No Data

QQQ241129P444000

- 0.01

- 0.000.00%

- 5D

- Daily

News

Fed's Waller Says He's Inclined to Vote for a Rate Cut

The 'shit stirrer' yen arbitrage trade has resurfaced! Global stock markets are shivering.

The Japanese yen carry trade, which once disrupted the market, is showing signs of recovery, driven by significant yield differentials and lower volatility; In November, bearish bets on the yen increased to $13.5 billion.

Federal Reserve officials are speaking out, is confidence in interest rate cuts in December significantly increasing? Employment data becomes crucial.

The market is prepared for further interest rate cuts.

S&P 500 And Nasdaq Hit Record Highs As December Trading Begins

Nasdaq, S&P hit new highs, French stock and bond yields fluctuate and rise, Euro once fell more than 1%, Dollar rose.

On the first trading day of December, Cyber Monday shopping amounts will break records, with the Nasdaq and Chinese concept stocks rising about 1%, and the chip index leading with a 2.6% increase, while the Dow fell from its peak. Tesla soared over 4% during the day, intel rose nearly 6% before turning negative, super micro computer surged nearly 29%, and Xpeng autos climbed over 5%, but Li Auto dropped nearly 4%. The French government faces a vote of no confidence, causing French stocks to briefly fall over 1%, and the spread between French and German government bond yields approached the widest in twelve years. US henry hub natural gas fell over 4%, the indian rupee hit a new low, and the offshore yuan dropped over 400 points, falling below 7.29 yuan.

US stocks closed: Chinese concept stock index 'three consecutive rises,' technology giants prop up NASDAQ, S&P to reach new highs.

① Technology giants continue to rise, with the S&P and Nasdaq hitting new highs; ② Musk's high salary once again rejected by a judge; ③ Super micro computer announces no inappropriate behavior found; ④ Intel CEO suddenly retires, reportedly forced out by the board of directors.

Comments

The potential “obstacle” to the current rally is this Friday’s payroll report. The data comes ahead of the Federal Reserve's last meeting of the year - 17 and 18 Dec. This report could potentially affect Fed’s rate cut decision.

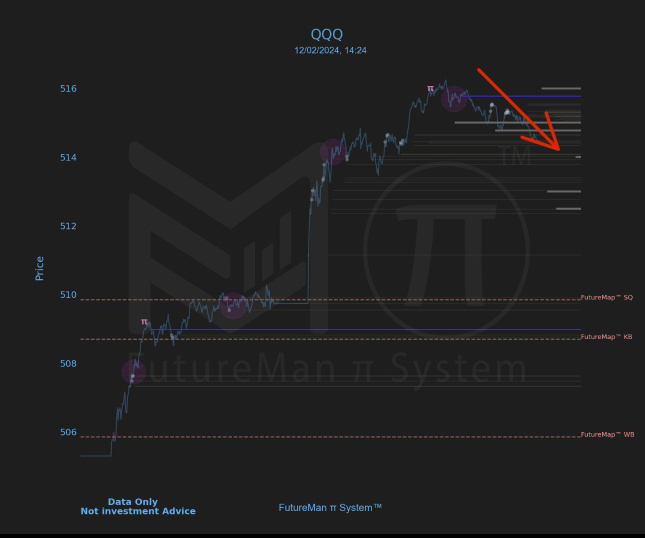

$Tesla (TSLA.US)$ $Lululemon Athletica (LULU.US)$ $Super Micro Computer (SMCI.US)$ $NVIDIA (NVDA.US)$ $MicroStrategy (MSTR.US)$ $Palantir (PLTR.US)$ $Meta Platforms (META.US)$ $Microsoft (MSFT.US)$ $Alphabet-C (GOOG.US)$ $iShares Bitcoin Trust (IBIT.US)$ $Amazon (AMZN.US)$ $Netflix (NFLX.US)$ $SPDR S&P 500 ETF (SPY.US)$ $S&P 500 Index (.SPX.US)$ $Invesco QQQ Trust (QQQ.US)$

Good luck on all your investments! Bring in the new year right! It's coming fast!

Seriously, should probably look at these stocks thoug...