that all employees were laid off."

Morgan Stanley: Maintains netease-S (09999) "shareholding" rating, target price raised to 185 Hong Kong dollars.

J.P. Morgan continues to list netease as the top pick in the digital entertainment sector.

[Brokerage Focus] Bocom Intl: Bullish on OTA/local life competition easing and sustained robust performance by 2025.

Jinwu Financial News | Bocom Intl released its 2025 outlook for the internet plus-related industry, as new policies are progressively implemented, the effects on online and offline consumer spending may become evident the fastest. There is bullish sentiment towards consumer categories on internet trading platforms that are relatively inelastic and can be quickly stimulated, as well as the software industry benefiting from AI empowerment and innovation recovery. It is suggested to focus on stable growth in core business, improvement in profitability, and valuation recovery opportunities driven by high shareholder returns. The bank is optimistic about the easing competition in OTA/local life and the sustained steady performance, with ecommerce > education > gaming > software having significant valuation recovery opportunities. OTA: Mainland hotel ADR pressure is easing, outbound business.

Comments

$JD.com (JD.US)$ $Baidu (BIDU.US)$ $NetEase (NTES.US)$ $KraneShares CSI China Internet ETF (KWEB.US)$

$TENCENT (00700.HK)$ $Tencent (TCEHY.US)$ $NetEase (NTES.US)$ $NTES-S (09999.HK)$ $BILIBILI-W (09626.HK)$ $FEIYU (01022.HK)$

$TENCENT (00700.HK)$ $Tencent (TCEHY.US)$ $NetEase (NTES.US)$ $NTES-S (09999.HK)$ $Bilibili (BILI.US)$ $BILIBILI-W (09626.HK)$

You could have made a lot of money with put options. 😂

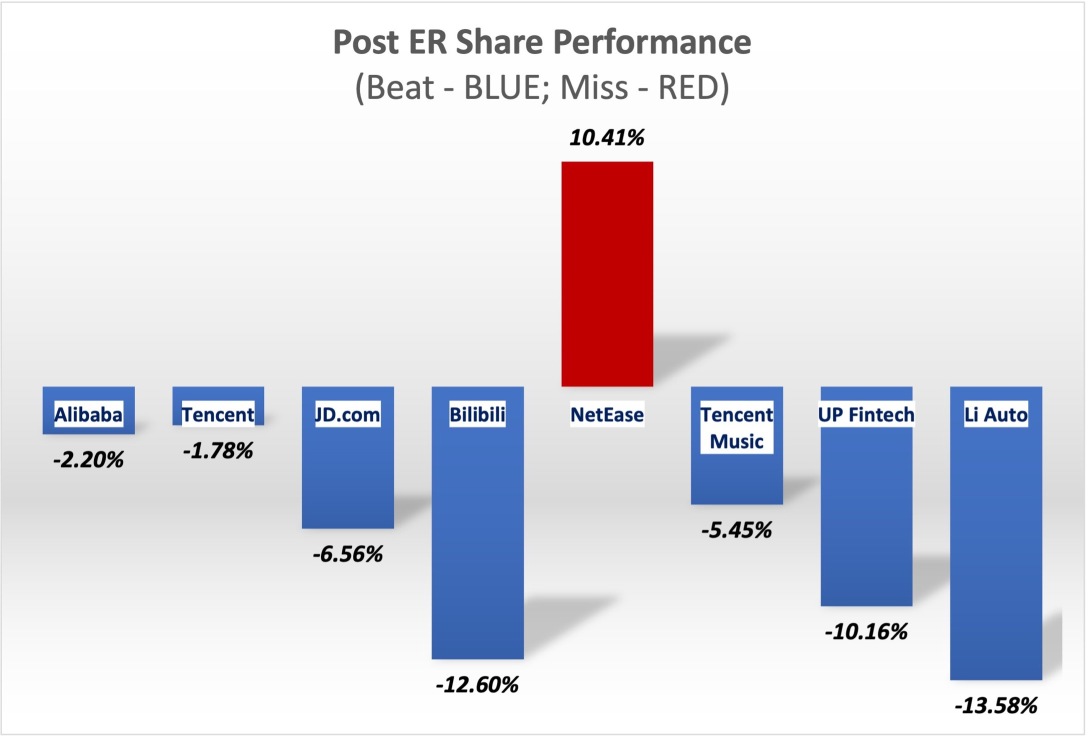

$TENCENT (00700.HK)$ $Tencent (TCEHY.US)$ $BABA-W (09988.HK)$ $Alibaba (BABA.US)$ $JD.com (JD.US)$ $JD-SW (09618.HK)$ $BILIBILI-W (09626.HK)$ $Bilibili (BILI.US)$ $NTES-S (09999.HK)$ $NetEase (NTES.US)$ $Li Auto (LI.US)$ $LI AUTO-W (02015.HK)$ $Tencent Music (TME.US)$ $TME-SW (01698.HK)$ $UP Fintech (TIGR.US)$

Analysis

Price Target

No Data

Business Data

No Data

This page we’re on is probably where you want to direct your message, much better insight on the Asian markets. Have a good day.

This page we’re on is probably where you want to direct your message, much better insight on the Asian markets. Have a good day.