No Data

PSQ ProShares Short QQQ

- 39.720

- -0.250-0.63%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

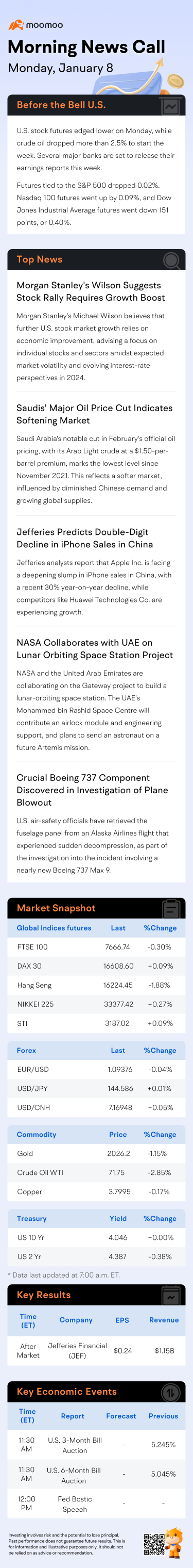

Stay put or cut interest rates as planned? Tonight's PCE will add fuel to the direction of next week's Fed decision.

The latest performance of the inflation index favored by the Federal Reserve is about to be released, the US Department of Commerce will release the US September Personal Consumption Expenditure Price Index (PCE) tonight, a key data disclosed before the Fed's interest rate decision next week.

Is there a hidden mystery in the US stock earnings conference? Bank of America: A key word frequently appearing sends a major bullish signal.

①As the third financial reporting season of the US stock market continues, more than one-third of US stock companies have already released their third-quarter financial reports; ②Bank of America has conducted a detailed analysis of the wording used by executives of US stock companies during the third quarter earnings conference calls, and has interpreted a significant signal: US stock company profits will increase significantly in 2025.

Four major historical lessons from the trade of the USA presidential election.

Deutsche Bank believes that the market performance after Donald Trump's unexpected election in 2016 will not be repeated, and the US stock market may face challenges due to controversial election results. If the new president cannot control either house of Congress, it will affect the implementation of future agendas. In addition, polling errors have a ripple effect and are not necessarily accurate.

Goldman Sachs predicts that the future 10-year ROI of US stocks will be as low as 3%, which has been refuted by many Wall Street professionals.

At present, there is no reason to believe that, with the passage of time, the economy and the market will face insurmountable challenges. Long-term gaming remains undefeated, and long-term investors can expect this momentum to continue.

What to Expect in the Week Ahead (GOOGL, AAPL, META Earnings; Jobs Report)

Goldman Sachs 'sings a different tune'! Wall Street bulls: It's unlikely that the US stock market will fall into a 'lost decade'.

①Goldman Sachs predicts that after experiencing a high-growth period in the past decade, the US stock market will face a "lost decade"; ②Long-time Wall Street bull Ed Yardeni believes that Goldman Sachs's prediction of low returns for the US stock market in the next ten years is too conservative; ③He believes that the next decade will see a stock market prosperity similar to the "roaring twenties".

Comments

Last week, a positive...

He became a millionaire many times over on a modest federal salary from trading.

Take a look:

Thomas Carper bought 30k in $ProShares Short QQQ (PSQ.US)$ , an ultrashort $Invesco QQQ Trust (QQQ.US)$ index, on July 13 2023.

He hedged/shorted in the past with great results with $Advisorshares Trust Ranger Equity Bear Etf (HDGE.US)$ , �������...

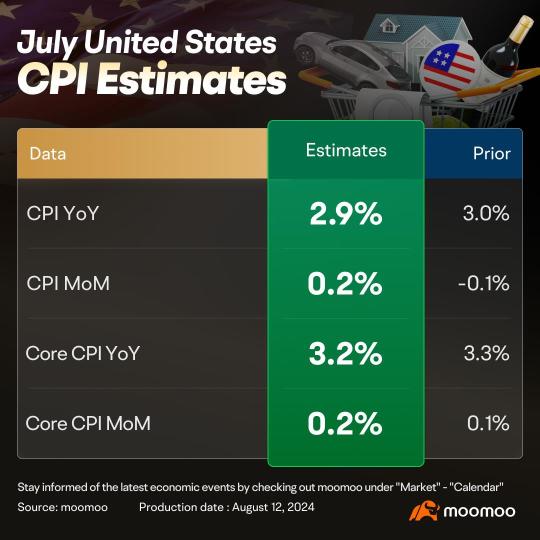

HYGWE : should we worry a lower cpi could signal economic slowdown tho not yet recession but would need more action from over cautious and behind the curve FED ... too little too late FED to rescue from recession

Ultratech HYGWE : what is worrying is this one of those emotions again. they've been talking about a recession since covid.

Moomoo Research OP HYGWE : What you said is very reasonable. If there is a recession, the investment opportunities of many investment types will decline, and bonds will be a good choice.