US OptionsDetailed Quotes

QQQ241204P531000

- 8.20

- 0.000.00%

15min DelayClose Dec 5 16:15 ET

0.00High0.00Low

0.00Open8.20Pre Close0 Volume0 Open Interest531.00Strike Price0.00Turnover0.00%IV-0.42%PremiumDec 4, 2024Expiry Date10.40Intrinsic Value100Multiplier-5DDays to Expiry0.00Extrinsic Value100Contract SizeAmericanOptions Type--Delta--Gamma63.49Leverage Ratio--Theta--Rho--Eff Leverage--Vega

Invesco QQQ Trust Stock Discussion

$Invesco QQQ Trust (QQQ.US)$ bigger move, lower volume. Sure thing

It's been an exciting ride watching the Nasdaq 100 climb and now, with the annual component review just around the corner on December 13th, the anticipation is real! Names like $Palantir (PLTR.US)$ , $MicroStrategy (MSTR.US)$ , and $Coinbase (COIN.US)$ are in the spotlight, potentially joining the elite ranks. 👀

My strategy lately? Well, I've been keeping a close eye on these potential additions, especially since Nasdaq 100 shake-ups can really shake things up. You...

My strategy lately? Well, I've been keeping a close eye on these potential additions, especially since Nasdaq 100 shake-ups can really shake things up. You...

9

3

3

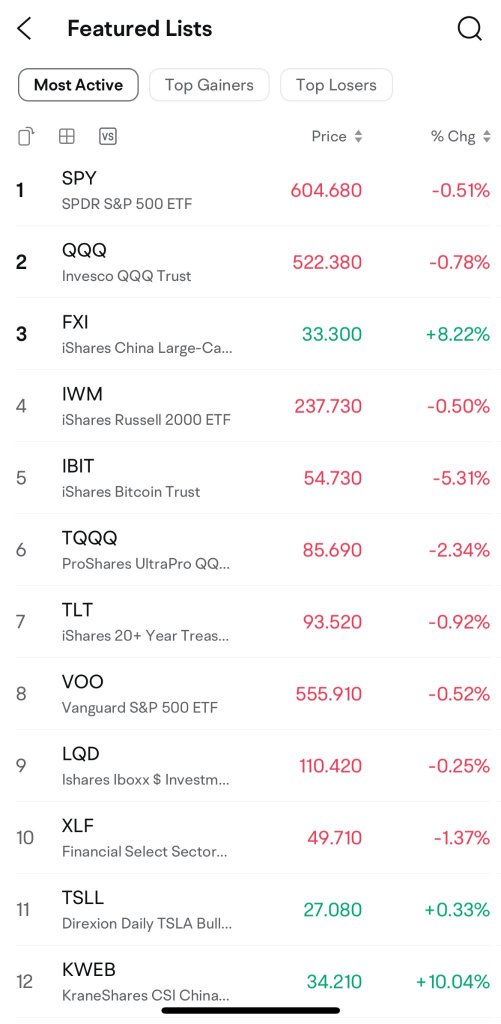

US tech stocks were dragged down by China's probe into Nvidia, but everything and anything that could benefit from new Chinese stimulus roars up

The Nasdaq fell 0.6%, and the S&P 500 fell by 0.6% from their record all-time high. Tech stocks, telcos, and cruise lines fell the most, while copper stocks such as Freeport-McMoRan $Freeport-McMoRan (FCX.US)$ and lithi...

The Nasdaq fell 0.6%, and the S&P 500 fell by 0.6% from their record all-time high. Tech stocks, telcos, and cruise lines fell the most, while copper stocks such as Freeport-McMoRan $Freeport-McMoRan (FCX.US)$ and lithi...

From YouTube

5

1

The stock market is finally pulling back a little bit after going up for the longest time. The market was dragged down by a few big tech names, especially Nvidia, who fell 2.55% after negative news came out from China.

On a side note, bitcoin retreated as well after closing above $100K.

It’s good to see such retracement as the markets (both equities and bitcoin) have been overheated for quite a while already.

A retracement now and then a Santa rally later will be ideal for m...

On a side note, bitcoin retreated as well after closing above $100K.

It’s good to see such retracement as the markets (both equities and bitcoin) have been overheated for quite a while already.

A retracement now and then a Santa rally later will be ideal for m...

From YouTube

16

4

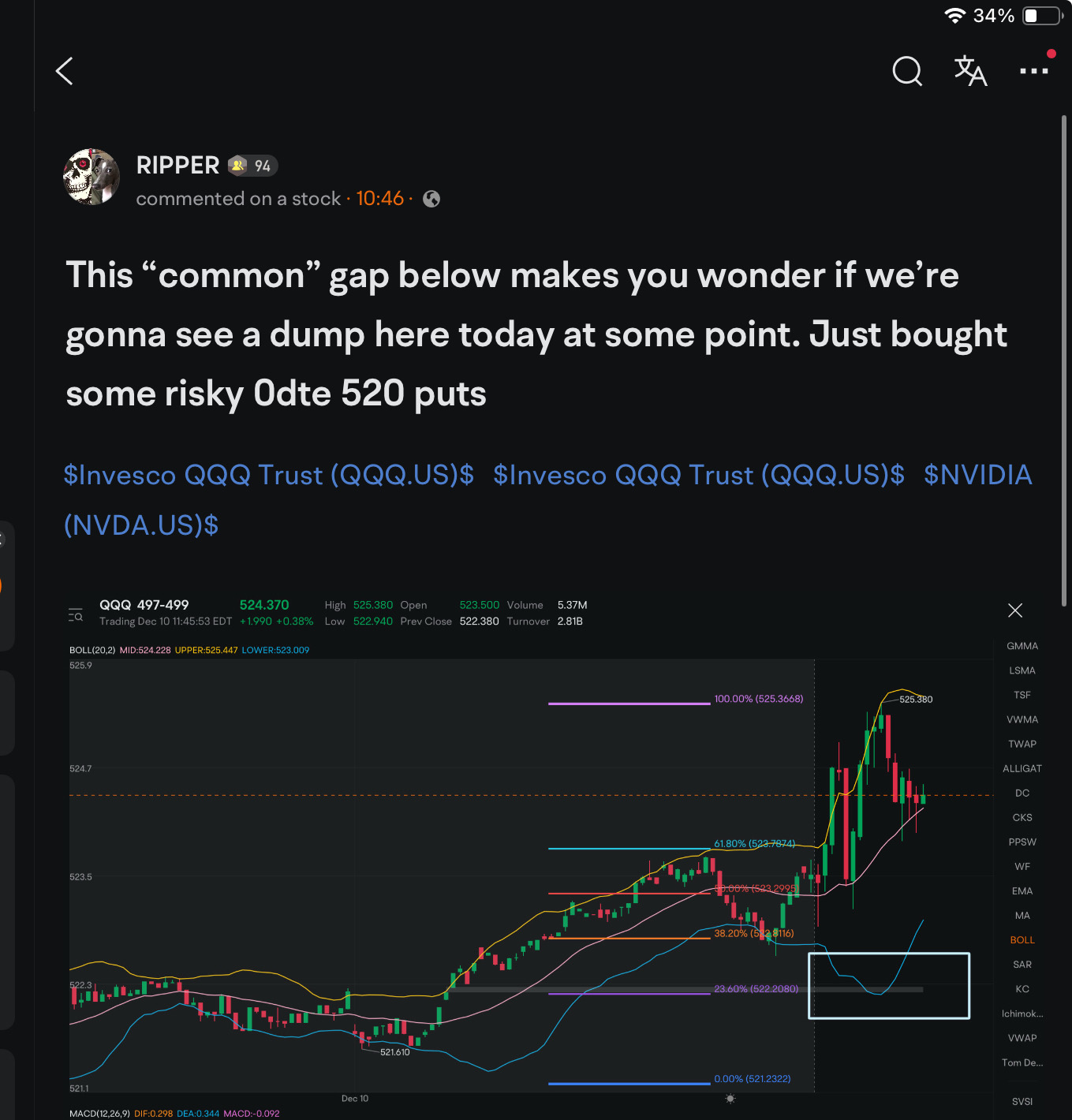

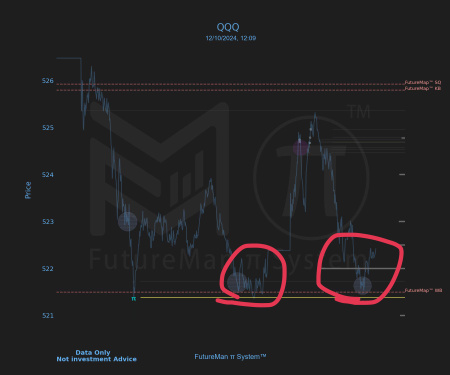

$Invesco QQQ Trust (QQQ.US)$ came right off the top support guess after the trump run I should have just made that the new uptrend line man so pissed i bought puts for the old uptrend line it blew right through it easy the day after my the sqqq calls expired right back down man I really messed that one up bad last week still thinking im done for awhile but hurts to see today's move after Friday I even told my roommates its not staying up Monday I bet it goes red asf but only mild red but could be...

No comment yet

70141151 : I think it's unlikely. Looking at the options, it's likely that the sell-off will continue tomorrow, probably until Thursday or Friday.

RIPPER OP 70141151 : That image is re post from this morning

Stock_Drift : It pays to be a winner!! Great job!!! @RIPPER

HailTheApocalypse : hey man, sometimes it's ok to brag. good job Ripper

RIPPER OP HailTheApocalypse : Haha thanks

Yea just feels good when you know you are still advancing in this game of trading

View more comments...