No Data

PSQ241220C47000

- 0.20

- 0.000.00%

- 5D

- Daily

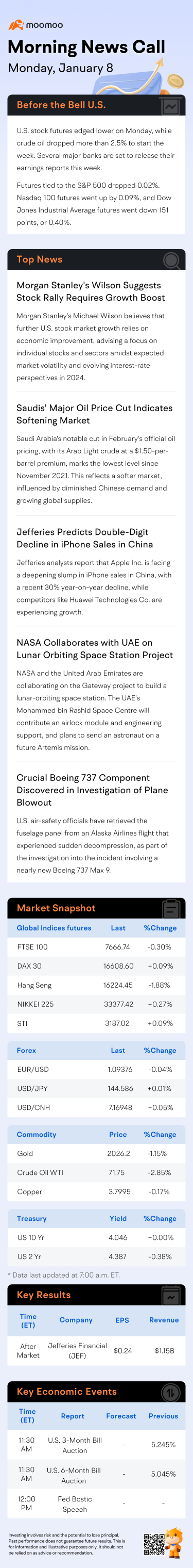

News

China has taken the lead! Wall Street strategists: the next "Trump trade" may be outside of the USA.

①When looking to the future, Jay Pelosky, the founder and global strategist of the New York investment consulting firm TPW Advisory, has insights that differ from many mainstream market views; ②He believes that Trump's victory might ultimately serve as an important catalyst - driving the usa market to end its long-standing excellent performance.

Is the high valuation holding steady for U.S. stocks in Q3 earnings?

S&P's third-quarter EPS year-on-year growth rate of 5% exceeded expectations, with communications services and medical care industries leading the way, while csi commodity equity index performed poorly. In addition, S&P's third-quarter profit year-on-year growth rate reached 74%, although exceeding expectations, it is below the average level of the past 5 years, hitting a two-year low.

Bank of America: "Potential BUGs" may drag down US stocks next year, bullish on Chinese stocks!

①Bank of America's strategist stated that if the ratio of the Nasdaq 100 index/S&P 500 index falls below the high of 2000, it will prompt investors to exit the 'American exceptionalism' trades; ②Reports predict that the American financial conditions may tighten, traders will increase their allocation to the Asian and European international markets in the first quarter, and expect Chinese stocks to perform well in 2025.

Trump Picks Hedge Fund Exec Scott Bessent As Treasury Secretary: What President-Elect's Choice Means For America's Economic Future

Goldman Sachs, the "bull market leader", outlook for 2025: Next year, the USA will be a year of simultaneous rise in stocks and bonds.

Goldman Sachs is bullish on the USA stock market and bonds market in 2025.

Continue playing music and dancing! Morgan Stanley CEO: US stocks will continue to rise next year, tariffs are not to be feared.

①Morgan Stanley CEO Ted Pick expects the USA economy to continue to perform strongly in 2025, feels optimistic about the prospects of the US stock market, and believes the s&p 500 index will continue to rise; ③ Despite factors such as policy uncertainty, Pick believes that both the USA and China have a common motivation to seek solutions that promote economic development, therefore not worried about the threat of trade tariffs.

Comments

Last week, a positive...

He became a millionaire many times over on a modest federal salary from trading.

Take a look:

Thomas Carper bought 30k in $ProShares Short QQQ (PSQ.US)$ , an ultrashort $Invesco QQQ Trust (QQQ.US)$ index, on July 13 2023.

He hedged/shorted in the past with great results with $Advisorshares Trust Ranger Equity Bear Etf (HDGE.US)$ , �������...

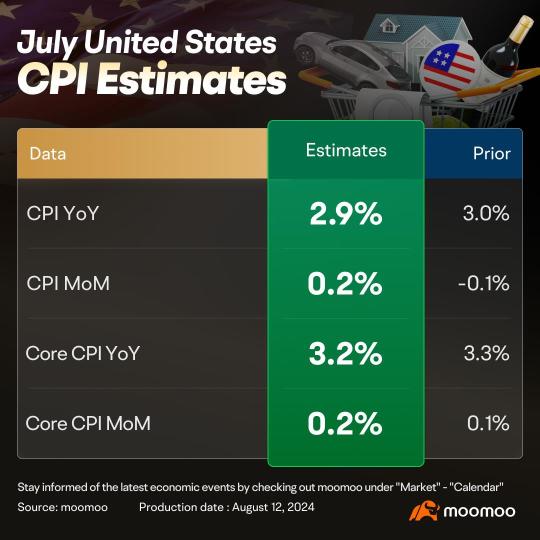

HYGWE : should we worry a lower cpi could signal economic slowdown tho not yet recession but would need more action from over cautious and behind the curve FED ... too little too late FED to rescue from recession

Ultratech HYGWE : what is worrying is this one of those emotions again. they've been talking about a recession since covid.

Moomoo Research OP HYGWE : What you said is very reasonable. If there is a recession, the investment opportunities of many investment types will decline, and bonds will be a good choice.