SG Stock MarketDetailed Quotes

O5RU AIMS APAC Reit

- 1.240

- -0.007-0.59%

10min DelayNot Open Aug 8 17:04 CST

1.260High1.240Low

1.260High1.240Low729.10KVolume1.260Open1.247Pre Close907.66KTurnover1.31752wk High0.09%Turnover Ratio810.95MShares1.07752wk Low0.054EPS TTM1.01BFloat Cap1.317Historical High22.96P/E (Static)810.95MShs Float0.481Historical Low0.054EPS LYR1.60%Amplitude0.10Dividend TTM0.70P/B100Lot Size7.74%Div YieldTTM

I believe many people regreted, I am not regretting because I really no money..![]() .

.

In just 2 days the market has taught everyone a good lesson.

anything can happen in market....

$AIMS APAC Reit (O5RU.SG)$

$Mapletree Log Tr (M44U.SG)$

$Mapletree Ind Tr (ME8U.SG)$ $Mapletree PanAsia Com Tr (N2IU.SG)$

In just 2 days the market has taught everyone a good lesson.

anything can happen in market....

$AIMS APAC Reit (O5RU.SG)$

$Mapletree Log Tr (M44U.SG)$

$Mapletree Ind Tr (ME8U.SG)$ $Mapletree PanAsia Com Tr (N2IU.SG)$

17

4

$AIMS APAC Reit (O5RU.SG)$ What's happening today? Some bad news not announced yet?

5

Columns SG Morning Highlights | Nio Sets New Record with Delivery of 20,544 Vehicles in May, Up 233.8% YoY

Good morning mooers! Here are things you need to know about today's Singapore markets:

●Singapore shares opened higher on Monday; STI up 0.30%

●Where the iEdge S-Reit Leaders Index sits within the Reit sector

●Stocks to watch: Nio, Seatrium, Sembcorp, Oiltek

●Latest share buy back transactions

-moomoo News SG

Market Snapshot

Singapore shares opened higher on Monday. The $FTSE Singapore Straits Time Index (.STI.SG)$ rose 0.30...

●Singapore shares opened higher on Monday; STI up 0.30%

●Where the iEdge S-Reit Leaders Index sits within the Reit sector

●Stocks to watch: Nio, Seatrium, Sembcorp, Oiltek

●Latest share buy back transactions

-moomoo News SG

Market Snapshot

Singapore shares opened higher on Monday. The $FTSE Singapore Straits Time Index (.STI.SG)$ rose 0.30...

14

2

Good morning mooers! Here are things you need to know about today's Singapore markets:

●Singapore shares opened higher on Tuesday; STI up 0.05%

●Dip in Chinese Tourist Arrivals Affects Singapore's Retail Sales Despite Concert

●Million-Dollar Resale Flat Transactions Rise by 11% MoM in April

●Stocks to watch: SIA, Paragon Reit, AA Reit

●Latest share buy back transactions

-moomoo News SG

Mark...

●Singapore shares opened higher on Tuesday; STI up 0.05%

●Dip in Chinese Tourist Arrivals Affects Singapore's Retail Sales Despite Concert

●Million-Dollar Resale Flat Transactions Rise by 11% MoM in April

●Stocks to watch: SIA, Paragon Reit, AA Reit

●Latest share buy back transactions

-moomoo News SG

Mark...

12

Compared with a few years back, the dividend ex-date should be released already... I wonder if there's any dividend for May 🤔

$AIMS APAC Reit (O5RU.SG)$

$AIMS APAC Reit (O5RU.SG)$

1

Rents of retail space in Singapore’s central region dipped 0.4 per cent in the first quarter of 2024, extending a decline of 0.1 per cent seen in Q4 2023 as vacancy rates rose for stores outside prime locations.

Falling rents in the fringe areas of the central region dragged on the overall rental index, even though rents in the central area rose 0.2 per cent in Q1. Rents in the fringe areas fell 1.8 per cent, said Wong Xian Yang, ...

Falling rents in the fringe areas of the central region dragged on the overall rental index, even though rents in the central area rose 0.2 per cent in Q1. Rents in the fringe areas fell 1.8 per cent, said Wong Xian Yang, ...

6

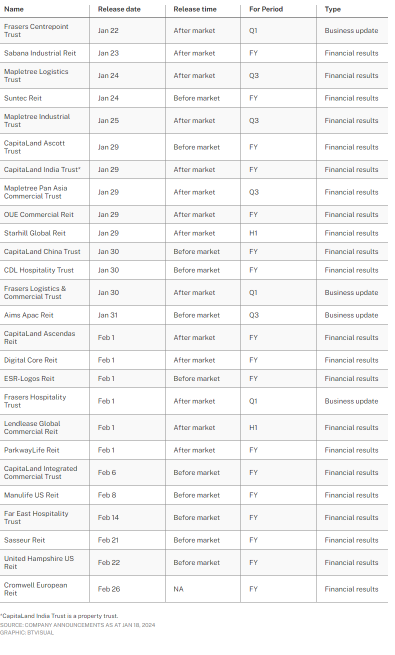

$FRASERS CENTREPOINT TRUST (J69U.SG)$ $Sabana Reit (M1GU.SG)$ $Mapletree Log Tr (M44U.SG)$ $Suntec Reit (T82U.SG)$ $Mapletree Ind Tr (ME8U.SG)$ $CapLand Ascott Trust (HMN.SG)$ $CapLand India T (CY6U.SG)$ $Mapletree PanAsia Com Tr (N2IU.SG)$ $OUEREIT (TS0U.SG)$ $StarhillGbl Reit (P40U.SG)$ $CapLand China T (AU8U.SG)$ $CDL HTrust (J85.SG)$ $FRASERS LOGISTICS & COM TRUST (BUOU.SG)$ $AIMS APAC Reit (O5RU.SG)$ $CapLand Ascendas REIT (A17U.SG)$ $DigiCore Reit USD (DCRU.SG)$ $ESR-LOGOS REIT (J91U.SG)$ $FRASERS HOSPITALITY TRUST (ACV.SG)$ $Lendlease Reit (JYEU.SG)$ $ParkwayLife Reit (C2PU.SG)$ $CapLand IntCom T (C38U.SG)$ $ManulifeReit USD (BTOU.SG)$ $Far East HTrust (Q5T.SG)$ $Sasseur Reit (CRPU.SG)$ $UtdHampshReitUSD (ODBU.SG)$ $Cromwell Reit EUR (CWBU.SG)$

24

1

$AIMS APAC Reit (O5RU.SG)$

Brokers’ take: RHB foresees higher earnings, valuations for AA Reit on master lease renewals

com.sg/companie...

Brokers’ take: RHB foresees higher earnings, valuations for AA Reit on master lease renewals

com.sg/companie...

iEdge S-Reit Index Weekly Review 31 Dec 23

S-REITs continue to receive upside pressure. Question remains. Is this merely sentiment driven? Despite speculation of rate cuts, economic conditions remain tight.

$AIMS APAC Reit (O5RU.SG)$ $Mapletree PanAsia Com Tr (N2IU.SG)$ $PARAGONREIT (SK6U.SG)$ $FRASERS LOGISTICS & COM TRUST (BUOU.SG)$ $Mapletree Ind Tr (ME8U.SG)$ $Lendlease Reit (JYEU.SG)$ $CapLand China T (AU8U.SG)$ $CSOP S-REITs INDEX ETF (SRT.SG)$ $CapLand India T (CY6U.SG)$ $CapLand IntCom T (C38U.SG)$ $CapLand Ascendas REIT (A17U.SG)$ $FRASERS CENTREPOINT TRUST (J69U.SG)$

S-REITs continue to receive upside pressure. Question remains. Is this merely sentiment driven? Despite speculation of rate cuts, economic conditions remain tight.

$AIMS APAC Reit (O5RU.SG)$ $Mapletree PanAsia Com Tr (N2IU.SG)$ $PARAGONREIT (SK6U.SG)$ $FRASERS LOGISTICS & COM TRUST (BUOU.SG)$ $Mapletree Ind Tr (ME8U.SG)$ $Lendlease Reit (JYEU.SG)$ $CapLand China T (AU8U.SG)$ $CSOP S-REITs INDEX ETF (SRT.SG)$ $CapLand India T (CY6U.SG)$ $CapLand IntCom T (C38U.SG)$ $CapLand Ascendas REIT (A17U.SG)$ $FRASERS CENTREPOINT TRUST (J69U.SG)$

8

10

No comment yet

powerful Otter_mwi : rich

I Am 102927471 :

104085035 : I always regret not buying the winning toto numbers

ChartTrader : hmm with big money don’t have to trade already I think