No Data

PSQ241220P39000

- 1.35

- +0.55+68.75%

- 5D

- Daily

News

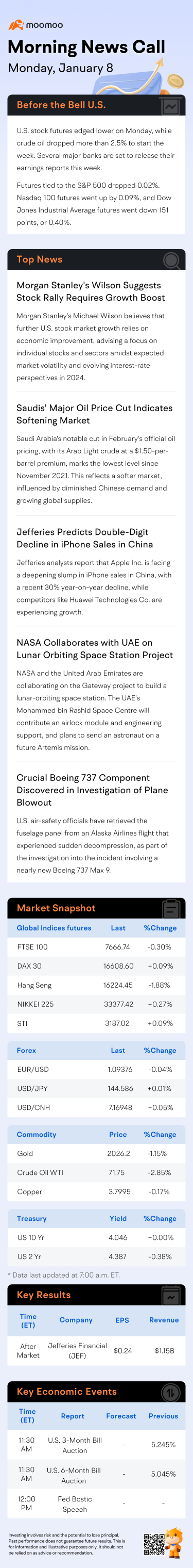

A once-in-a-century event! The U.S. stock market is expected to rise over 20% for two consecutive years, and Wall Street is betting on new highs by the end of the year.

① On Monday this week, the s&p 500 index set a new record, and Wall Street investment banks predict that U.S. stocks will continue to rise by the end of the year; ② If the s&p 500 index continues to rise this month, it will have increased more than 20% for two consecutive years, a scenario that has only occurred three times in the past century.

US Morning News Call | Trump Shifts Stance on Strong Dollar; Tesla Launches New Version of Self-Driving Software

How will the US stock market perform in December? History can tell you five things.

Aristotle once said, "To appreciate the beauty of snowflakes, one must endure the cold of winter." So, as the US stock market is about to enter the end of the year, in what manner will investors be able to appreciate a magnificent snowy landscape?

Record-breaking gains in the US stock market laid the foundation for December's rise, with Wall Street filled with optimism.

Due to recent outstanding performances and historical trends boosting market sentiment, this year may have even greater upward potential.

China has taken the lead! Wall Street strategists: the next "Trump trade" may be outside of the USA.

①When looking to the future, Jay Pelosky, the founder and global strategist of the New York investment consulting firm TPW Advisory, has insights that differ from many mainstream market views; ②He believes that Trump's victory might ultimately serve as an important catalyst - driving the usa market to end its long-standing excellent performance.

Is the high valuation holding steady for U.S. stocks in Q3 earnings?

S&P's third-quarter EPS year-on-year growth rate of 5% exceeded expectations, with communications services and medical care industries leading the way, while csi commodity equity index performed poorly. In addition, S&P's third-quarter profit year-on-year growth rate reached 74%, although exceeding expectations, it is below the average level of the past 5 years, hitting a two-year low.

Comments

Last week, a positive...

He became a millionaire many times over on a modest federal salary from trading.

Take a look:

Thomas Carper bought 30k in $ProShares Short QQQ (PSQ.US)$ , an ultrashort $Invesco QQQ Trust (QQQ.US)$ index, on July 13 2023.

He hedged/shorted in the past with great results with $Advisorshares Trust Ranger Equity Bear Etf (HDGE.US)$ , �������...

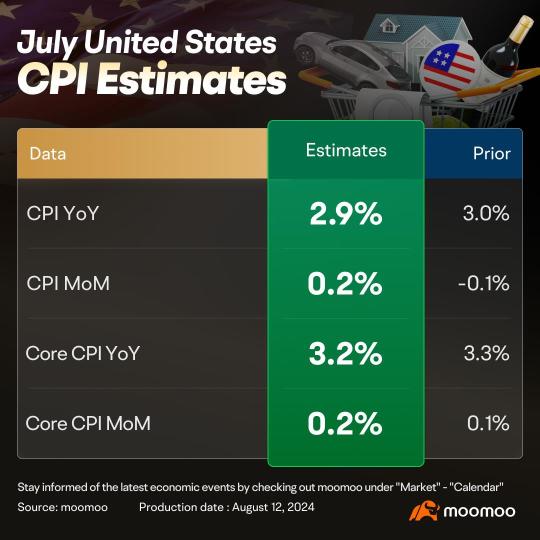

HYGWE : should we worry a lower cpi could signal economic slowdown tho not yet recession but would need more action from over cautious and behind the curve FED ... too little too late FED to rescue from recession

Ultratech HYGWE : what is worrying is this one of those emotions again. they've been talking about a recession since covid.

Moomoo Research OP HYGWE : What you said is very reasonable. If there is a recession, the investment opportunities of many investment types will decline, and bonds will be a good choice.