No Data

NVDY241115C30000

- 0.05

- 0.000.00%

- 5D

- Daily

News

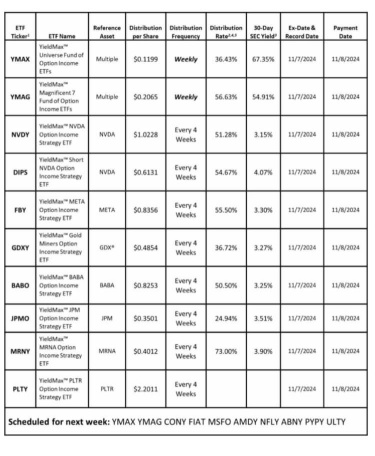

YieldMax NVDA Option Income Strategy ETF Declares $1.0228 Dividend

YieldMax NVDA Option Income Strategy ETF Declares $1.099 Dividend

Here's How Bond ETFs Fared as Investors Parsed New Inflation, Jobless-claims Data

Huang Renxun: The future of AI lies in 'reasoning', and a significant reduction in chip costs is key!

①Huang Renxun's latest statement indicates that the future of ai will be a service capable of "reasoning", but to reach this stage, the cost of computation needs to be reduced first; ②He said that nvidia will increase chip performance by two to three times each year, while maintaining the same cost and energy consumption levels, to lay the foundation for these advancements.

Nvidia soared, due to Blackwell and also due to OpenAI, while institutions are actually underweighted?

Huang Renxun stated in an interview with CNBC that the upcoming Blackwell AI 'super chip' has a 'crazy' demand. At the same time, nvidia invested 0.1 billion US dollars in the financing of OpenAI, the market sees this cooperation as a symbolic step, and it may enable nvidia to have a deeper understanding of OpenAI's chip procurement plan.

Huang Renxun claims that the demand for Blackwell chips is "crazy".

Comments say that Huang Renxun's speech eased concerns about the delay in Blackwell chip production. Three weeks ago, Huang Renxun exaggeratedly affirmed that the demand for Blackwell was too high in his speech, causing nvidia's intraday surge of 9%, leading to a V-shaped reversal in the US stock market large caps.

Comments

Until when? What price? The point is to male money & take care of our families, I assume. So, How much is enough? What is the Exit Strategy? At Annual Sales of 1 Million Dollars, 280,000,000 shares in Float, How high will the stock price go? im gonna buy 100 shares today! But HOW LONG DO I HODL? I wanna put that c...

Did anyone receive dividend for 7Nov24?

104237531 : Sell when he enters above the Bollinger Band, if too far from ema5. Wait for the washing plate to finish before buying back. I think it will go up today.

未来财富 : Why do you care so much? They are not lacking money, with powerful holding power. They will add positions when it drops, seeing the future that you cannot see.

TheOracleOfBroMaha OP : I guess if I was trading real money like money that I could have for my kids or buy a house with and just lame stuff like that I guess I would have like a plan like you know like oh if the stock goes down 25% I would probably sell And then try to invest in something that was going to go up. Or if it went up say 25 or 50% save from 30 to 50 I would sell it 50 you know if I could or if I saw it go to 53 and then start dropping back down I would sell you know somewhere where I was hoping would be the top.but it seems like there’s a lot of people on here are just like oh no matter what and just hold it no matter what. And I guess I don’t understand that philosophy. I was hoping someone could tell me what the hell you guys are thinking that’s all.