US Stock MarketDetailed Quotes

OKTA Okta

- 113.740

- +0.940+0.83%

Close Mar 21 16:00 ET

- 114.190

- +0.450+0.40%

Post 17:59 ET

19.75BMarket Cap1895.67P/E (TTM)

115.020High110.650Low3.50MVolume111.740Open112.800Pre Close398.61MTurnover2.15%Turnover Ratio1895.67P/E (Static)173.60MShares116.96052wk High3.08P/B18.48BFloat Cap70.56052wk Low--Dividend TTM162.50MShs Float294.000Historical High--Div YieldTTM3.87%Amplitude21.520Historical Low113.956Avg Price1Lot Size

Okta Stock Forum

$PROSHARES ULTRA NASDAQ CYBERSECURITY ETF (UCYB.US)$ $CrowdStrike (CRWD.US)$ $Palo Alto Networks (PANW.US)$ $Check Point Software (CHKP.US)$ $Cloudflare (NET.US)$ $Okta (OKTA.US)$ $Fortinet (FTNT.US)$ FYI

It appears nobody on moo moo ever has talked about this ETF.

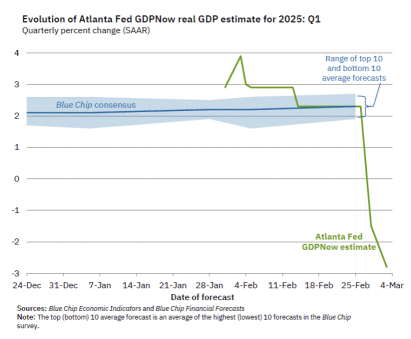

there's a tremendous amount of controversy in the media it started back in December that Trump's policies are inflationary that came from the head of the Federal reserve around the 18th or 19th of December when he had his fomc meeting and that re...

It appears nobody on moo moo ever has talked about this ETF.

there's a tremendous amount of controversy in the media it started back in December that Trump's policies are inflationary that came from the head of the Federal reserve around the 18th or 19th of December when he had his fomc meeting and that re...

5

2

I'm really not too proficient this, and I am fumbling and tumbling along the way.

Micron and OKTA unexpectedly gapped up earlier this month, and the covered call options' expiry are coming soon (Micron's is this Friday).

Assuming the market price on Friday remains above my strike price like what it is now, when is the right time for me to roll it/ them? Is it at the very last moment or earlier? How should I determine what and when to do it, and how to opt...

Micron and OKTA unexpectedly gapped up earlier this month, and the covered call options' expiry are coming soon (Micron's is this Friday).

Assuming the market price on Friday remains above my strike price like what it is now, when is the right time for me to roll it/ them? Is it at the very last moment or earlier? How should I determine what and when to do it, and how to opt...

3

2

The tech market was turbulent in the last weeks of February, and now investors must beware of the Ides of March.

Equity prices rebounded mid-week on Wednesday, March 5th. What can investors look toward for safety while the tech market falls?

First up, how did we get here?

The Nasdaq index fell nearly 10% from recent highs set on February 19th. It started with a short week, a historically bad thing for equity prices in 2025. Market...

Equity prices rebounded mid-week on Wednesday, March 5th. What can investors look toward for safety while the tech market falls?

First up, how did we get here?

The Nasdaq index fell nearly 10% from recent highs set on February 19th. It started with a short week, a historically bad thing for equity prices in 2025. Market...

+4

23

14

11

$Okta (OKTA.US)$ Let's go 125 🚀 Bull's power

Too expensive to roll, but not profitable yet to close this Friday. What would a pro do to make the most of this sitution?

This is only stock in my 7 option-stock portfolio to have risen in the past week. And it rose so sharply, unexpectedly.

This is only stock in my 7 option-stock portfolio to have risen in the past week. And it rose so sharply, unexpectedly.

2

Here is what my AI model has given for today’s (05 Mar) daily watchlist. Appreciate your support and do leave me a comment if you have any questions.

$Sea (SE.US)$ $Okta (OKTA.US)$ $Strategy (MSTR.US)$

We can discuss there and lastly, appreciate a LIKE and Share from you.

Appreciate if you could share your thoughts in the comment section what do you think of today’s watchlist.

$Sea (SE.US)$ $Okta (OKTA.US)$ $Strategy (MSTR.US)$

We can discuss there and lastly, appreciate a LIKE and Share from you.

Appreciate if you could share your thoughts in the comment section what do you think of today’s watchlist.

![[05 Mar] Today's Pick - Sea Limited (SE), Okta Inc (OKTA) and Micro Strategy (MSTR)](http://1500015405.vod2.myqcloud.com/c84591d5vodtranssgp1500015405/1b1c0b7f1397757906618725869/coverBySnapshot/coverBySnapshot_10_0.jpg)

6

1

2

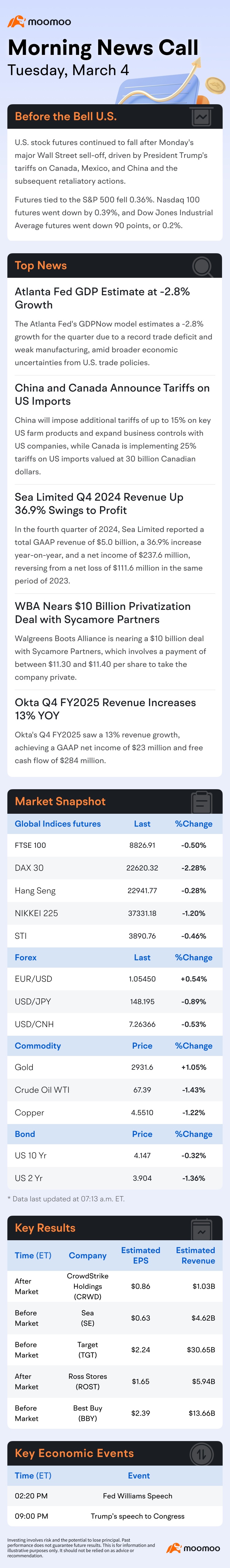

Good morning mooers! Here are things you need to know about today's market:

Sycamore Partners to Acquire Walgreens Boots Alliance Soon.

The FBM KLCI fell sharply on Tuesday, with 1,044 stocks closing lower.

Stocks to watch: ECOWLD, MSC, PARAMON

- Moomoo News MY

Wall Street Summary

$S&P 500 Index (.SPX.US)$ 5,778.15 (-1.22%)

$Dow Jones Industrial Average (.DJI.US)$ 42,520.99 (-1.55%)

$Nasdaq Composite Index (.IXIC.US)$ 18,285.16 (-0.35%)

On Tuesday, stocks fell a...

Sycamore Partners to Acquire Walgreens Boots Alliance Soon.

The FBM KLCI fell sharply on Tuesday, with 1,044 stocks closing lower.

Stocks to watch: ECOWLD, MSC, PARAMON

- Moomoo News MY

Wall Street Summary

$S&P 500 Index (.SPX.US)$ 5,778.15 (-1.22%)

$Dow Jones Industrial Average (.DJI.US)$ 42,520.99 (-1.55%)

$Nasdaq Composite Index (.IXIC.US)$ 18,285.16 (-0.35%)

On Tuesday, stocks fell a...

15

1

3

Stocks ended lower Tuesday but partly recouped earlier steep losses as President Trump’s plan to go forward with tariffs against Canada and Mexico – and Canada’s imposition of a 25% retaliatory levy on certain U.S. products – spooked Wall Street.

The $Dow Jones Industrial Average (.DJI.US)$ led the way lower, shedding 670.25 points (1.6%) to a 42,520.99 close after trailing by as much as 2.1% earlier in the day. The $S&P 500 Index (.SPX.US)$ likewise ...

The $Dow Jones Industrial Average (.DJI.US)$ led the way lower, shedding 670.25 points (1.6%) to a 42,520.99 close after trailing by as much as 2.1% earlier in the day. The $S&P 500 Index (.SPX.US)$ likewise ...

13

2

9

$Okta (OKTA.US)$ Why up when I Just sold last 2day

1

No comment yet

more than we need you. remember that.

more than we need you. remember that.

CNN is a

CNN is a  show. you watch that crap, sorry to hear.

show. you watch that crap, sorry to hear.

10baggerbamm OP : follow up I just want to show you a long-term chart of the underlying index that it mirrors with a 2X magnification. this is CIBR

and you can see that over time it's going in One direction and that's because you cannot reduce your cybersecurity protection. any day stocks can be down because they are stocks that are traded within a market so you can have an event take place from a particular company where they miss earnings or guide lower and it can pull down the index you can have a global event take place a geopolitical event take place the market sells off these stocks sell off. whoever overtime this is one that you want to buy dollar cost average in and just build a position and anytime the market takes a dump at a little more.

ASteffie :