No Data

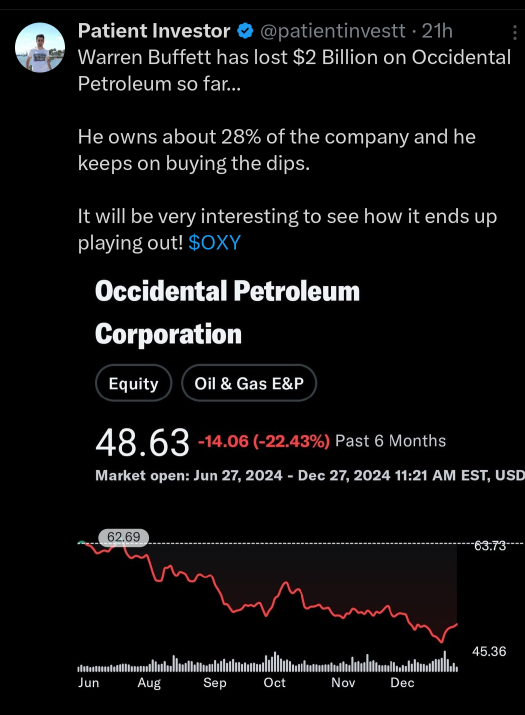

OXY Occidental Petroleum

- 49.410

- +0.950+1.96%

- 49.440

- +0.030+0.06%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Occidental Petroleum Options Spot-On: On December 31st, 65,388 Contracts Were Traded, With 1.16 Million Open Interest

The most bullish oil prices in four months! Traders focus on "Trump VS Iran".

Although oversupply puts pressure on the oil market in 2025, investors are still preparing for upside risks, primarily influenced by Trump's stance on Iran after returning to the White House, as well as the ongoing geopolitical risks.

Oil Prices See Bullish Bets At Four-Month High Amid 2025 Risks

Occidental Petroleum Options Spot-On: On December 30th, 63,774 Contracts Were Traded, With 1.18 Million Open Interest

Toronto Stocks Fall Amid Broad Declines

Cold weather exceeded expectations, USA Henry Hub Natural Gas Futures surged over 20% during trading, is inflation cooling down in jeopardy again?

On Monday during Regular Trading Hours, the NYMEX Henry Hub Natural Gas Futures February contract saw its intraday increase expand to 21%, reporting at $4.094 per million British thermal units. This is the largest increase for this contract since it began trading in 2012. Analysis suggests that higher natural gas prices may have macroeconomic implications, which could drive up inflation rates, while severe cold may also suppress Consumer spending in the USA.

Comments

when Trump's president and oil production goes up 100 plus percent more than what it is and the US becomes a net exporter, oil prices will fall precipitously. down 50% within 12 months of January 20th is inauguration. profits for every oil company will drop significantly and their stock prices will also drop. it's not rocket science people it's history repeating itself.

and as was mentioned before even the goat can be wrong

Business Data

No Data

profit from this trade. #dontgetgreedy

profit from this trade. #dontgetgreedy

Hatt bosdike OP : Oil is the play big money like warren know it already