US Stock MarketDetailed Quotes

RDUS Radius Recycling

- 29.100

- +0.090+0.31%

Close Mar 26 16:00 ET

- 28.850

- -0.250-0.86%

Pre 04:32 ET

820.68MMarket Cap-2.90P/E (TTM)

29.160High28.940Low796.46KVolume29.020Open29.010Pre Close23.14MTurnover3.04%Turnover RatioLossP/E (Static)28.20MShares29.16052wk High1.41P/B763.59MFloat Cap10.40552wk Low0.75Dividend TTM26.24MShs Float78.167Historical High2.58%Div YieldTTM0.76%Amplitude1.860Historical Low29.053Avg Price1Lot Size

Radius Recycling Stock Forum

$Radius Recycling (RDUS.US)$

FYI: For those that don't know, this company is in the steel industry. This is the ticker that ran up from $13 - $28 on Toyota merger news.

It is an America company which is why Toyota is after it, IMO.

Steel Stocks ⬆️

FYI: For those that don't know, this company is in the steel industry. This is the ticker that ran up from $13 - $28 on Toyota merger news.

It is an America company which is why Toyota is after it, IMO.

Steel Stocks ⬆️

3

1

Stocks that might benefit from the tariff on steel

If you have more drop the tickers in the comments

$Radius Recycling (RDUS.US)$

$Cleveland-Cliffs (CLF.US)$

$Ternium (TX.US)$

$Worthington Steel (WS.US)$

$Olympic Steel (ZEUS.US)$

$Ampco-Pittsburgh (AP.US)$

$Steel (SPLP.US)$

$United States Steel (X.US)$

If you have more drop the tickers in the comments

$Radius Recycling (RDUS.US)$

$Cleveland-Cliffs (CLF.US)$

$Ternium (TX.US)$

$Worthington Steel (WS.US)$

$Olympic Steel (ZEUS.US)$

$Ampco-Pittsburgh (AP.US)$

$Steel (SPLP.US)$

$United States Steel (X.US)$

3

4

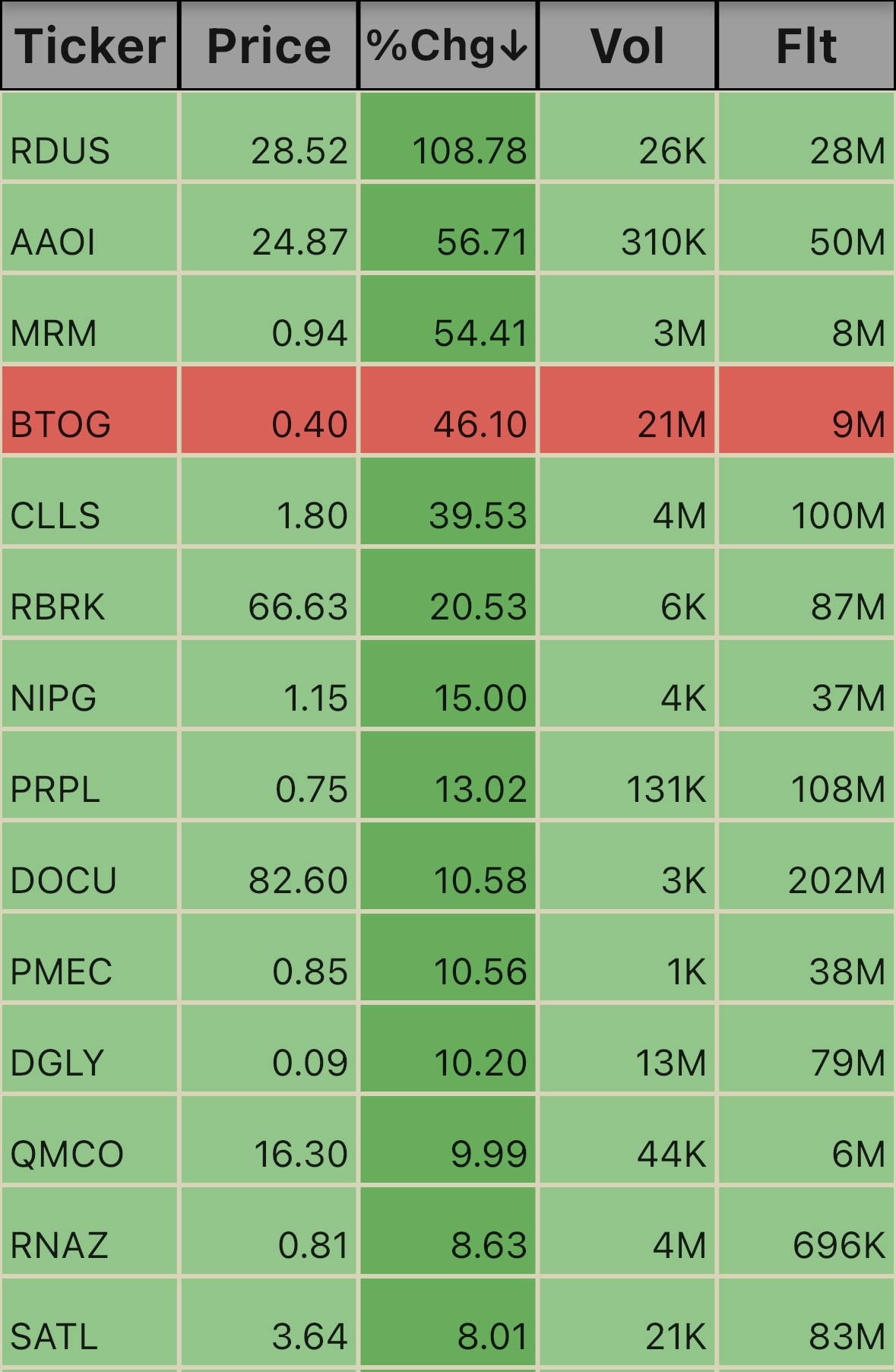

$Satellogic (SATL.US)$ $Transcode Therapeutics (RNAZ.US)$ $Quantum (QMCO.US)$ $Digital Ally (DGLY.US)$ $Primech Holdings (PMEC.US)$ $DocuSign (DOCU.US)$ $Purple Innovation (PRPL.US)$ $NIP Group (NIPG.US)$ $Rubrik (RBRK.US)$ $Cellectis (CLLS.US)$ $Bit Origin (BTOG.US)$ $MEDIROM Healthcare Technologies (MRM.US)$ $Applied Optoelectronics (AAOI.US)$ $Radius Recycling (RDUS.US)$ 📊⚡️📊

11

$Radius Recycling (RDUS.US)$

Toyota Tsusho America Pays 115% Premium in $1.34B Radius Recycling Acquisition Deal

Toyota Tsusho America Pays 115% Premium in $1.34B Radius Recycling Acquisition Deal

$Radius Recycling (RDUS.US)$ wtf kinda recycling is this oh I know the type where you got to sell of the drugs the cops confiscated from people recycling ♻️

$Radius Recycling (RDUS.US)$ who knew recycling could be so profitable?

$Radius Recycling (RDUS.US)$ A big drop is coming, and the last ones to buy will be left on the highest peak

2

No comment yet

Tonyco : Yeah I mean, it's on alot of radars now!