US ETFDetailed Quotes

NUGT Direxion Daily Gold Miners Index Bull 2X Shares

- 35.160

- +0.380+1.09%

Close Dec 31 16:00 ET

35.360High34.460Low

35.360High34.460Low992.46KVolume34.490Open34.780Pre Close34.77MTurnover6.84%Turnover Ratio--P/E (Static)14.50MShares60.32952wk High--P/B509.89MFloat Cap22.73952wk Low0.63Dividend TTM14.50MShs Float2014.930Historical High1.79%Div YieldTTM2.59%Amplitude19.469Historical Low35.035Avg Price1Lot Size

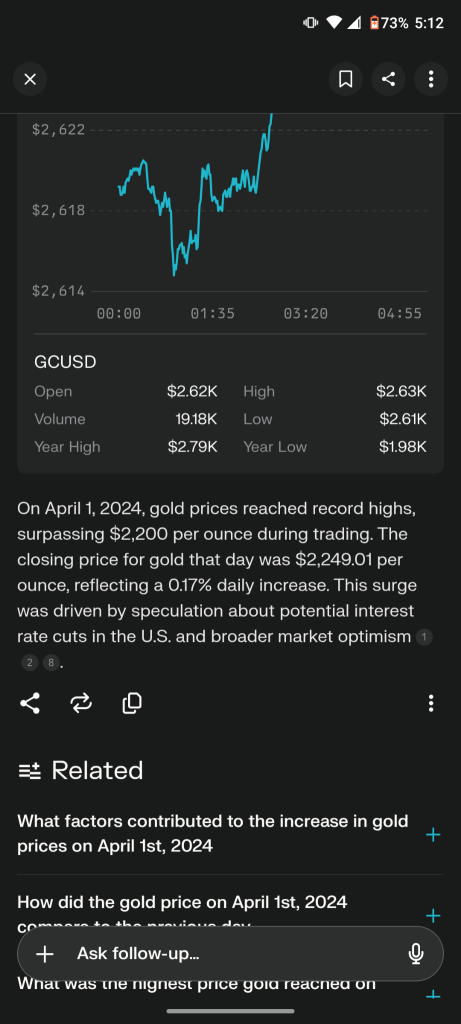

$Direxion Daily Gold Miners Index Bull 2X Shares (NUGT.US)$ if we look at this ETF today and draw a line back in time we cross it April 1st and maybe I'm the fool for saying this..

way back earlier this year seems like a lifetime ago the bobbleheads on TV got on the bandwagon it's time to buy the mining stocks because the price of gold is going up you see we broke out from about 1850 through 2100 and these mental Giants realize when the commodity that company sell increases and their costs remai...

way back earlier this year seems like a lifetime ago the bobbleheads on TV got on the bandwagon it's time to buy the mining stocks because the price of gold is going up you see we broke out from about 1850 through 2100 and these mental Giants realize when the commodity that company sell increases and their costs remai...

11

6

$Direxion Daily Gold Miners Index Bull 2X Shares (NUGT.US)$ gold hammered today because peace deal between Israel is eminent according to the White House where hammas is going to be releasing hostages and they want to get this done so Trump doesn’t get the credit for it.

1

$Direxion Daily Gold Miners Index Bull 2X Shares (NUGT.US)$ a potential peace deal between Hamas and Israel is potentially within the next 24 to 36 hours and that is what has caused $86 drop in gold and all of the related mining companies are also down as a result.

2

$Direxion Daily Gold Miners Index Bull 2X Shares (NUGT.US)$ please don't gap up overnight. give us a chance to get in tomorrow

$Direxion Daily Gold Miners Index Bull 2X Shares (NUGT.US)$ they say a picture's worth a thousand words so let's use the kiss methodology here.

100% of the time there's a direct correlation to the price movement when it touches the lower Bollinger band, The Blue line.

forget everything going on in the world, if you're not colorblind when you see the chart touch the Blue line you buy it really that simple.

the blue line is oversold and 90% of all price movement happens between the lower and the...

100% of the time there's a direct correlation to the price movement when it touches the lower Bollinger band, The Blue line.

forget everything going on in the world, if you're not colorblind when you see the chart touch the Blue line you buy it really that simple.

the blue line is oversold and 90% of all price movement happens between the lower and the...

1

1

$Direxion Daily Gold Miners Index Bull 2X Shares (NUGT.US)$ if you look at this chart you don't need to know what economic events have transpired what political events have transpired what inflation was what CPI was what unemployment was who beat earnings who missed earnings. all of that daily riff Raff is ignored. if you buy when it's oversold which is the Blue line you made money, period.. plain and simple.

gold has gotten butchered since Trump was elected.

Bitcoin is taking off.

there's a te...

gold has gotten butchered since Trump was elected.

Bitcoin is taking off.

there's a te...

10

1

$Direxion Daily Gold Miners Index Bull 2X Shares (NUGT.US)$ if we touch 48 anything you need to take a position and if it drifts a little lower add to it 47 46. gold's been getting hammered and it's absurd it's down $57 today the last time I looked.. if Apple misses will probably have a down day tomorrow I know there shouldn't be any correlation but why would gold be down today if it's not for the tech stocks. so anywhere is 46,47, 48 it's a buy.

5

6

$Direxion Daily Gold Miners Index Bull 2X Shares (NUGT.US)$ drop to 45 pls I'll join

No comment yet

modest Narwhal_1005 : would you also nibble at shny?

10baggerbamm OP modest Narwhal_1005 : this ETF that you mentioned is more of a well-rounded basket it not only includes the large gold mining companies but also what they call the junior mining companies.

as they say a rising tide lifts All ships so yes you could feel comfortable buying this ETF.

if gold rises back to 27 28xx, this ETF will go up nicely.

I will point this out I will not buy this basket this ETF.

and the reasons very simple I only buy ETFs that have options.. I like to have the ability to add to a position potentially by selling puts and collecting the premium and I like the ability to sell covered calls against my long position to generate income as well.

when you buy an ETF that does not have options it limits your total return to only having the basket increase in net asset value so with this particular ETF gold must rise in order for you to have a positive return on your investment.

with nugt if gold just stays sideways I can sell puts and make money I can sell calls and make money and my total return over the course of say 3 months is going to be about 20%.

if gold does nothing with this etf shny your returns going to be basically zero.

that's why I need to have the ability to sell puts and sell calls and why I will not buy an ETF that does not have options

as they say a rising tide lifts All ships so yes you could feel comfortable buying this ETF.

if gold rises back to 27 28xx, this ETF will go up nicely.

I will point this out I will not buy this basket this ETF.

and the reasons very simple I only buy ETFs that have options.. I like to have the ability to add to a position potentially by selling puts and collecting the premium and I like the ability to sell covered calls against my long position to generate income as well.

when you buy an ETF that does not have options it limits your total return to only having the basket increase in net asset value so with this particular ETF gold must rise in order for you to have a positive return on your investment.

with nugt if gold just stays sideways I can sell puts and make money I can sell calls and make money and my total return over the course of say 3 months is going to be about 20%.

if gold does nothing with this etf shny your returns going to be basically zero.

that's why I need to have the ability to sell puts and sell calls and why I will not buy an ETF that does not have options

Kim10 : which broker do u use to trade margin ?

10baggerbamm OP Kim10 : I don't use margin, I do use leverage with leveraged ETFs and options but I don't borrow against equity and use margin to obtain leverage

Kim10 10baggerbamm OP : you don't sell naked calls at all?

View more comments...