No Data

US Stock MarketDetailed Quotes

RCAT Red Cat Holdings

- 6.1600

- +0.1800+3.01%

Close Mar 25 16:00 ET

- 6.1300

- -0.0300-0.49%

Post 16:29 ET

527.40MMarket Cap-11.62P/E (TTM)

6.1800High5.9000Low3.02MVolume5.9900Open5.9800Pre Close18.33MTurnover4.38%Turnover RatioLossP/E (Static)85.62MShares15.273752wk High19.49P/B425.14MFloat Cap0.751052wk Low--Dividend TTM69.02MShs Float15.2737Historical High--Div YieldTTM4.68%Amplitude0.5250Historical Low6.0700Avg Price1Lot Size

Post-Market

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Unit: --

Capital Trend

IntradayDayWeekMonth

No Data

News

Red Cat Holdings Appoints Interim CFO Jeffrey Thompson

Express News | Red Cat Holdings Inc - Jeffrey Thompson Appointed Interim CFO

Red Cat Holdings Options Imply 8.4% Move in Share Price Post-earnings

$RCAT Stock Is up 12% Today. Here's What We See in Our Data.

What You Can Learn From Red Cat Holdings, Inc.'s (NASDAQ:RCAT) P/S After Its 54% Share Price Crash

Highlighting Red Cat Holdings And Two Other Leading Growth Stocks With Insider Influence

Comments

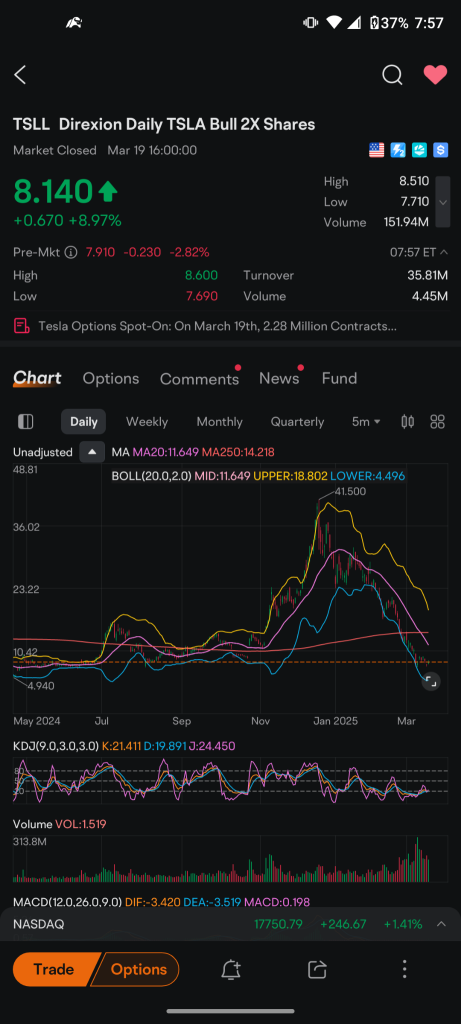

$Red Cat Holdings (RCAT.US)$ every one of these stock charts on a daily basis looks virtually identical.

they all started rallying last November they peaked either end of December early January and they have pretty much eliminated that entire bubble. most have consolidated at or near the 250 day moving average.

you can pull up virtually any technology company any small cap in an industry that was in play and all of the charts look the same

they all started rallying last November they peaked either end of December early January and they have pretty much eliminated that entire bubble. most have consolidated at or near the 250 day moving average.

you can pull up virtually any technology company any small cap in an industry that was in play and all of the charts look the same

+1

4

10

2

2

$Red Cat Holdings (RCAT.US)$ wow what happened here

$Red Cat Holdings (RCAT.US)$

selling covered calls to recover some monies 🤞🏻

selling covered calls to recover some monies 🤞🏻

Read more

Market Insights

Fed Rate Cut Beneficiaries Fed Rate Cut Beneficiaries

Stocks that are expected to benefit from a Federal Reserve rate cut. Information is provided by Futu and is a non-exhaustive list of all thematic stocks for reference purposes only.

This section presents the top 5 stocks in Fed Rate Cut Beneficiaries, ranked from highest to lowest based on real-time market data. Stocks that are expected to benefit from a Federal Reserve rate cut. Information is provided by Futu and is a non-exhaustive list of all thematic stocks for reference purposes only.

This section presents the top 5 stocks in Fed Rate Cut Beneficiaries, ranked from highest to lowest based on real-time market data.

JFL : im at top of the mountain

10baggerbamm OP JFL : this is where you have a decision to make..

you either buy more to bring your cost bases down or you're going to be in it for a very long time for to recover best case scenario.. of course it may not recover.

I think the drone industry is going to have a banner year I think there's a tremendous amount of demand for counter drone technology for offensive drones whether it's surveillance whether it's for attack purposes. so I think this industry is a whole has a very bright future..

Ginvest : on 1/22, you made comment said this stock has potential to go under 2, so i sold it at around 7.6. i will buy it back at 2. thanks for the advice then

10baggerbamm OP Ginvest : we may have put in a bottom and if that's the case the two is not going to happen unless there's a material problem with this company there's a setback or they lose a contract or there's accounting issues. you have to look at my statements relative to the time they are made. you can't look at them in a very fast dynamic Market which is what we are in weeks or months later and expect what happens in the future to be 100% correlated to the statement at that time.

so it's possible that this company and all the other drone companies that rallied up and have since come down they've wiped out that bubble and they're at or near a bottom.

we could have a 4 or 500-point down NASDAQ day very easily as we've had in the past and then everything sinks 5 to 7%.

no absolutes in the market I'm just a person I don't have a crystal ball as I've said mine's in the repair shop they keep telling me it's going to be done any day now but all I'm doing is looking at the information the historical trends I have my own beliefs in terms of what's going on in the market and I add my own flavor if you will to that.. that's where I come up with my price targets my entry points my exit points.. it's not an exact science so if you can get close that's a win.

in other words you did good by selling it at 7:00 because it's down $2 but if you like the company you're able to buy 40% more now that it's falling with the same amount of money and build a larger position if you choose to do so

ASteffie 10baggerbamm OP :

View more comments...