No Data

QLD241115P99000

- 0.19

- 0.000.00%

- 5D

- Daily

News

Don't Let Election Outcomes Drive Investing Decisions, Wells Fargo Says, After Trump's Win

Lock in the finance minister target this week? The media reported that Trump tends to choose Wall Street veterans.

Media reports that former Soros Fund manager Scott Bessent, hedge fund tycoon Paulson, and former U.S. Trade Representative Lighthizer are all possible candidates for the Secretary of the Treasury; the Treasury Secretary interviews will be held at the Mar-a-Lago estate, with an expected five to eight candidates, each presenting their situation with a PPT demonstration and indicating their recommenders, for Trump to assess how important this person is to his inner circle.

U.S. stocks close: S&P index breaks through the key level of 6000 points for the first time, with Tesla and cryptos concept stocks soaring together.

① Most of the china concept stocks are up, nasdaq China Golden Dragon Index rose by 0.59%; ② MicroStrategy bought another 0.0272 million bitcoin; ③ Musk played a key role in the formation of Trump's future team; ④ US regulatory authorities have launched an investigation into honda motor.

Is the market too excited? Morgan Stanley: The Fed will have to respond to Trump, at the earliest by May next year.

Analysis suggests that although the Trump administration is expected to implement new measures in areas such as tariffs, immigration, and fiscal policy, due to the time lag in policy implementation, the Federal Reserve is unlikely to adjust policies at the meetings in January or March next year, with the earliest reaction window possibly in May next year.

Tesla Gains 8% to Hit $1 Trillion Market Cap for First Time Since Musk Agreed to Buy Twitter

Cross-market firecrackers are sounding! After the Federal Reserve's interest rate decision night, what is the probability of a rate cut in December?

①If measured by the comprehensive performance of cross-assets, yesterday may have been the best performing day of the year for the Fed interest rate day market; ②The Fed announced a 25 basis point rate cut to 4.5%-4.75% on Thursday as expected by the market, with a possible rate cut again in December; ③CME's FedWatch tool shows that traders currently expect a 25 basis point rate cut by the Fed in December with a probability of 67.8%.

Comments

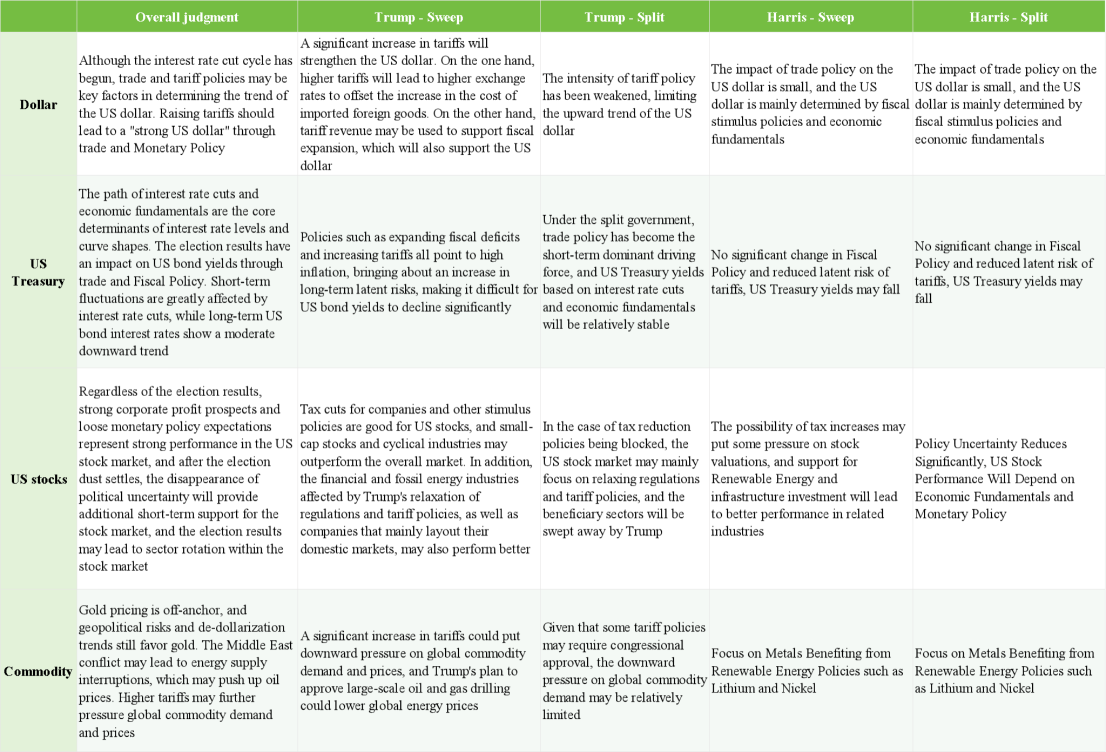

Stanley Druckenmiller, an experienced hedge fund manager, is known for his keen market insights and bold investment style. With important elections approaching in the United States, Druckenmiller recently shared his perspectives, discussing not only the current market conditions but also predicting how different election outcomes might impact the investment environme...

On September 18, 2024, the Federal Reserve announced a 50 basis point rate cut, a decision that came amid significant fluctuations in market expectations regarding the extent of the cut. Compared to historical preemptive rate cuts, this round's expected magnitude and duration are notably longer, resembling the rate-cut cycle from 1984 to 1986, during which the cut reached 562.5 basis points and lasted ...

The Nasdaq-100 Index Fund (QQQ) has outpaced market benchmarks with a growth rate of 155.55% over the past five years.

Despite this, QQQ's valuation is also quite high. According to Morningstar data as of September 4, 2024, its forward P/E ratio is 26.89, and its trailing cash flow P/E ratio is 21.29. Is such a valuation justified? A deeper analysis of QQQ's fundamentals reveals st...

Walmart's stock price has risen significantly in recent years, with a P/E ratio of 42.2 and a price-to-free cash flow ratio exceeding 80, reflecting market optimism about its future. However, given Walmart's already massive scale and intense market competition, its potential for earnings growth does not seem to justify the current high valuation.

In the past few years, Walmart's earnings growth has no...