No Data

PRNT The 3D Printing ETF

- 20.610

- +0.690+3.46%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Weekly Buzz: Magnificent Mix of Market Reactions

November Starts with a Climb to end Tough Week | Wall Street Today

Friday Market Climbs on Amazon Earnings, Labor Numbers at Four-Year Low | Live Stock

Denso, etc., announced a share buyback on October 31st.

The following are the stocks that announced the establishment of a share buyback framework on October 31st (Thu) <8141> Shinko Shoji 3.77 million shares (9.9%) 3.1 billion 92.04 million yen 2600 yen (24/11/1-25/1/31) <6902> Denso 0.2 billion 80 million shares (9.6%) 450 billion yen (24/11/1-25/10/27) <9104> Mitsui O.S.K. Lines 30 million shares (8.3%) 100 billion yen (24/11/1-25/10/31) <7741> HOYA 3 million shares

Intel's earnings per share outlook exceeds market expectations.

[Semiconductors] Intel's revenue forecast for the October-December period, announced on October 31st, slightly exceeded market expectations. In response to this, an optimistic view has emerged that it may partially recover lost market share, leading to a sharp rise in stock price in after-hours trading. <6857> Advantest <8035> Tokyo Electron Ltd. Unsponsored ADR <7735> Screen Holdings <7729> Tokyo Seimitsu <7731> Nikon Corp Spons <6383> Dai

Canon Inc-spons adr, 3Q operating profit increased by 14.4% to 296.6 billion yen.

Canon Inc-Spons ADR <7751> announced its third quarter financial results for the fiscal year ending December 2024, with revenue increasing by 7.3% year-on-year to 3 trillion 236.1 billion 11 million yen, operating profit increasing by 14.4% to 296.6 billion 38 million yen. The gross profit margin increased by 0.8 points from the same period last year to 47.8%, due to cost reductions and favorable product mix, with gross profit also increasing by 7.1% year-on-year to 516.4 billion yen. [Positive evaluation] Takeda Pharmaceuticals Mid-Term <4502> | <7735> S

Comments

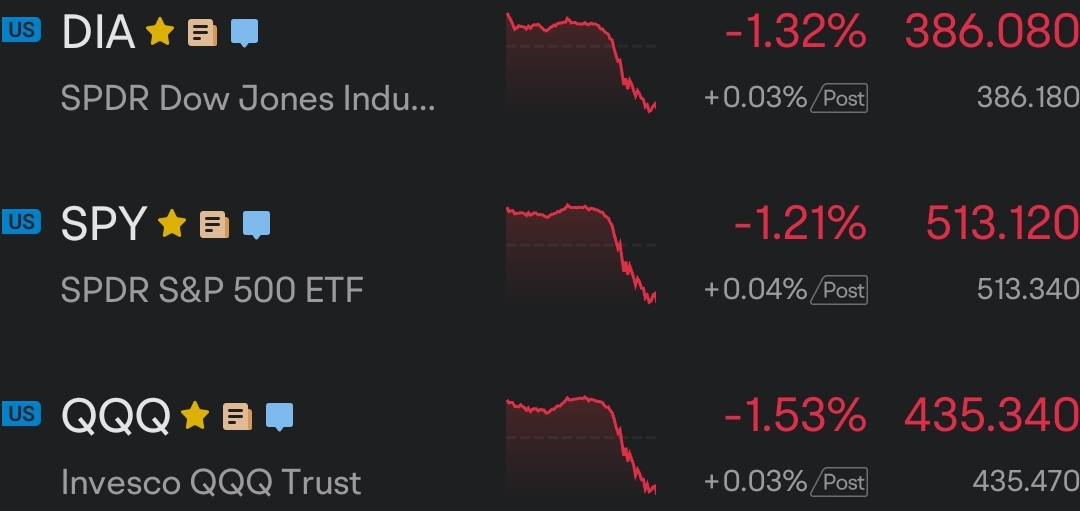

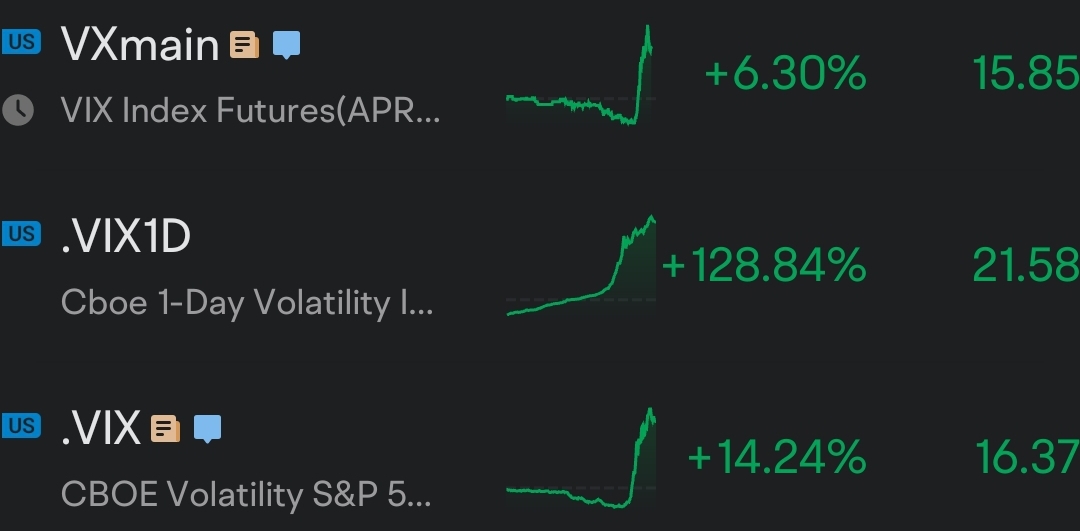

Intraday Market Crash

The major indices took a nose dive today. The day started off somewhat bullish but ended on a very bad note. Markets have been very over extended for quite a while now, and many investors have been anticipating a correction very soon. Is what we saw today the start of the correction everyone has been waiting for?

Bearish Technicals

The first warning sign that I see in the technical picture is the fact th...

$Reddit (RDDT.US)$

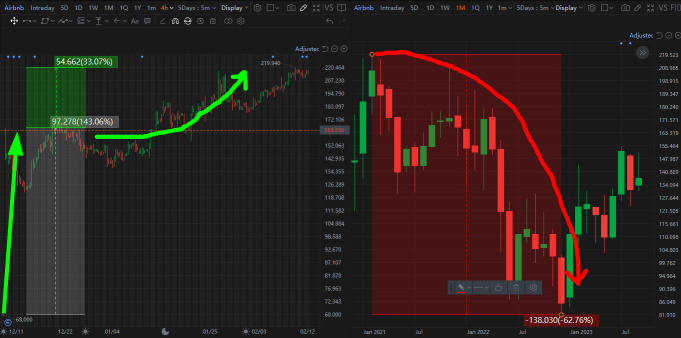

Meme Stock Mania

Reddit was one of the main facilitators in the meme stock craze that followed the massive liquidity injeciton from the Federal Reserve after the pandemic market crash. So much money was flowing into equity markets that just about every stock on the NASDAQ was ripping. Even the tiny companies that had no businees participating in the buy everything rally were ripping as well.

Along with influenc...

Looking for Trades Around Every Corner and Under Every Rock

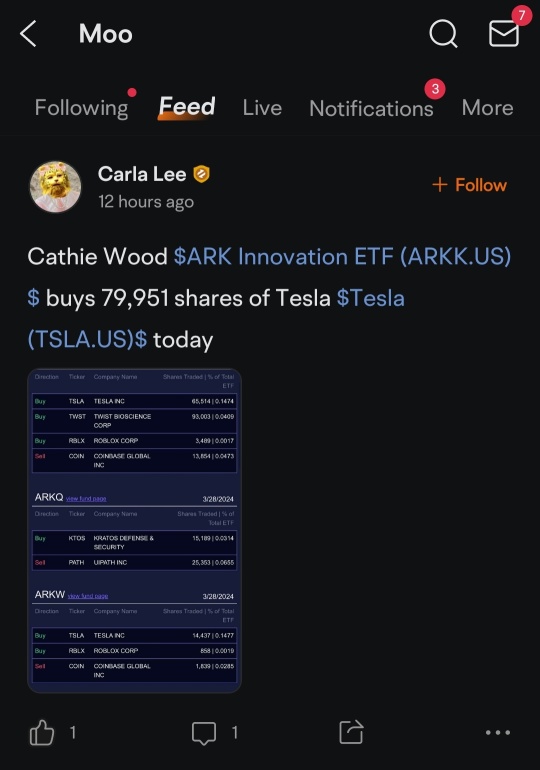

There are so many good trading opportunities at any given moment. Keeping up with every rallying stock is almost impossible. So, there is always a good trade somewhere to be found if you are willing to keep your eyes open. The community feed is a place where I will often come across profitable trades.

The community feed is easy to fi...

In today discussion, we will be talking about two priceless investing traits that we can learn from Cathie Wood (founder, CEO and CIO of Ark Invest).

Without further ado, let’s begin!

Having more than a million of followers on twitter ( $Twitter (Delisted) (TWTR.US)$ ), which is more than major ETF companies in the U.S. combined, Cathie was also awarded the best stock picker in 2020 by ...

RIPPER : I’m excited ……

SpyderCall OP RIPPER : Me too. I love a good dip to buy. And puts habe extremely low premiums right now. They could possibly print big time.

RIPPER : Am I the only one who saw this fall coming? I’m confused because seems like most out there were caught off guard.

All week long, I have had a gut feeling this exact fall was going to occur simply from my constant close observation of the moving averages. The patterns and overall movement of moving averages (throughout all time frames)TELL A STORY.

Only saying that because I’m not the best trader in any way, shape or form, but it seems even the pros didn’t see it coming

RIPPER SpyderCall OP : Yep, I had a couple of BIG bangers today.

It’s a good idea right now, to sort through the tickers with the most meat on the bone, lowest IV that appear to be topped out. Yes, most I’m looking at appear to be completely topped out.

If my original theory is correct, and this is the initial stage of transitioning from bull run to bear, then we are about to have some of the best opportunities of the entire quarter.

SpyderCall OP RIPPER : Good call. today was ugly. How low do you think it will go before the market buys it back up?

View more comments...