US Stock MarketDetailed Quotes

PATH UiPath

- 11.220

- -0.120-1.06%

Close Mar 26 16:00 ET

- 11.180

- -0.040-0.36%

Pre 07:28 ET

6.19BMarket Cap-86.31P/E (TTM)

11.395High11.070Low7.97MVolume11.310Open11.340Pre Close89.29MTurnover1.83%Turnover RatioLossP/E (Static)551.49MShares22.83052wk High3.35P/B4.88BFloat Cap9.50052wk Low--Dividend TTM434.70MShs Float90.000Historical High--Div YieldTTM2.87%Amplitude9.500Historical Low11.201Avg Price1Lot Size

UiPath Stock Forum

$UiPath (PATH.US)$

will go past 14?? huhu

will go past 14?? huhu

1

2

5

2

I will start with my positions in $NVIDIA (NVDA.US)$ . Other than $NVIDIA (NVDA.US)$ I have the leveraged ETF $GraniteShares 2x Long NVDA Daily ETF (NVDL.US)$ which is currently losing ![]() . I also have the short puts options which I wish to close by this week

. I also have the short puts options which I wish to close by this week ![]() .

.

So how do I feel about Nvidia? I would say that it has been more volatile than I anticipated despite of its good earnings, the stock has not been performing as well. With the upcoming Nvidia GTC ...

So how do I feel about Nvidia? I would say that it has been more volatile than I anticipated despite of its good earnings, the stock has not been performing as well. With the upcoming Nvidia GTC ...

+3

66

25

11

Columns Wall Street Today: S&P 500 Falls Into Correction Territory as Tariff Fears Outweigh Tame PPI Report

The $S&P 500 Index (.SPX.US)$ fell into correction territory and the $Nasdaq Composite Index (.IXIC.US)$ and $Dow Jones Industrial Average (.DJI.US)$ both sank more than 1% Thursday as President Donald Trump's ongoing trade tiffs outweighed good news on wholesale inflation.

The Nasdaq shed 345.44 points (2%) to a 17,303.01 close, while the S&P 500 lost 77.78 ticks (1.4%) to 5,521.52 and the DJIA gave ...

The Nasdaq shed 345.44 points (2%) to a 17,303.01 close, while the S&P 500 lost 77.78 ticks (1.4%) to 5,521.52 and the DJIA gave ...

19

4

26

$UiPath (PATH.US)$ in fact, with DOGR cutting government spending, path presents a good opportunity to improve the government's operation through their RPA and AI agent. If they can turn this risk to opportunity, this will certainly fuel their growth again.

5

2

Morning Movers

Gapping Up

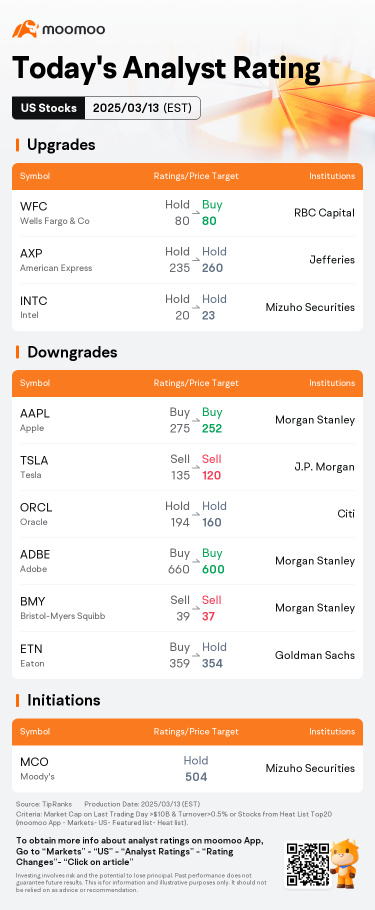

$Intel (INTC.US)$ stock surged 12% following the appointment of Lip-Bu Tan, former CEO of Cadence Design Systems, as its new chief executive. Tan replaces interim co-CEOs David Zinsner and MJ Holthaus.

$D-Wave Quantum (QBTS.US)$ stock rose 4.6% in premarket trade as the firm expects revenue to significantly exceed Wall Street consensus as it benefits from the sale of an Advantage annealing quantum computer...

Gapping Up

$Intel (INTC.US)$ stock surged 12% following the appointment of Lip-Bu Tan, former CEO of Cadence Design Systems, as its new chief executive. Tan replaces interim co-CEOs David Zinsner and MJ Holthaus.

$D-Wave Quantum (QBTS.US)$ stock rose 4.6% in premarket trade as the firm expects revenue to significantly exceed Wall Street consensus as it benefits from the sale of an Advantage annealing quantum computer...

Expand

Expand 26

1

10

$UiPath (PATH.US)$ valuation using P/R, P/E and DCF, expecting their adjusted EPS to continue to grow.

7

$UiPath (PATH.US)$ sank nearly 20% after hours Wednesday after the automation-software firm missed analyst estimates for fiscal Q4 revenues and issued forward guidance below what the market had expected.

PATH shed 18% to $9.71 shortly before 4:30 p.m. ET after reporting $423.6 million of revenues in the three months ended Jan. 31 -- trailing to $425.1 million that analysts had expected.

The company also guid...

PATH shed 18% to $9.71 shortly before 4:30 p.m. ET after reporting $423.6 million of revenues in the three months ended Jan. 31 -- trailing to $425.1 million that analysts had expected.

The company also guid...

5

1

No comment yet

101486842 : No,back to 10 soon

103237380 101486842 : why