No Data

ORCL Oracle

- 177.740

- -12.710-6.67%

- 177.700

- -0.040-0.02%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Oracle Stock Is Dropping. Why Wall Street Is OK With an Earnings Miss.

Jim Cramer Suggests Oracle Can Be Bought on Weakness and C3.ai Sold Into Strength

Oracle Positioned To Benefit From Enterprise Revolution, Says Dan Ives: 'The Software Phase Of The AI Revolution Is Now Here'

Top Gap Ups and Downs on Tuesday: GOOG, GOOGL, ORCL and More

Oracle Price Target Raised to $185 From $153 at Goldman Sachs

U.S. stocks closed: The Dow Jones fell for four consecutive days, Chinese concept stocks plummeted over 4%, as the market focused on the CPI report.

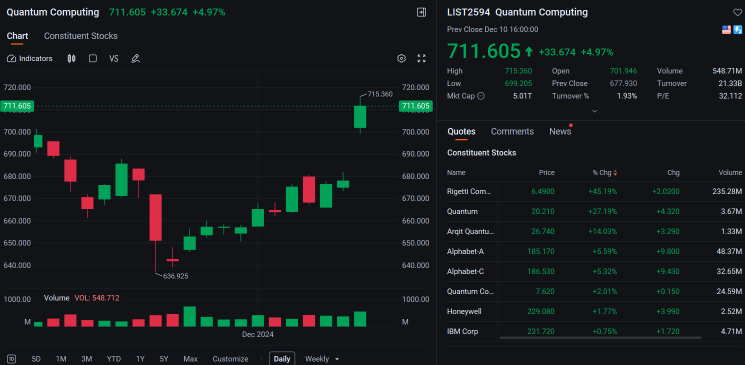

① The Nasdaq China Golden Dragon Index fell 4.34%, as China Concept Stocks collectively declined; ② Apple is reportedly planning to equip its smartwatches with satellite communication capabilities; ③ Google A rose 5.62%, as the company launched its latest quantum chip "Willow," achieving significant technological breakthroughs; ④ Microsoft shareholders voted against the Bitcoin investment proposal.

Comments

U.S. stocks slipped for second consecutive session on Tuesday as the end-of-year rally hit resistance ahead of inflation data due today (11 Dec), mainly driven by profit-taki...

Major U.S. indices ended the session lower as cautious sentiment ahead of key inflation data weighed on markets. $Dow Jones Industrial Average (.DJI.US)$ dropped 0.35%, $S&P 500 Index (.SPX.US)$ declined 0.30%, and $Nasdaq Composite Index (.IXIC.US)$ fell 0.24%, marking a second straight day of losses.

Sectoral and Stock Movements

The technology sector faced significant challenges, with $Oracle (ORCL.US)$ falling ...

Just past 4 pm ET the $S&P 500 Index (.SPX.US)$ traded -0.30%, the $Dow Jones Industrial Average (.DJI.US)$ fell 0.35%, and the $Nasdaq Composite Index (.IXIC.US)$ fell 0.25%.

MACRO

On Tuesday, ...