No Data

QLD250117C61000

- 0.00

- 0.000.00%

- 5D

- Daily

No Data

News

Palantir Sees Millions of Dollars in Bearish Option Trades as Stock Tumbles

Wall Street's New Year interest rate "gamble": from several rate cuts, it has changed to whether rates will remain unchanged or not...

On Tuesday, the 10-year U.S. Treasury yield, known as the "anchor of Global asset pricing," further reached its highest level in eight months; the betting game surrounding the Federal Reserve's interest rate direction seems to have completely shifted from several rate cuts this year to whether further cuts will actually happen...

2024 "Capitol Hill Stock God" performance: dozens of members of Congress outperform the Large Cap stock market, with the highest yield reaching 149%!

① According to a new report, in the recently passed year of 2024, the stock investment portfolios of over 20 USA lawmakers outperformed the Large Cap; ② Congressman David Rouzer had the highest investment portfolio return, reaching 149%; ③ This has once again raised concerns about insider trading among congressional members.

U.S. stock market close: Inflation concerns lead to a decline in all indexes, NVIDIA fell 6% after reaching a new high.

① The Nasdaq China Golden Dragon Index fell by 0.2%, with China Concept Stocks showing mixed results; ② NVIDIA launched its personal computing product Project DIGITS; ③ XPENG Huaitian: Flying cars will be mass-produced and delivered in 2026; ④ Vaccine stocks soared, with Moderna rising nearly 12% and Novavax increasing by nearly 11%.

Bubble or No Bubble? See What SA Analysts Have to Say

Goldman Sachs: What does it mean when hedge funds suddenly short the market in large numbers?

Goldman Sachs Analyst John Marshall pointed out that the hawkish shift of the Federal Reserve on December 18 led to a sharp decline in financing spreads, and the selling through Futures channels is still ongoing this week. This is similar to the situation in December 2021, indicating that the U.S. stock market may face the risk of a decline.

Comments

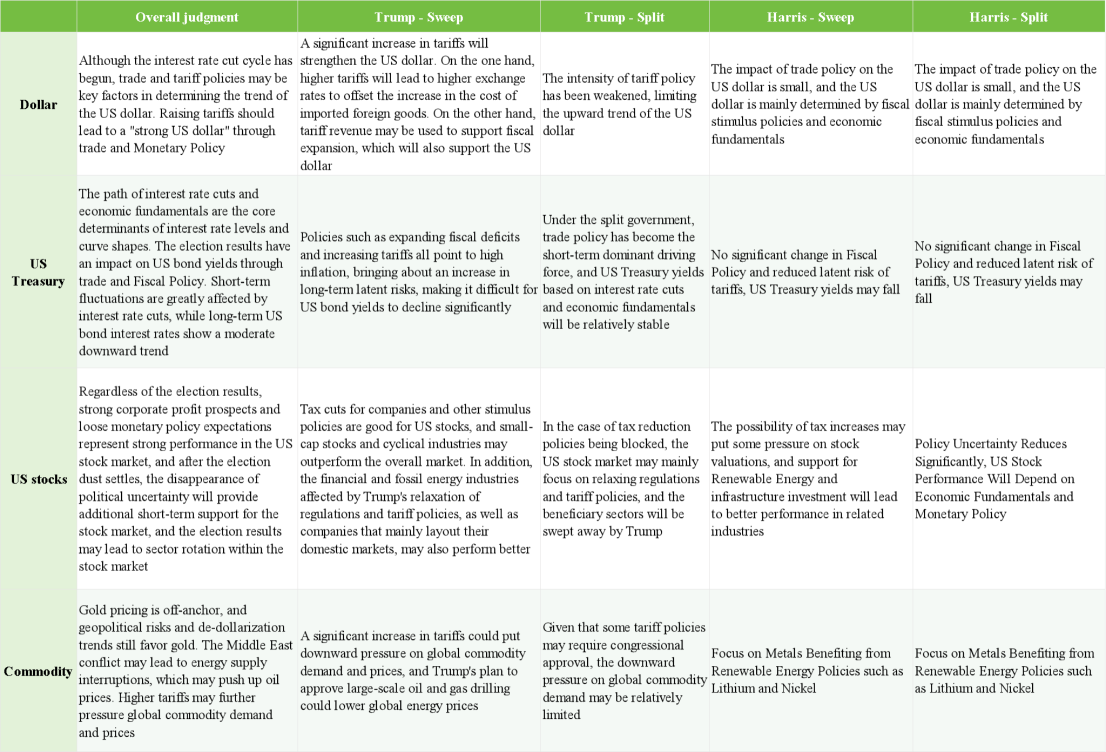

Stanley Druckenmiller, an experienced hedge fund manager, is known for his keen market insights and bold investment style. With important elections approaching in the United States, Druckenmiller recently shared his perspectives, discussing not only the current market conditions but also predicting how different election outcomes might impact the investment environme...

On September 18, 2024, the Federal Reserve announced a 50 basis point rate cut, a decision that came amid significant fluctuations in market expectations regarding the extent of the cut. Compared to historical preemptive rate cuts, this round's expected magnitude and duration are notably longer, resembling the rate-cut cycle from 1984 to 1986, during which the cut reached 562.5 basis points and lasted ...

The Nasdaq-100 Index Fund (QQQ) has outpaced market benchmarks with a growth rate of 155.55% over the past five years.

Despite this, QQQ's valuation is also quite high. According to Morningstar data as of September 4, 2024, its forward P/E ratio is 26.89, and its trailing cash flow P/E ratio is 21.29. Is such a valuation justified? A deeper analysis of QQQ's fundamentals reveals st...

Walmart's stock price has risen significantly in recent years, with a P/E ratio of 42.2 and a price-to-free cash flow ratio exceeding 80, reflecting market optimism about its future. However, given Walmart's already massive scale and intense market competition, its potential for earnings growth does not seem to justify the current high valuation.

In the past few years, Walmart's earnings growth has no...